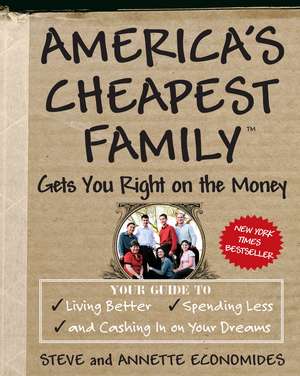

America's Cheapest Family Gets You Right on the Money: Your Guide to Living Better, Spending Less, and Cashing in on Your Dreams

Autor Steve Economides, Annette Economidesen Limba Engleză Paperback – 31 dec 2006

Meet Steve and Annette Economides. They’ve been called cheapskates, thriftaholics, and tightwads, but in these tough economic times, Steve and Annette have managed to feed their family of seven on just $350 per month, pay off their first house in nine years and purchase a second, larger home, buy cars with cash, take wonderful vacations, and put money in savings. Without degrees in finance or six-figure salaries, Steve and Annette have created a comfortable, debt-free life for themselves and their children. In America’s Cheapest Family Gets You Right on the Money, they show you how they did it- and how you can do it too.

Steve and Annette share many down-to-earth principles and the simple spending plan that they have used since 1982. They have taught this economizing lifestyle to thousands of people worldwide through seminars and their newsletter, and they include lots of real-life stories to make you feel as if you’re having your own private coaching session. Not only will you find solutions to your financial dilemmas, you’ll also discover a whole new way of life.

You don’t need to be a CPA or a math wizard to learn their revolutionary system, which will teach you:

- hundreds of ways to save money on everyday household expenses, including groceries, clothing, and health care

- how to save in advance for major purchases such as homes, cars, and vacations

- how to stop living paycheck to paycheck

- how to eliminate debt . . . forever!

America’s Cheapest Family Gets You Right on the Money puts meeting your financial goals- and living well at the same time- in reach for every family.

Preț: 107.65 lei

Nou

Puncte Express: 161

Preț estimativ în valută:

20.60€ • 22.03$ • 17.17£

20.60€ • 22.03$ • 17.17£

Carte indisponibilă temporar

Doresc să fiu notificat când acest titlu va fi disponibil:

Se trimite...

Preluare comenzi: 021 569.72.76

Specificații

ISBN-13: 9780307339454

ISBN-10: 0307339459

Pagini: 280

Dimensiuni: 187 x 234 x 19 mm

Greutate: 0.49 kg

Editura: Three Rivers Press (CA)

ISBN-10: 0307339459

Pagini: 280

Dimensiuni: 187 x 234 x 19 mm

Greutate: 0.49 kg

Editura: Three Rivers Press (CA)

Notă biografică

Steve and Annette Economides launched their popular bimonthly newsletter, The HomeEconomiser, in 2003. They are frequently quoted money-saving experts and have appeared in Good Housekeeping as well as on National Public Radio and Good Morning America. They live in Scottsdale, Arizona, with their children.

Extras

one

America’s Cheapest Family

We’ve been called “America’s Cheapest Family,” “the First Family of Frugal,” “cheapskates,” “thrift-a-holics,” “tightwads,” or one of many other less flattering terms. Even calling us by our real last name, Economides, relates to saving cash. Yes, that’s our real name—it’s pronounced “econo-mee-dis.” It’s Greek and means “son of the steward.”

As the nicknames make clear, we don’t like to spend a lot of money. But we don’t economize just for the sake of skimping. We have big dreams—goals that together we are working toward. We are living proof that even in tough economic times, it’s possible to:

•Raise responsible kids

•Purchase a home and pay it off in nine years

•Buy cars for cash

•Enjoy fabulous debt-free vacations

•Feed a growing family on a grocery budget of just $350 each month

•Put savings in the bank

What’s more, all this was done during the first twelve years of our marriage on an average income of less than $35,000.

A Wish Fulfilled

This is a book we wish had existed when we were starting out on our financial journey. We’re not going to bog you down with pages of hard-to-follow economic theory and calculations. Instead, we focus on practical advice that even the most financially challenged can easily implement. America’s Cheapest Family Gets You Right on the Money will show you how to buy groceries smarter and less expensively, create a household budget that really works, buy affordable cars and homes, find alternative sources for dressing fabulously, deal with medical care and expenses, discover fun recreational activities that are free, plan and take great vacations that don’t break the bank, teach kids to earn and manage money, build a great savings plan for the future, get out of debt and emerge from the vicious cycle of living paycheck to paycheck, and so much more.

Neither of us has a finance or accounting background. Neither of our parents taught us to manage money—they were frugal, but by no means financial wizards. We are just an average couple who have discovered the secrets to living well on way less than most people can imagine.

Many people believe that thrifty living can be more easily accomplished in a rural setting. We are here to tell you that it just isn’t so! Living in the suburbs all of our lives, we can strongly say that there are great bargains to be had at every turn. With a dense population comes greater opportunities to scoop up steep discounts and free items.

Writing from the perspective of a family, we hope to bring our message to every age group. The younger generation needs to hear that there is an alternative to today’s credit-charged lifestyle—frugal living can be fun and very rewarding, something our children know well. Those in the throes of the middle years, whether raising kids, building careers, or both, need to hear that work doesn’t need to own them. We can vouch for the fact that they can live on less and still reach incredible goals. And as we edge our way toward retirement, we can offer guidance to seniors, many of whom live on Social Security or are learning to stretch their savings. As economizers, we proclaim that no matter what your financial state, and regardless of what the economy is doing, you can not only survive but thrive.

Three Principles for Getting you Right on the Money

There will be three themes that you’ll see recur throughout this book: avoid debt like the plague, live below your means, and embrace the thrifty lifestyle.

Avoid Debt Like the Plague

Why avoid debt, especially when many financial experts advocate credit card usage to establish a good credit score? Because the overuse of credit actually lowers your standard of living. After spending freely, eventually you’ll have to pay back what you’ve borrowed. This will have to be done with money that could better be spent on today’s needs rather than yesterday’s desires. The restriction of your cash flow after experiencing credit-enabled “freedom” is always a bitter pill to swallow. The average American family has a credit card balance of over $7,000, and we have seen the dark side of credit abuse in which relationships and families crumble under the heavy weight of unpaid debts. The good news is that most people can be debt-free (with the exception of their home) in about eighteen months if they develop a plan and stick with it. We’ll show you exactly how it can be done!

While some call us naive to live without the “benefits” of credit (that’s right, we don’t have any credit cards), we’re here to say that it can be done—and life can be good! We have more things than we need, experience more good living than we deserve, and thoroughly enjoy all that we can afford. Can life be any better than this?

