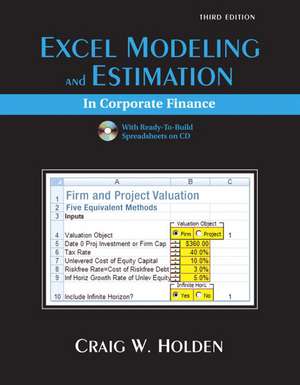

Excel Modeling and Estimation in Corporate Finance: United States Edition

Autor Craig W. Holdenen Limba Engleză Mixed media product – 3 mar 2008

This book focuses on active learning by teaching students how to build and estimate financial models using Excel so they understand the steps involved, rather than being handed completed spreadsheets.

Preț: 297.26 lei

Nou

Puncte Express: 446

Preț estimativ în valută:

56.88€ • 59.66$ • 47.35£

56.88€ • 59.66$ • 47.35£

Cartea nu se mai tipărește

Doresc să fiu notificat când acest titlu va fi disponibil:

Se trimite...

Preluare comenzi: 021 569.72.76

Specificații

ISBN-13: 9780136025610

ISBN-10: 0136025617

Pagini: 216

Dimensiuni: 216 x 279 x 13 mm

Greutate: 0.53 kg

Ediția:Nouă

Editura: Pearson Education

Colecția Prentice Hall

Locul publicării:Upper Saddle River, United States

ISBN-10: 0136025617

Pagini: 216

Dimensiuni: 216 x 279 x 13 mm

Greutate: 0.53 kg

Ediția:Nouă

Editura: Pearson Education

Colecția Prentice Hall

Locul publicării:Upper Saddle River, United States

Cuprins

Contents

Chapter 1 — Single Cash Flow

Chapter 2 — Annuity

Chapter 3 — NPV Using Constant Discounting

Chapter 4 — NPV Using General Discounting

Chapter 5 — Loan Amortization

Chapter 6 — Bond Valuation

Chapter 7 — Estimating Cost of Capital

Chapter 8 — Stock Valuation

Chapter 9 — Firm and Project Valuation

Chapter 10 — The Yield Curve

Chapter 11 — US Yield Curve Dynamics

Chapter 12 — Project NPV

Chapter 13 — Cost-Reducing Project

Chapter 14 — Break-Even Analysis

Chapter 15 — Corporate Financial Planning

Chapter 16 — Du Pont System of Ratio Analysis

Chapter 17 — Life-Cycle Financial Planning

Chapter 18 — Binomial Option Pricing

Chapter 19 — Real Options

Chapter 20 — Black Scholes Option Pricing

Chapter 21 — Debt and Equity Valuation

Chapter 22 — International Parity

Chapter 23 — Useful Excel Tricks

Short Retail Descripti

Chapter 1 — Single Cash Flow

Chapter 2 — Annuity

Chapter 3 — NPV Using Constant Discounting

Chapter 4 — NPV Using General Discounting

Chapter 5 — Loan Amortization

Chapter 6 — Bond Valuation

Chapter 7 — Estimating Cost of Capital

Chapter 8 — Stock Valuation

Chapter 9 — Firm and Project Valuation

Chapter 10 — The Yield Curve

Chapter 11 — US Yield Curve Dynamics

Chapter 12 — Project NPV

Chapter 13 — Cost-Reducing Project

Chapter 14 — Break-Even Analysis

Chapter 15 — Corporate Financial Planning

Chapter 16 — Du Pont System of Ratio Analysis

Chapter 17 — Life-Cycle Financial Planning

Chapter 18 — Binomial Option Pricing

Chapter 19 — Real Options

Chapter 20 — Black Scholes Option Pricing

Chapter 21 — Debt and Equity Valuation

Chapter 22 — International Parity

Chapter 23 — Useful Excel Tricks

Short Retail Descripti

Caracteristici

For undergraduate and graduate courses in corporate finance or financial management.

This book focuses on active learning by teaching students how to build and estimate financial models using Excel so they understand the steps involved, rather than being handed completed spreadsheets.

Ready-To-Build Spreadsheets

The accompanying CD provides ready-to-build spreadsheets for every chapter that dictates step-by-step instructions to the student. Since the CD provides instructions within each spreadsheet, so students do not have to refer back to the book for each step. This approach allows students to concentration on implementing financial formulas and estimation.

Excel Modeling and Estimation — The New Content

Several significant updates have been made to this edition, including:

This book focuses on active learning by teaching students how to build and estimate financial models using Excel so they understand the steps involved, rather than being handed completed spreadsheets.

Ready-To-Build Spreadsheets

The accompanying CD provides ready-to-build spreadsheets for every chapter that dictates step-by-step instructions to the student. Since the CD provides instructions within each spreadsheet, so students do not have to refer back to the book for each step. This approach allows students to concentration on implementing financial formulas and estimation.

Excel Modeling and Estimation — The New Content

Several significant updates have been made to this edition, including:

- Estimating firm valuation in a two-stage framework

- Estimating the cost of capital using the static CAPM based on the Fama-MacBeth method

- Estimating the cost of capital using the APT or Intertemporal CAPM based on the Fama-French three factor model

- Four international parity conditions

- A new chapter on Excel tricks

- Flexible content to use as a supplement with any textbook for a corporate finance course

- Opportunities to build from simple Excel examples to practical, real-world applications using Excel.