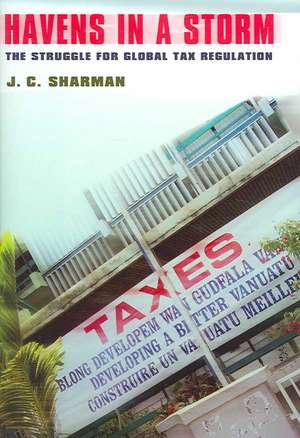

Havens in a Storm – The Struggle for Global Tax Regulation: Cornell Studies in Political Economy

Autor J. C. Sharmanen Limba Engleză Hardback – 29 noi 2006

In a fascinating book based on fieldwork and interviews in twenty-two countries in the Caribbean, North America, Europe, and islands in the Pacific and Indian Oceans, J. C. Sharman shows how the struggle was decided in favor of the tax havens, which eventually avoided common regulation. No other book on tax havens is based on such extensive fieldwork, and no other author has had access to so many of the key decision makers who played roles in the conflict between onshore and offshore Sharman suggests that microstates succeeded in their struggle with great powers because of their astute deployment of reputation and effective rhetorical self-positioning. In effect, they persuaded a transnational audience that the OECD was being untrue to its own values by engaging in a hypocritical, bullying exercise inimical to free competition.

Din seria Cornell Studies in Political Economy

-

Preț: 213.28 lei

Preț: 213.28 lei -

Preț: 154.39 lei

Preț: 154.39 lei -

Preț: 277.16 lei

Preț: 277.16 lei -

Preț: 230.51 lei

Preț: 230.51 lei -

Preț: 196.77 lei

Preț: 196.77 lei -

Preț: 175.73 lei

Preț: 175.73 lei -

Preț: 423.45 lei

Preț: 423.45 lei -

Preț: 172.22 lei

Preț: 172.22 lei -

Preț: 406.75 lei

Preț: 406.75 lei -

Preț: 206.45 lei

Preț: 206.45 lei -

Preț: 426.42 lei

Preț: 426.42 lei -

Preț: 360.43 lei

Preț: 360.43 lei -

Preț: 183.67 lei

Preț: 183.67 lei -

Preț: 304.15 lei

Preț: 304.15 lei -

Preț: 282.58 lei

Preț: 282.58 lei - 27%

Preț: 721.37 lei

Preț: 721.37 lei - 27%

Preț: 719.97 lei

Preț: 719.97 lei -

Preț: 418.11 lei

Preț: 418.11 lei - 27%

Preț: 722.76 lei

Preț: 722.76 lei - 27%

Preț: 721.20 lei

Preț: 721.20 lei -

Preț: 447.25 lei

Preț: 447.25 lei - 27%

Preț: 720.26 lei

Preț: 720.26 lei -

Preț: 452.05 lei

Preț: 452.05 lei - 27%

Preț: 720.93 lei

Preț: 720.93 lei - 27%

Preț: 718.98 lei

Preț: 718.98 lei - 27%

Preț: 723.20 lei

Preț: 723.20 lei - 27%

Preț: 722.76 lei

Preț: 722.76 lei -

Preț: 477.28 lei

Preț: 477.28 lei - 27%

Preț: 720.66 lei

Preț: 720.66 lei - 27%

Preț: 722.36 lei

Preț: 722.36 lei - 23%

Preț: 581.99 lei

Preț: 581.99 lei - 27%

Preț: 724.87 lei

Preț: 724.87 lei - 27%

Preț: 724.31 lei

Preț: 724.31 lei - 27%

Preț: 721.09 lei

Preț: 721.09 lei -

Preț: 164.14 lei

Preț: 164.14 lei -

Preț: 162.00 lei

Preț: 162.00 lei - 27%

Preț: 723.75 lei

Preț: 723.75 lei - 27%

Preț: 719.53 lei

Preț: 719.53 lei - 27%

Preț: 726.00 lei

Preț: 726.00 lei -

Preț: 420.98 lei

Preț: 420.98 lei - 27%

Preț: 726.29 lei

Preț: 726.29 lei

Preț: 474.03 lei

Nou

Puncte Express: 711

Preț estimativ în valută:

90.71€ • 96.100$ • 75.63£

90.71€ • 96.100$ • 75.63£

Carte tipărită la comandă

Livrare economică 17 aprilie-01 mai

Preluare comenzi: 021 569.72.76

Specificații

ISBN-13: 9780801445040

ISBN-10: 0801445043

Pagini: 224

Dimensiuni: 154 x 234 x 22 mm

Greutate: 0.45 kg

Ediția:New.

Editura: MB – Cornell University Press

Seria Cornell Studies in Political Economy

ISBN-10: 0801445043

Pagini: 224

Dimensiuni: 154 x 234 x 22 mm

Greutate: 0.45 kg

Ediția:New.

Editura: MB – Cornell University Press

Seria Cornell Studies in Political Economy

Descriere

Small states have learned in recent decades that capital accumulates where taxes are low; as a result, tax havens have increasingly competed for the attention of international investors with tax and regulatory concessions. Economically powerful...