Live Below Your Means

This important principle is best accomplished by using a written budget. This is really much easier than you think—and in Chapter 3: Budgeting we’ll show you how you can use a budget to set aside money in advance of all your expenses. In today’s fast-paced lifestyle, spending can easily get out of control. A budget is a great tool to manage spending and makes living below your means achievable. How do you know when you are living below your means? Is it when all the bills are paid and you’ve still got money left over? We think it’s much more than that. Budgeting is the cornerstone of family finances. In every chapter we’ll build upon that foundation with loads of ideas to free up money that you didn’t even know you had.

Embrace the Thrifty Lifestyle

Being thrifty means that we should always strive to be efficient and resourceful with what we have. (Uggh! That sounds about as exciting as oatmeal.) But in reality, we look at this lifestyle as a game and the savings in time and money as the prize. Every chapter will contain tips, secrets, and new skills you can learn to help you win every time.

Many people say that avoiding credit, living below your means, and being thrifty are a waste of time. Ha! We say that as you experience success in reaching your financial dreams (and you will), you’ll be so convinced these practical principles work that you’ll never go back to the way you were living before. And you’ll leave the scoffers behind you, eating your financial dust!

How “America’s Cheapest Family” Got Started

When we dreamed up the idea for the HomeEconomiser newsletter in March 2003, we had no idea that our thrifty advice would be so warmly embraced. There was tremendous interest from the media, and within one month several newspaper stories appeared, as did TV spots and radio interviews. In the next eighteen months the story spread from Phoenix across the United States and even to London, Hong Kong, Turkey, Australia, and New Zealand.

We were first hailed as “America’s Cheapest Family” when we appeared on Good Morning America in 2004. Initially we flinched at the use of the word cheap. Ugh! We have never thought of ourselves as cheapskates. We think of ourselves as deal makers and bargain hunters. But in a language that has no positive adjectives to describe people who live within their means, are careful to evaluate every purchase, and always have money in the bank, we can understand the dilemma. To a world that loves to spend, those of us who love to save just aren’t looked upon in a positive light. What options are available to reporters try- ing to describe a family they believe to be the ultimate in our line of work? Are we the Frugalest? The Most Miserly? The Tightwaddiest, the Thriftiest, the Most Parsimonious? The Economical Economideses? Or the Super Skimpers? If they called us Smart Shoppers, then what would that make everyone who didn’t shop as we do? After a long evaluation and numerous discussions, we decided that if being “America’s Cheapest Family” provided us with a platform to help many thousands of families break away from financial enslavement, then we would be willing. (Besides, it’s much easier for most people to pronounce than Economides.)

Necessity Is the Mother of Economizing

Annette was raised in a large Italian family on Long Island, New York, and Steve grew up in a large Greek family on the South Side of Chicago. We met in 1979, married in 1982, and began our frugal journey together. As a newly married couple, we received lots of advice. Some family members recommended that Steve should work two jobs and Annette ought to work as well—all this so that we could save our money and purchase a house in three years’ time. But Annette wanted to learn to make our home and we wanted to be able to spend time together as a newly married couple, so we chose to do things differently. Steve worked just one job, while Annette stayed home and stretched our money until it begged for mercy.

By our first wedding anniversary, our family had grown to three. Steve was earning a whopping $7 an hour as a graphic designer. Annette worked diligently following our spending plan—pinching pennies really paid off as our savings grew. In his best-seller Life’s Little Instruction Book, H. Jackson Brown Jr. wrote the following to his son: “When starting out, don’t worry about not having enough money. Limited funds are a blessing, not a curse. Nothing encourages creative thinking in quite the same way.” This quote describes our early years to a T, and we certainly did feel blessed.

Almost exactly three years later, with baby number two on the way, we purchased our first home—a four-bedroom repo-fixer-upper. We put 15 percent down and then began aggressively paying down the principal and fine-tuning our spending plan. Nine years later, we made the last payment on that house. Our average annual income at that time was less than $35,000. Making the last payment was a monumental occasion for many reasons, not the least of which was that we were now totally convinced that thrifty living really did pay off. Our kids were happy, and we had many of the things that you would associate with a suburban family—except that we had absolutely no debt.

We’d been married twelve years by 1995, and our family had grown to include five children. Our wonderful 1,450-square-foot home, however, seemed to have shrunk. We were literally tripping over each other. After months of searching, we bought and moved into a much larger house, our dream home. It was comparatively huge—3,500 square feet with five bedrooms. The house was set on three-quarters of an acre with a citrus orchard—and lots of room for the kids to learn, grow, and do plenty of chores. Applying the same principles we used in our first home, we’ve continued to pay down our mortgage, establish an emergency fund, build some retirement savings, and buy a couple of new (used) cars with cash. Our income has increased in the intervening ten years, but we kept our expenses low and concentrated on making our money stretch as far as we could.

While financial goals are important, our greatest success has been raising five well-adjusted, happy children: John, twenty-three, Becky, twenty-one, Roy, seventeen, Joseph, fourteen, and Abbey, twelve. Economizing as a family has taught our kids important lessons about managing money, grounded them in nonmaterialistic values, and, most significantly, brought us together as a family. We’ve chosen to involve our children in managing our household finances and in turn, they have helped us economize better. Our daughter Becky discovered the thrill of consignment store shopping when she needed a dress for the prom—she uncovered a stunning lavender gown for less than $20. Our youngest son, Joseph, absolutely glowed when he encountered a virtually new baseball bat that retailed for $150 on sale at a thrift store for $10. Our youngest daughter, Abbey, was thrilled to find a long-desired Barbie horse at a silent auction fund-raiser. Not only did she use her own money for a wonderful toy, but the money went to a great cause. We know that our tightwad ways can teach the next generation skills that will last a lifetime.

We’ve been asked many times if financial success would alter our lifestyle. It hasn’t and won’t. While our economizing started out of necessity, it has now become a creative and enjoyable lifestyle that we would never abandon. We have discovered an equilibrium in our lives and a contentment in what we possess. Our greatest desire is to help others discover the same peace and contentment.

Reaching Out

In October 1983, Steve stood up in front of a group of 150 men from our church. As a young man just starting out on his financial journey, he asked if there were any older men who would be willing to help us and other young families learn to manage their finances and make sound plans for the future. Not one of them offered to help. Steve was flabbergasted. As we refined our saving and money management skills over the years, people started asking us for advice. Since then we have coached scores of individuals and families, helping them straighten out some pretty sticky financial situations. In dealing with creditors, past-due bills, and bloated budgets, we’ve helped these families cut a path through the money jungle to the pastures of financial stability. In many cases, we’ve had to disentangle them from a credit-induced paralysis and help them see the value of using a little bit of planning and a lot of creativity instead of their credit cards. The results have been heartwarming.

