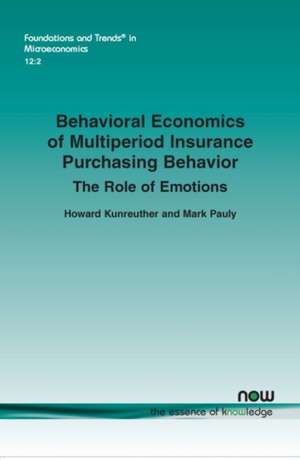

Behavioral Economics of Multiperiod Insurance Purchasing Behavior

Autor Howard Kunreuther, Mark Paulyen Limba Engleză Paperback – 31 mar 2019

Preț: 418.85 lei

Preț vechi: 455.27 lei

-8% Nou

Puncte Express: 628

Preț estimativ în valută:

80.16€ • 83.38$ • 66.17£

80.16€ • 83.38$ • 66.17£

Carte tipărită la comandă

Livrare economică 14-28 aprilie

Preluare comenzi: 021 569.72.76

Specificații

ISBN-13: 9781680835243

ISBN-10: 1680835246

Pagini: 104

Dimensiuni: 156 x 234 x 6 mm

Greutate: 0.17 kg

Editura: Now Publishers Inc

ISBN-10: 1680835246

Pagini: 104

Dimensiuni: 156 x 234 x 6 mm

Greutate: 0.17 kg

Editura: Now Publishers Inc

Descriere

Demonstrates that emotions play a role in predicting departures from expected utility maximization for making insurance purchasing decisions over time. The authors highlight the conceptual issues and alternative theories of behaviour about repeat insurance purchasing over time.