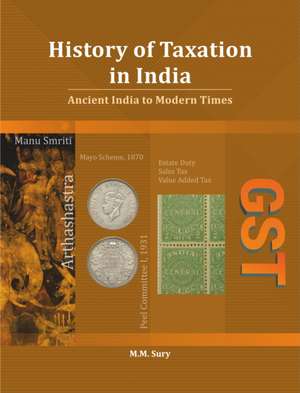

History of Taxation in India: Ancient India to Modern Times

Autor Dr. M M Suryen Limba Engleză Hardback – 31 oct 2022

Preț: 592.15 lei

Preț vechi: 669.87 lei

-12% Nou

Puncte Express: 888

Preț estimativ în valută:

113.31€ • 118.60$ • 94.31£

113.31€ • 118.60$ • 94.31£

Carte indisponibilă temporar

Doresc să fiu notificat când acest titlu va fi disponibil:

Se trimite...

Preluare comenzi: 021 569.72.76

Specificații

ISBN-13: 9788177085396

ISBN-10: 8177085395

Pagini: 246

Dimensiuni: 195 x 248 mm

Greutate: 0.57 kg

Editura: New Century Publications

Colecția New Century Publications (IND)

ISBN-10: 8177085395

Pagini: 246

Dimensiuni: 195 x 248 mm

Greutate: 0.57 kg

Editura: New Century Publications

Colecția New Century Publications (IND)