For five years we managed a volunteer financial coaching ministry at our church. At that time our kids were relatively young (ages one through twelve)—a full-time job in itself. Add to that Steve’s ever- increasing work responsibilities, and we came to realize that this growing ministry was just too overwhelming a task for us to maintain. When we turned over the reins of the ministry, it consisted of seventeen volunteer counselors whom we had trained, with over seventy people then being helped by the ministry.

In 2003, after twenty-one years in the workforce, first as a graphic designer and later as an advertising account executive, Steve quit his job. We felt led to help more people, but at a less frenetic pace, so we decided to pursue teaching about economizing full time.

We took our personal lifestyle and our many coaching experiences and put them in written form—and the HomeEconomiser newsletter was born. The response from readers has been amazing: families are taking control of their finances and seeing fantastic results. In three years’ time we expanded from local distribution to having subscribers in numerous countries around the world. Many readers have said that through reading our newsletter they have come to feel like our family is part of their family. We hope you’ll feel the same way too. Writing this book is an extension of the HomeEconomiser newsletter, years of “economizer” living, and thousands of hours spent helping others reach their financial goals.

We also know that there are some of you out there who could run circles around us with your thrifty knowledge and habits. We applaud you and urge you to keep setting the standard for careful living. We realize that we’re still a work in progress, always looking for new ways to improve. We hope that those of you who are black-belt economizers will catch the vision and join with us in helping so many others who are looking for ways to make their money go further.

How To Maximize Your Use of This Book

The concept for this book has been developed from our own family budgeting habits, years of personal budget coaching, and family budgeting seminars that we have presented since 1989. The process of going through every area of a family’s budget as we do in this book and sharing how we manage expenses is similar to what we did in the past, sitting around our kitchen table while we coached a family on their finances. You can think of the following pages as your own private coaching session!

While we’ve included hundreds of ways to help you make your money go further, we couldn’t possibly cover every area of household finances. It would make this book an enormous reference manual instead of an easy-to-read guide with some humor mixed in to help the medicine go down.

This book can be used any number of ways: you can read through it from start to finish, you can refer to it as a reference manual, or you can just jump from chapter to chapter to deal with needs as they arise. For instance, if you discover that the amount you’re spending on kids’ clothes has gotten out of hand, read the clothing chapter. If your utility expenses are crippling your budget, read the utilities chapter.

We’ve put much thought into the order of the chapters in this book. We start with the grocery chapter because for most families this is one of the fastest ways to achieve significant savings quickly. We follow that with budgeting, because it is the foundation to building a sound financial future. It has been the single most valuable tool in helping us reach our financial goals. The chapters that follow are organized from the necessities down to the more optional expenses in the family budget. We put the debt chapter near the middle of the book because we didn’t want to hit you with a lot of heavy stuff right away. But if you are struggling with a mountain of debt, you may want to start with Chapter 7 and then read the rest of the book in order. We know that our chapters may not be in the same order as most financial books (like our attitudes chapter, near the end of the book), but then again, we’ve always done things differently—that’s what makes life with us so much fun!

We won’t lie to you—there aren’t many quick fixes to household finance problems. Sometimes things we propose might seem radical. But please allow the ideas to sink in and take time to germinate. When a real need crops up in our lives, sometimes it’s those crazy ideas that provide the answer we’re looking for. We can promise that if you focus on one issue at a time, you will eventually find a solution that works for your family. And with each victory will come a renewed conviction that you can and will be able to clear the next hurdle to come your way.

We’ve included lots of stories from our lives and from the lives of people we’ve helped. The stories we tell are all true, but to protect the privacy of the people involved, we have changed the names and any other identifying details. Thrifty subscribers to the HomeEconomiser newsletter have also added lots of their great tips throughout the book.

The Significance of the Mouse, the Owl, and the Ant

We realize that everyone reading this book will be at a different place on their journey toward saving money. Some will be considering the frugal life for the first time, while others will be seasoned veterans. In each chapter, we present three levels of practical steps that can be taken right now: the Timid Mouse, the Wise Owl, and the Amazing Ant.

What do a mammal and an insect have to do with America’s Cheapest Family? Well, nature plays a big role in our family. We home-school our kids and encourage them to observe and investigate animal and insect behavior. We pay attention to what these animals do, and often we become aware of how some of our own behaviors—good and bad—parallel theirs.

The habits and characteristics of three particular creatures can be an encouragement to you as a seeker of deals and discounts. Each chapter concludes with a page titled “What You Can Do Now,” in which we present three levels of application of the principles and stories that we have related in the chapter. We know that not everyone reading this book will be at the same degree of thriftiness, so we’ve broken down our advice for beginners (Timid Mouse), intermediates (Wise Owl), and—for those hard-core tightwads—the advanced advice (Amazing Ant).

These titles may seem a bit juvenile, but once you understand some of the characteristics of these creatures, we think you’ll agree with our reasons for relating them to the different stages of frugal living.

Timid Mouse

Mice are shy creatures. They rarely come out during the day. At night, when they do go on the prowl, they tend to do so secretively. They stay close to the walls or other objects that will conceal them. They don’t want to be detected. They find what they need or want, then scamper back to their hiding place and enjoy their loot.

Fledgling economizers are much the same. It may be embarrassing to think that someone might catch them at a garage sale or thrift store. They don’t want anyone to know that they are hunting for “cheap” stuff. So they go out in neighborhoods where they won’t be detected or shop late at night, when they’re less likely to be noticed. They would be mortified if anyone knew that the clothes that they are wearing were purchased at a thrift store. Although they enjoy the bargains they find, they won’t be quick to tell anyone else about their great finds.

It’s okay to be timid at the outset—we all were a little uncertain about how and where to start. Our encouragement to the timid mice is to keep looking for new ways to save. Keep going out and searching. Soon you’ll be so confident in your thrifty ways that you won’t have to be so secretive about it and your pile of loot will really start to accumulate.

Wise Owl

A family of great horned owls inhabits the area around our home. We often see them fly to the top of our tallest pine trees and peer out over the neighborhood, watching and waiting for something to consume (contrary to common belief, they don’t hunt only at night). They are patient—very patient. Waiting quietly and hidden, they watch. When the time is right and their quarry is in sight, they silently swoop down from the treetops and strike. They carry their prey to a hideaway and share it with their family. They’ll stay in one area for a time, but once the food supply is diminished, they move on to greener pastures. Although they are wise in their hunting habits, they only gather enough food for a few days at a time—there is no reserve, so life is a constant pursuit of food.

Intermediate thrifty people are much like owls. They know that there are bargains to be found in abundance—they’ll just have to watch and wait. They know that patience pays and pays big-time. They still aren’t too keen about others knowing what they are up to and how they find their deals—especially if someone gets to a bargain before they do. But they are confident enough about their hunting skills to do it day or night—it really doesn’t matter. Hunting for treasure is a great way to provide for their needs, and they enjoy it. But it takes constant vigilance and consumes much of their time and mental energy.

