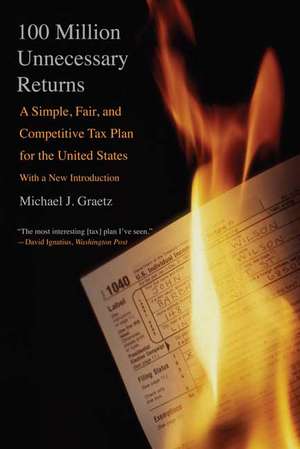

100 Million Unnecessary Returns: A Simple, Fair, and Competitive Tax Plan for the United States; With a New Introduction

Autor Michael J. Graetzen Limba Engleză Paperback – 16 mar 2010

Graetz offers a solution. Imagine a world in which most Americans pay no income tax at all, and those who do enjoy a far simpler tax process—all this without decreasing government revenues or removing key incentives for employer-sponsored health care plans and pensions. As Graetz adeptly and clearly describes, this world is within our grasp.

Preț: 303.33 lei

Nou

Puncte Express: 455

Preț estimativ în valută:

58.04€ • 60.75$ • 48.31£

58.04€ • 60.75$ • 48.31£

Carte tipărită la comandă

Livrare economică 31 martie-14 aprilie

Preluare comenzi: 021 569.72.76

Specificații

ISBN-13: 9780300164572

ISBN-10: 0300164572

Pagini: 288

Ilustrații: 19 b-w illus.

Dimensiuni: 140 x 210 x 17 mm

Greutate: 0.37 kg

Ediția:Revised

Editura: Yale University Press

Colecția Yale University Press

ISBN-10: 0300164572

Pagini: 288

Ilustrații: 19 b-w illus.

Dimensiuni: 140 x 210 x 17 mm

Greutate: 0.37 kg

Ediția:Revised

Editura: Yale University Press

Colecția Yale University Press

Notă biografică

Michael J. Graetz is a Professor of Law at Columbia University Law School.

Recenzii

"The most interesting [tax] plan I've seen."—David Ignatius, The Washington Post

“Michael Graetz, one of the world’s leading tax policy experts, has put forth a plan that joins sensible economics with political possibility. His proposal should be essential reading for the next president.”—Glenn Hubbard, Dean, Columbia University Graduate School of Business, former chair of the Council of Economic Advisors under President George W. Bush