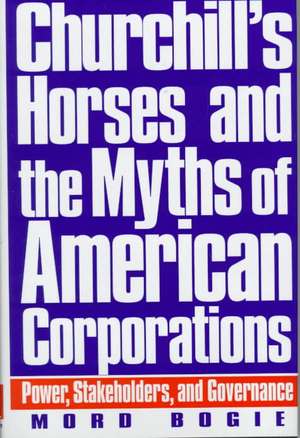

Churchill's Horses and the Myths of American Corporations: Power, Stakeholders, and Governance

Autor Mord Bogieen Limba Engleză Hardback – 11 feb 1998 – vârsta până la 17 ani

Preț: 438.41 lei

Preț vechi: 603.61 lei

-27% Nou

Puncte Express: 658

Preț estimativ în valută:

83.90€ • 86.93$ • 70.02£

83.90€ • 86.93$ • 70.02£

Carte tipărită la comandă

Livrare economică 21 martie-04 aprilie

Preluare comenzi: 021 569.72.76

Specificații

ISBN-13: 9781567200737

ISBN-10: 1567200737

Pagini: 232

Dimensiuni: 156 x 235 x 23 mm

Greutate: 0.55 kg

Ediția:New.

Editura: Bloomsbury Publishing

Colecția Praeger

Locul publicării:New York, United States

ISBN-10: 1567200737

Pagini: 232

Dimensiuni: 156 x 235 x 23 mm

Greutate: 0.55 kg

Ediția:New.

Editura: Bloomsbury Publishing

Colecția Praeger

Locul publicării:New York, United States

Notă biografică

MORD BOGIE is a consultant, former lawyer, U.S. foreign aid official, and corporate executive with business experience on five continents. He graduated from Princeton in public and international affairs and, after service in the Marine Corps, from Harvard Law School. He lives with his wife, Sharon Nickles, a computer consultant, in Beacon, New York. This is his first book.

Cuprins

Introduction: Our Underachieving CorporationsControlCorporations Are Nothing More or Less Than Their PeoplePublic Corporations Are Just Private Corporations with Many OwnersThe Owners of a Public Corporation Control It by Electing Its DirectorsThe First Concern of Public Corporation Management Is Shareholder ValueShareholdersCorporations Maximize Shareholder Value by Maximizing Current ProfitCorporate Profit Is the Best Measure of Real Shareholder ValueCorporate Profit Is Owned by the Shareholders Who Own the CorporationCorporations Exist to Maximize Shareholder ValueCustomersCorporations Engage in Marketing to Satisfy Their Customers' NeedsCorporations Invest in Brands to Increase Customer ValueCorporations Are Required by Supply & Demand to Charge Their Lowest PricesCorporations Innovate to Satisfy Their Customer's NeedsManagersCorporate Management Is EntrepreneurialCorporate Management Is StrategicProfessional Managers Can Run Any Corporate BusinessCorporate Management Is Strong Because It's Team ManagementCEOsIn Public Corporations the CEO Is Controlled by Independent DirectorsCEOs Are Paid What They Are WorthCEO Compensation Is Linked to Corporate PerformanceCEOs Devote Full Time to Managing Their CorporationWorkersPublic Corporations Are Proficient at Motivating Their WorkersCorporations Stay Competitive in a Global Economy by DownsizingCorporations Have to Lay Off Workers When Business Is BadRaising Productivity Benefits Workers by Raising What They EarnCapitalistsWall Street's Primary Function Is Raising Money for Public CorporationsInvestment Bankers Serve the Interests of Clients and Investors SimultaneouslyThe Market Is a Level Trading Field for Public InvestorsWall Street's Influence on Public Corporations Is BeneficialAfterword: We Are All Consumers, We Are All WorkersTable of Anti-MythsNotes on SourcesSelected BibliographyIndex