Amazing Ant

Ants are truly unbelievable creatures. They are organized, diligent, and tireless. They use their nests to store food for their seasonal needs. In areas where winter is harsher and longer, ant nests are larger and deeper in the ground, providing room to store more food for the long winter and more protection from the cold. Ants look at the weather and plan for the future needs of their colony. When scouts go out and find food, they lay a scent trail for other workers to follow. You’ll often see columns of ants marching ceaselessly to and from a food source. Ants are strong. They can carry material equivalent to many times their body weight. If they encounter an obstruction to their work, they either go over or around it or call in the reserves to move it out of the way. Teamwork and diligence are some of their most admirable attributes.

Advanced economizers are very much like ants. Organization is their key to success. Their pantries are arranged so they can track what supplies they have and what they need, and their clothes are organized as well. They are always looking for bargains, and when they find them they let others know. The network of other frugal-minded friends they have established provides them with greater savings and the encouragement to press on with diligence in the face of a culture that wants to squish them. Planning in advance for events that they see coming in the future is their strength. They know that their kids will need larger clothes, so they develop a storage system and a network of friends with whom they can trade outgrown clothes. They store bargain-priced food to feed their family quality products at a lower cost.

How we write

This book is truly a family effort. The kids are the laboratory for many of our great ideas, and unfortunately some of our more unpopular ones too. We’ve given them space in each chapter to express their opinions about various topics.

We—Annette and Steve—have written this book together. For the most part, we have written in the first person plural, except when we speak of ourselves individually. There we’ve decided to refer to ourselves in the third person—“Annette says” or “Steve thinks.” It makes our writing less cumbersome and easier to understand. Although it may be atypical, we write as one voice.

Too often, books on the frugal lifestyle are written by one spouse, and it leaves us wondering what the other spouse is feeling about the decisions being made. We have agreed to agree before making any major decisions. This policy may result in delays, but what’s more important is that it builds unity and protects us from mistakes. This book was written the same way—together. That isn’t to say that we agree on everything in life, but regarding the essential points of living within our means, saving in advance of every purchase, and teaching our kids to do the same, we are of one mind and on the same page.

Reference Materials

One of the most important things we’ll teach you in this book is the power of knowledge and the value of research. In pre-Internet days, research was much more time-consuming and daunting. With the proliferation of information available through free Web sites, becoming powerfully informed is much easier. While all of our research is not done on the Internet, having access is most helpful. Throughout the book we have included recommendations for Web sites and helpful books. Our Web site, AmericasCheapestFamily.com, also contains a wealth of information and many more links to aid you on your quest. If this is something new to you, just remember that most public libraries offer online access and assistance in navigating the Internet.

Taking Notes

We’ve intentionally left wide margins in this book so you can make notes, scribble down ideas, set goals, or just doodle.

But even if you don’t write anything in here, try to document your progress somewhere. Many people say they set goals, but only a small percentage actually take the time to write them down. You are much more likely to reach your goals if you’ve taken the time to think them through, write them down, and review them often. You should see some of our old lists of goals—whew, a few of the things we jotted down seem silly now. But the list of the things we have accomplished is staggering—it contains so many things that originally seemed insurmountable when we wrote them down years ago.

Please Be Careful

Much of the material contained in this book chronicles our experiences. There are also some ideas that have been sent in by readers of our newsletter. We make every effort to do things by the book, safely and legally. There are so many ways to save money that cheating or fudging the truth just isn’t necessary. But economizers are typically rebels at heart and trailblazers, people who don’t follow the beaten path. While that is a good thing, there are risks involved with veering outside the lines. It is up to you to exercise your best judgment and care when you employ the concepts we discuss. Use what we write as a point of departure for your own research. Making sound financial decisions must be based on your personal values, time, research, and in many cases the advice of a financial professional.

Through our newsletter and its coverage in the media, America’s Cheapest Family has touched millions of lives. We hope that this book will reach and help millions more. two

Groceries:

Savings by the Bagful

When it comes to reducing household expenses, one of the fastest and easiest ways is to look at your grocery spending habits. How much can you save? That all depends on how much effort and time you have to spend.

According to the U.S. Department of Labor, the average American family of four spends $8,513 per year on groceries. That’s $709 each month—$177 per person! By comparison, we spend just $350 per month to feed a family of seven, including three growing boys! That’s $50 per person—66 percent less than the national average. Implementing just a couple of Annette’s many strategies in your grocery-buying habits can have a huge impact on your food budget. If the average family could reduce their food bill just 20 percent, they’d have an extra $1,702 in the bank each year.

Remember that what we share are just a few of the strategies that we use. There is so much to say that we could fill a whole volume on groceries alone. But we are going to present plenty of ideas for you to be able to save hundreds of dollars on your groceries this year. Not all may apply to your lifestyle or family, but stick with us. We’re writing from over twenty-four years’ experience practicing and perfecting these habits. Try a few, and you may be pleasantly surprised not only with the benefit to your household but with the savings you’ll gain.

The Cost of Impulsiveness

When Steve was working as an advertising account executive, he had a client who marketed cheese products on military bases worldwide. We were shocked to read in a food industry publication that grocers expect six of ten items consumers pick up in the store to be unplanned purchases. Sixty percent!

Later, Steve and this client created an in-store promotion where they set up a display showcasing regularly priced spaghetti, pasta sauce, Parmesan cheese, and Italian salad dressing. Above it was hung a banner announcing “Pasta Tonite.” They also handed out a very confusing coupon sheet that required the consumer to purchase three different items from the display in order to redeem any one coupon. Sales of the regularly priced items from the display increased 38 percent, just because it was easy for shoppers to pick up an entire meal. Coupon redemptions were less than 1 percent. The manufacturer saw a huge sales increase without having to “pay” for it through coupon redemptions. This promotion was repeated for five years, and the sales results were consistent.

J. Jeffrey Inman at the University of Wisconsin, Madison, and Russell S. Winer at the University of California, Berkeley, researched the effects that in-store activity such as promotions, displays, and signage had on consumer purchases. In their study “Where the Rubber Meets the Road: A Model of In-Store Consumer Decision Making,” they present an analysis of the decisions of over 4,200 customers who made 30,000 purchases in fourteen different cities. In a nutshell, they discovered the following habits:

•Shoppers making a “quick trip” to the store to pick up a few specific items usually purchase 54 percent more than they planned.

•Forty-seven percent of shoppers go to the store three or four times each week.

•Consumers graze at the grocery store, with impulse buys making up between 50.8 and 67.7 percent of total purchases.

(In the following three statistics, the number represents the percentage of times unplanned items are purchased from these displays.)

•End-of-aisle displays encourage higher impulse buys—61 percent.

•In-aisle displays encourage moderate impulsive purchases—58 percent.

•Checkout displays—candy and magazines—generate the highest impulsivity, a 64 percent rate.

(Even though this study was conducted in 1998, our observations and discussions with store managers tell us that if anything has changed, we as a society are more impulsive now than before.)

The more often you go to the store, the more often you will walk past displays, endcaps of special items, and the ever-enticing goodies in the checkout lane. The more often you pass these locations, the more likely you’ll be to spend more than you intended. This is exactly what retailers are banking on. They study the numbers, watch our habits, and record our purchases.

If you’re not careful, a trip to the store to pick up ten items will easily grow to sixteen. Curb the impulse and save!

Chopping Shopping: Reducing Trips to the Store

America’s Cheapest Family

We’ve been called “America’s Cheapest Family,” “the First Family of Frugal,” “cheapskates,” “thrift-a-holics,” “tightwads,” or one of many other less flattering terms. Even calling us by our real last name, Economides, relates to saving cash. Yes, that’s our real name—it’s pronounced “econo-mee-dis.” It’s Greek and means “son of the steward.”

As the nicknames make clear, we don’t like to spend a lot of money. But we don’t economize just for the sake of skimping. We have big dreams—goals that together we are working toward. We are living proof that even in tough economic times, it’s possible to:

•Raise responsible kids

•Purchase a home and pay it off in nine years

•Buy cars for cash

•Enjoy fabulous debt-free vacations

•Feed a growing family on a grocery budget of just $350 each month

•Put savings in the bank

What’s more, all this was done during the first twelve years of our marriage on an average income of less than $35,000.

A Wish Fulfilled

This is a book we wish had existed when we were starting out on our financial journey. We’re not going to bog you down with pages of hard-to-follow economic theory and calculations. Instead, we focus on practical advice that even the most financially challenged can easily implement. America’s Cheapest Family Gets You Right on the Money will show you how to buy groceries smarter and less expensively, create a household budget that really works, buy affordable cars and homes, find alternative sources for dressing fabulously, deal with medical care and expenses, discover fun recreational activities that are free, plan and take great vacations that don’t break the bank, teach kids to earn and manage money, build a great savings plan for the future, get out of debt and emerge from the vicious cycle of living paycheck to paycheck, and so much more.

Neither of us has a finance or accounting background. Neither of our parents taught us to manage money—they were frugal, but by no means financial wizards. We are just an average couple who have discovered the secrets to living well on way less than most people can imagine.

Many people believe that thrifty living can be more easily accomplished in a rural setting. We are here to tell you that it just isn’t so! Living in the suburbs all of our lives, we can strongly say that there are great bargains to be had at every turn. With a dense population comes greater opportunities to scoop up steep discounts and free items.

Writing from the perspective of a family, we hope to bring our message to every age group. The younger generation needs to hear that there is an alternative to today’s credit-charged lifestyle—frugal living can be fun and very rewarding, something our children know well. Those in the throes of the middle years, whether raising kids, building careers, or both, need to hear that work doesn’t need to own them. We can vouch for the fact that they can live on less and still reach incredible goals. And as we edge our way toward retirement, we can offer guidance to seniors, many of whom live on Social Security or are learning to stretch their savings. As economizers, we proclaim that no matter what your financial state, and regardless of what the economy is doing, you can not only survive but thrive.

Three Principles for Getting you Right on the Money

There will be three themes that you’ll see recur throughout this book: avoid debt like the plague, live below your means, and embrace the thrifty lifestyle.

Avoid Debt Like the Plague

Why avoid debt, especially when many financial experts advocate credit card usage to establish a good credit score? Because the overuse of credit actually lowers your standard of living. After spending freely, eventually you’ll have to pay back what you’ve borrowed. This will have to be done with money that could better be spent on today’s needs rather than yesterday’s desires. The restriction of your cash flow after experiencing credit-enabled “freedom” is always a bitter pill to swallow. The average American family has a credit card balance of over $7,000, and we have seen the dark side of credit abuse in which relationships and families crumble under the heavy weight of unpaid debts. The good news is that most people can be debt-free (with the exception of their home) in about eighteen months if they develop a plan and stick with it. We’ll show you exactly how it can be done!

While some call us naive to live without the “benefits” of credit (that’s right, we don’t have any credit cards), we’re here to say that it can be done—and life can be good! We have more things than we need, experience more good living than we deserve, and thoroughly enjoy all that we can afford. Can life be any better than this?

Live Below Your Means

This important principle is best accomplished by using a written budget. This is really much easier than you think—and in Chapter 3: Budgeting we’ll show you how you can use a budget to set aside money in advance of all your expenses. In today’s fast-paced lifestyle, spending can easily get out of control. A budget is a great tool to manage spending and makes living below your means achievable. How do you know when you are living below your means? Is it when all the bills are paid and you’ve still got money left over? We think it’s much more than that. Budgeting is the cornerstone of family finances. In every chapter we’ll build upon that foundation with loads of ideas to free up money that you didn’t even know you had.

Embrace the Thrifty Lifestyle

Being thrifty means that we should always strive to be efficient and resourceful with what we have. (Uggh! That sounds about as exciting as oatmeal.) But in reality, we look at this lifestyle as a game and the savings in time and money as the prize. Every chapter will contain tips, secrets, and new skills you can learn to help you win every time.

Many people say that avoiding credit, living below your means, and being thrifty are a waste of time. Ha! We say that as you experience success in reaching your financial dreams (and you will), you’ll be so convinced these practical principles work that you’ll never go back to the way you were living before. And you’ll leave the scoffers behind you, eating your financial dust!

How “America’s Cheapest Family” Got Started

When we dreamed up the idea for the HomeEconomiser newsletter in March 2003, we had no idea that our thrifty advice would be so warmly embraced. There was tremendous interest from the media, and within one month several newspaper stories appeared, as did TV spots and radio interviews. In the next eighteen months the story spread from Phoenix across the United States and even to London, Hong Kong, Turkey, Australia, and New Zealand.

We were first hailed as “America’s Cheapest Family” when we appeared on Good Morning America in 2004. Initially we flinched at the use of the word cheap. Ugh! We have never thought of ourselves as cheapskates. We think of ourselves as deal makers and bargain hunters. But in a language that has no positive adjectives to describe people who live within their means, are careful to evaluate every purchase, and always have money in the bank, we can understand the dilemma. To a world that loves to spend, those of us who love to save just aren’t looked upon in a positive light. What options are available to reporters try- ing to describe a family they believe to be the ultimate in our line of work? Are we the Frugalest? The Most Miserly? The Tightwaddiest, the Thriftiest, the Most Parsimonious? The Economical Economideses? Or the Super Skimpers? If they called us Smart Shoppers, then what would that make everyone who didn’t shop as we do? After a long evaluation and numerous discussions, we decided that if being “America’s Cheapest Family” provided us with a platform to help many thousands of families break away from financial enslavement, then we would be willing. (Besides, it’s much easier for most people to pronounce than Economides.)

Necessity Is the Mother of Economizing

Annette was raised in a large Italian family on Long Island, New York, and Steve grew up in a large Greek family on the South Side of Chicago. We met in 1979, married in 1982, and began our frugal journey together. As a newly married couple, we received lots of advice. Some family members recommended that Steve should work two jobs and Annette ought to work as well—all this so that we could save our money and purchase a house in three years’ time. But Annette wanted to learn to make our home and we wanted to be able to spend time together as a newly married couple, so we chose to do things differently. Steve worked just one job, while Annette stayed home and stretched our money until it begged for mercy.

By our first wedding anniversary, our family had grown to three. Steve was earning a whopping $7 an hour as a graphic designer. Annette worked diligently following our spending plan—pinching pennies really paid off as our savings grew. In his best-seller Life’s Little Instruction Book, H. Jackson Brown Jr. wrote the following to his son: “When starting out, don’t worry about not having enough money. Limited funds are a blessing, not a curse. Nothing encourages creative thinking in quite the same way.” This quote describes our early years to a T, and we certainly did feel blessed.

Almost exactly three years later, with baby number two on the way, we purchased our first home—a four-bedroom repo-fixer-upper. We put 15 percent down and then began aggressively paying down the principal and fine-tuning our spending plan. Nine years later, we made the last payment on that house. Our average annual income at that time was less than $35,000. Making the last payment was a monumental occasion for many reasons, not the least of which was that we were now totally convinced that thrifty living really did pay off. Our kids were happy, and we had many of the things that you would associate with a suburban family—except that we had absolutely no debt.

We’d been married twelve years by 1995, and our family had grown to include five children. Our wonderful 1,450-square-foot home, however, seemed to have shrunk. We were literally tripping over each other. After months of searching, we bought and moved into a much larger house, our dream home. It was comparatively huge—3,500 square feet with five bedrooms. The house was set on three-quarters of an acre with a citrus orchard—and lots of room for the kids to learn, grow, and do plenty of chores. Applying the same principles we used in our first home, we’ve continued to pay down our mortgage, establish an emergency fund, build some retirement savings, and buy a couple of new (used) cars with cash. Our income has increased in the intervening ten years, but we kept our expenses low and concentrated on making our money stretch as far as we could.

While financial goals are important, our greatest success has been raising five well-adjusted, happy children: John, twenty-three, Becky, twenty-one, Roy, seventeen, Joseph, fourteen, and Abbey, twelve. Economizing as a family has taught our kids important lessons about managing money, grounded them in nonmaterialistic values, and, most significantly, brought us together as a family. We’ve chosen to involve our children in managing our household finances and in turn, they have helped us economize better. Our daughter Becky discovered the thrill of consignment store shopping when she needed a dress for the prom—she uncovered a stunning lavender gown for less than $20. Our youngest son, Joseph, absolutely glowed when he encountered a virtually new baseball bat that retailed for $150 on sale at a thrift store for $10. Our youngest daughter, Abbey, was thrilled to find a long-desired Barbie horse at a silent auction fund-raiser. Not only did she use her own money for a wonderful toy, but the money went to a great cause. We know that our tightwad ways can teach the next generation skills that will last a lifetime.

We’ve been asked many times if financial success would alter our lifestyle. It hasn’t and won’t. While our economizing started out of necessity, it has now become a creative and enjoyable lifestyle that we would never abandon. We have discovered an equilibrium in our lives and a contentment in what we possess. Our greatest desire is to help others discover the same peace and contentment.

Reaching Out

In October 1983, Steve stood up in front of a group of 150 men from our church. As a young man just starting out on his financial journey, he asked if there were any older men who would be willing to help us and other young families learn to manage their finances and make sound plans for the future. Not one of them offered to help. Steve was flabbergasted. As we refined our saving and money management skills over the years, people started asking us for advice. Since then we have coached scores of individuals and families, helping them straighten out some pretty sticky financial situations. In dealing with creditors, past-due bills, and bloated budgets, we’ve helped these families cut a path through the money jungle to the pastures of financial stability. In many cases, we’ve had to disentangle them from a credit-induced paralysis and help them see the value of using a little bit of planning and a lot of creativity instead of their credit cards. The results have been heartwarming.

For five years we managed a volunteer financial coaching ministry at our church. At that time our kids were relatively young (ages one through twelve)—a full-time job in itself. Add to that Steve’s ever- increasing work responsibilities, and we came to realize that this growing ministry was just too overwhelming a task for us to maintain. When we turned over the reins of the ministry, it consisted of seventeen volunteer counselors whom we had trained, with over seventy people then being helped by the ministry.

In 2003, after twenty-one years in the workforce, first as a graphic designer and later as an advertising account executive, Steve quit his job. We felt led to help more people, but at a less frenetic pace, so we decided to pursue teaching about economizing full time.

We took our personal lifestyle and our many coaching experiences and put them in written form—and the HomeEconomiser newsletter was born. The response from readers has been amazing: families are taking control of their finances and seeing fantastic results. In three years’ time we expanded from local distribution to having subscribers in numerous countries around the world. Many readers have said that through reading our newsletter they have come to feel like our family is part of their family. We hope you’ll feel the same way too. Writing this book is an extension of the HomeEconomiser newsletter, years of “economizer” living, and thousands of hours spent helping others reach their financial goals.

We also know that there are some of you out there who could run circles around us with your thrifty knowledge and habits. We applaud you and urge you to keep setting the standard for careful living. We realize that we’re still a work in progress, always looking for new ways to improve. We hope that those of you who are black-belt economizers will catch the vision and join with us in helping so many others who are looking for ways to make their money go further.

How To Maximize Your Use of This Book

The concept for this book has been developed from our own family budgeting habits, years of personal budget coaching, and family budgeting seminars that we have presented since 1989. The process of going through every area of a family’s budget as we do in this book and sharing how we manage expenses is similar to what we did in the past, sitting around our kitchen table while we coached a family on their finances. You can think of the following pages as your own private coaching session!

While we’ve included hundreds of ways to help you make your money go further, we couldn’t possibly cover every area of household finances. It would make this book an enormous reference manual instead of an easy-to-read guide with some humor mixed in to help the medicine go down.

This book can be used any number of ways: you can read through it from start to finish, you can refer to it as a reference manual, or you can just jump from chapter to chapter to deal with needs as they arise. For instance, if you discover that the amount you’re spending on kids’ clothes has gotten out of hand, read the clothing chapter. If your utility expenses are crippling your budget, read the utilities chapter.

We’ve put much thought into the order of the chapters in this book. We start with the grocery chapter because for most families this is one of the fastest ways to achieve significant savings quickly. We follow that with budgeting, because it is the foundation to building a sound financial future. It has been the single most valuable tool in helping us reach our financial goals. The chapters that follow are organized from the necessities down to the more optional expenses in the family budget. We put the debt chapter near the middle of the book because we didn’t want to hit you with a lot of heavy stuff right away. But if you are struggling with a mountain of debt, you may want to start with Chapter 7 and then read the rest of the book in order. We know that our chapters may not be in the same order as most financial books (like our attitudes chapter, near the end of the book), but then again, we’ve always done things differently—that’s what makes life with us so much fun!

We won’t lie to you—there aren’t many quick fixes to household finance problems. Sometimes things we propose might seem radical. But please allow the ideas to sink in and take time to germinate. When a real need crops up in our lives, sometimes it’s those crazy ideas that provide the answer we’re looking for. We can promise that if you focus on one issue at a time, you will eventually find a solution that works for your family. And with each victory will come a renewed conviction that you can and will be able to clear the next hurdle to come your way.

We’ve included lots of stories from our lives and from the lives of people we’ve helped. The stories we tell are all true, but to protect the privacy of the people involved, we have changed the names and any other identifying details. Thrifty subscribers to the HomeEconomiser newsletter have also added lots of their great tips throughout the book.

The Significance of the Mouse, the Owl, and the Ant

We realize that everyone reading this book will be at a different place on their journey toward saving money. Some will be considering the frugal life for the first time, while others will be seasoned veterans. In each chapter, we present three levels of practical steps that can be taken right now: the Timid Mouse, the Wise Owl, and the Amazing Ant.

What do a mammal and an insect have to do with America’s Cheapest Family? Well, nature plays a big role in our family. We home-school our kids and encourage them to observe and investigate animal and insect behavior. We pay attention to what these animals do, and often we become aware of how some of our own behaviors—good and bad—parallel theirs.

The habits and characteristics of three particular creatures can be an encouragement to you as a seeker of deals and discounts. Each chapter concludes with a page titled “What You Can Do Now,” in which we present three levels of application of the principles and stories that we have related in the chapter. We know that not everyone reading this book will be at the same degree of thriftiness, so we’ve broken down our advice for beginners (Timid Mouse), intermediates (Wise Owl), and—for those hard-core tightwads—the advanced advice (Amazing Ant).

These titles may seem a bit juvenile, but once you understand some of the characteristics of these creatures, we think you’ll agree with our reasons for relating them to the different stages of frugal living.

Timid Mouse

Mice are shy creatures. They rarely come out during the day. At night, when they do go on the prowl, they tend to do so secretively. They stay close to the walls or other objects that will conceal them. They don’t want to be detected. They find what they need or want, then scamper back to their hiding place and enjoy their loot.

Fledgling economizers are much the same. It may be embarrassing to think that someone might catch them at a garage sale or thrift store. They don’t want anyone to know that they are hunting for “cheap” stuff. So they go out in neighborhoods where they won’t be detected or shop late at night, when they’re less likely to be noticed. They would be mortified if anyone knew that the clothes that they are wearing were purchased at a thrift store. Although they enjoy the bargains they find, they won’t be quick to tell anyone else about their great finds.

It’s okay to be timid at the outset—we all were a little uncertain about how and where to start. Our encouragement to the timid mice is to keep looking for new ways to save. Keep going out and searching. Soon you’ll be so confident in your thrifty ways that you won’t have to be so secretive about it and your pile of loot will really start to accumulate.

Wise Owl

A family of great horned owls inhabits the area around our home. We often see them fly to the top of our tallest pine trees and peer out over the neighborhood, watching and waiting for something to consume (contrary to common belief, they don’t hunt only at night). They are patient—very patient. Waiting quietly and hidden, they watch. When the time is right and their quarry is in sight, they silently swoop down from the treetops and strike. They carry their prey to a hideaway and share it with their family. They’ll stay in one area for a time, but once the food supply is diminished, they move on to greener pastures. Although they are wise in their hunting habits, they only gather enough food for a few days at a time—there is no reserve, so life is a constant pursuit of food.

Intermediate thrifty people are much like owls. They know that there are bargains to be found in abundance—they’ll just have to watch and wait. They know that patience pays and pays big-time. They still aren’t too keen about others knowing what they are up to and how they find their deals—especially if someone gets to a bargain before they do. But they are confident enough about their hunting skills to do it day or night—it really doesn’t matter. Hunting for treasure is a great way to provide for their needs, and they enjoy it. But it takes constant vigilance and consumes much of their time and mental energy.

Amazing Ant

Ants are truly unbelievable creatures. They are organized, diligent, and tireless. They use their nests to store food for their seasonal needs. In areas where winter is harsher and longer, ant nests are larger and deeper in the ground, providing room to store more food for the long winter and more protection from the cold. Ants look at the weather and plan for the future needs of their colony. When scouts go out and find food, they lay a scent trail for other workers to follow. You’ll often see columns of ants marching ceaselessly to and from a food source. Ants are strong. They can carry material equivalent to many times their body weight. If they encounter an obstruction to their work, they either go over or around it or call in the reserves to move it out of the way. Teamwork and diligence are some of their most admirable attributes.

Advanced economizers are very much like ants. Organization is their key to success. Their pantries are arranged so they can track what supplies they have and what they need, and their clothes are organized as well. They are always looking for bargains, and when they find them they let others know. The network of other frugal-minded friends they have established provides them with greater savings and the encouragement to press on with diligence in the face of a culture that wants to squish them. Planning in advance for events that they see coming in the future is their strength. They know that their kids will need larger clothes, so they develop a storage system and a network of friends with whom they can trade outgrown clothes. They store bargain-priced food to feed their family quality products at a lower cost.

How we write

This book is truly a family effort. The kids are the laboratory for many of our great ideas, and unfortunately some of our more unpopular ones too. We’ve given them space in each chapter to express their opinions about various topics.

We—Annette and Steve—have written this book together. For the most part, we have written in the first person plural, except when we speak of ourselves individually. There we’ve decided to refer to ourselves in the third person—“Annette says” or “Steve thinks.” It makes our writing less cumbersome and easier to understand. Although it may be atypical, we write as one voice.

Too often, books on the frugal lifestyle are written by one spouse, and it leaves us wondering what the other spouse is feeling about the decisions being made. We have agreed to agree before making any major decisions. This policy may result in delays, but what’s more important is that it builds unity and protects us from mistakes. This book was written the same way—together. That isn’t to say that we agree on everything in life, but regarding the essential points of living within our means, saving in advance of every purchase, and teaching our kids to do the same, we are of one mind and on the same page.

Reference Materials

One of the most important things we’ll teach you in this book is the power of knowledge and the value of research. In pre-Internet days, research was much more time-consuming and daunting. With the proliferation of information available through free Web sites, becoming powerfully informed is much easier. While all of our research is not done on the Internet, having access is most helpful. Throughout the book we have included recommendations for Web sites and helpful books. Our Web site, AmericasCheapestFamily.com, also contains a wealth of information and many more links to aid you on your quest. If this is something new to you, just remember that most public libraries offer online access and assistance in navigating the Internet.

Taking Notes

We’ve intentionally left wide margins in this book so you can make notes, scribble down ideas, set goals, or just doodle.

But even if you don’t write anything in here, try to document your progress somewhere. Many people say they set goals, but only a small percentage actually take the time to write them down. You are much more likely to reach your goals if you’ve taken the time to think them through, write them down, and review them often. You should see some of our old lists of goals—whew, a few of the things we jotted down seem silly now. But the list of the things we have accomplished is staggering—it contains so many things that originally seemed insurmountable when we wrote them down years ago.

Please Be Careful

Much of the material contained in this book chronicles our experiences. There are also some ideas that have been sent in by readers of our newsletter. We make every effort to do things by the book, safely and legally. There are so many ways to save money that cheating or fudging the truth just isn’t necessary. But economizers are typically rebels at heart and trailblazers, people who don’t follow the beaten path. While that is a good thing, there are risks involved with veering outside the lines. It is up to you to exercise your best judgment and care when you employ the concepts we discuss. Use what we write as a point of departure for your own research. Making sound financial decisions must be based on your personal values, time, research, and in many cases the advice of a financial professional.

Through our newsletter and its coverage in the media, America’s Cheapest Family has touched millions of lives. We hope that this book will reach and help millions more. two

Groceries:

Savings by the Bagful

When it comes to reducing household expenses, one of the fastest and easiest ways is to look at your grocery spending habits. How much can you save? That all depends on how much effort and time you have to spend.

According to the U.S. Department of Labor, the average American family of four spends $8,513 per year on groceries. That’s $709 each month—$177 per person! By comparison, we spend just $350 per month to feed a family of seven, including three growing boys! That’s $50 per person—66 percent less than the national average. Implementing just a couple of Annette’s many strategies in your grocery-buying habits can have a huge impact on your food budget. If the average family could reduce their food bill just 20 percent, they’d have an extra $1,702 in the bank each year.

Remember that what we share are just a few of the strategies that we use. There is so much to say that we could fill a whole volume on groceries alone. But we are going to present plenty of ideas for you to be able to save hundreds of dollars on your groceries this year. Not all may apply to your lifestyle or family, but stick with us. We’re writing from over twenty-four years’ experience practicing and perfecting these habits. Try a few, and you may be pleasantly surprised not only with the benefit to your household but with the savings you’ll gain.

The Cost of Impulsiveness

When Steve was working as an advertising account executive, he had a client who marketed cheese products on military bases worldwide. We were shocked to read in a food industry publication that grocers expect six of ten items consumers pick up in the store to be unplanned purchases. Sixty percent!

Later, Steve and this client created an in-store promotion where they set up a display showcasing regularly priced spaghetti, pasta sauce, Parmesan cheese, and Italian salad dressing. Above it was hung a banner announcing “Pasta Tonite.” They also handed out a very confusing coupon sheet that required the consumer to purchase three different items from the display in order to redeem any one coupon. Sales of the regularly priced items from the display increased 38 percent, just because it was easy for shoppers to pick up an entire meal. Coupon redemptions were less than 1 percent. The manufacturer saw a huge sales increase without having to “pay” for it through coupon redemptions. This promotion was repeated for five years, and the sales results were consistent.

J. Jeffrey Inman at the University of Wisconsin, Madison, and Russell S. Winer at the University of California, Berkeley, researched the effects that in-store activity such as promotions, displays, and signage had on consumer purchases. In their study “Where the Rubber Meets the Road: A Model of In-Store Consumer Decision Making,” they present an analysis of the decisions of over 4,200 customers who made 30,000 purchases in fourteen different cities. In a nutshell, they discovered the following habits:

•Shoppers making a “quick trip” to the store to pick up a few specific items usually purchase 54 percent more than they planned.

•Forty-seven percent of shoppers go to the store three or four times each week.

•Consumers graze at the grocery store, with impulse buys making up between 50.8 and 67.7 percent of total purchases.

(In the following three statistics, the number represents the percentage of times unplanned items are purchased from these displays.)

•End-of-aisle displays encourage higher impulse buys—61 percent.

•In-aisle displays encourage moderate impulsive purchases—58 percent.

•Checkout displays—candy and magazines—generate the highest impulsivity, a 64 percent rate.

(Even though this study was conducted in 1998, our observations and discussions with store managers tell us that if anything has changed, we as a society are more impulsive now than before.)

The more often you go to the store, the more often you will walk past displays, endcaps of special items, and the ever-enticing goodies in the checkout lane. The more often you pass these locations, the more likely you’ll be to spend more than you intended. This is exactly what retailers are banking on. They study the numbers, watch our habits, and record our purchases.

If you’re not careful, a trip to the store to pick up ten items will easily grow to sixteen. Curb the impulse and save!

Chopping Shopping: Reducing Trips to the Store

Recenzii

“Of all the how-to-do-it books ever written, the best and most constructively useful are the Bible, Voltaire’s Candide- and this one. The time is right, right now, for somebody to give us all a top sergeant lesson in practical economics: ‘There is no free lunch.’ Congratulations, Annette and Steve Economides: I pray your readers will practice what you teach.”

- PAUL HARVEY, legendary American radio broadcaster and host of The Rest of the Story on the ABC Radio Network

“If your family is struggling with debt or you find yourself spending more money than you can legitimately afford, pick up and READ this book today! Implement the strategies you find and enjoy a lifetime free of financial anxiety!”

- Glinda Bridgforth, financial coach, Oprah Debt Diet consultant, and bestselling author of Girl, Make Your Money Grow! and Girl, Get Your Credit Straight!

- PAUL HARVEY, legendary American radio broadcaster and host of The Rest of the Story on the ABC Radio Network

“If your family is struggling with debt or you find yourself spending more money than you can legitimately afford, pick up and READ this book today! Implement the strategies you find and enjoy a lifetime free of financial anxiety!”

- Glinda Bridgforth, financial coach, Oprah Debt Diet consultant, and bestselling author of Girl, Make Your Money Grow! and Girl, Get Your Credit Straight!

Descriere

Dubbed "Americas Cheapest Family" by ABCs "Good Morning America," the Economides transformed their household finances by living below their means. Here, they offer savvy advice on avoiding debt and easing into frugality.