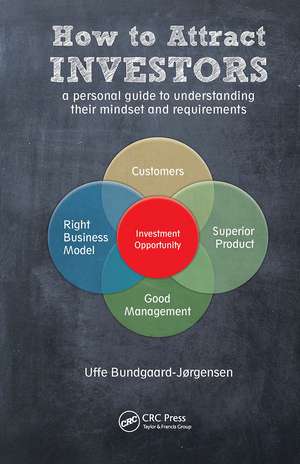

How to Attract Investors: A Personal Guide to Understanding Their Mindset and Requirements

Autor Uffe Bundgaard-Jorgensenen Limba Engleză Hardback – 9 noi 2016

How to Attract Investors takes the reader into the minds of the investors, addressing many of the challenges connected to investor search and negotiation and living with investors as co-owners. Even the finest skills of the brightest entrepreneurs wouldn’t be complete without the knowledge of the investor’s mind. This is the book that unravels it, layer by layer.

Preț: 378.17 lei

Nou

Puncte Express: 567

Preț estimativ în valută:

72.36€ • 75.74$ • 60.23£

72.36€ • 75.74$ • 60.23£

Carte tipărită la comandă

Livrare economică 31 martie-14 aprilie

Livrare express 21-27 februarie pentru 158.30 lei

Preluare comenzi: 021 569.72.76

Specificații

ISBN-13: 9789814745208

ISBN-10: 9814745200

Pagini: 390

Dimensiuni: 152 x 229 x 27 mm

Greutate: 0.72 kg

Ediția:1

Editura: Jenny Stanford Publishing

Colecția Jenny Stanford Publishing

ISBN-10: 9814745200

Pagini: 390

Dimensiuni: 152 x 229 x 27 mm

Greutate: 0.72 kg

Ediția:1

Editura: Jenny Stanford Publishing

Colecția Jenny Stanford Publishing

Public țintă

Academic and Professional Practice & DevelopmentCuprins

The Investors. Business or Just a Dream - the Business Plan Puzzle. Meeting Investors and Negotiations. Life with Investors.

Recenzii

"How to Attract Investors is extensive, very practical and truly hands-on, filling an important gap in entrepreneurship literature: a book that provides entrepreneurs with advice they can use and act on instantly."

—Marc-Michael Bergfeld, professor of global entrepreneurship and family firms, Munich Business School, Germany and managing director, CPG—Courage Partners Group, Germany

"An end-to-end approach to enticing and managing investors. Essential reading for entrepreneurs."

—John Straw, serial entrepreneur and author of iDisrupted and senior consultant at IBM IoT, McKinsey and IDisruptive, London, UK

"A must-have for ambitious entrepreneurs and recommended reading for all those working with entrepreneurs in the ecosystem."

—William Stevens, managing director, Tech Tour/Europe Unlimited, Belgium

"This book is a valuable tool to evaluate where to use the limited resources in order to succeed with the challenging task of securing liquidity for future growth, while still staying in control."

—Steen Donner, CEO of Scion DTU, Science and Technology Park, Technical University of Denmark, Denmark

—Marc-Michael Bergfeld, professor of global entrepreneurship and family firms, Munich Business School, Germany and managing director, CPG—Courage Partners Group, Germany

"An end-to-end approach to enticing and managing investors. Essential reading for entrepreneurs."

—John Straw, serial entrepreneur and author of iDisrupted and senior consultant at IBM IoT, McKinsey and IDisruptive, London, UK

"A must-have for ambitious entrepreneurs and recommended reading for all those working with entrepreneurs in the ecosystem."

—William Stevens, managing director, Tech Tour/Europe Unlimited, Belgium

"This book is a valuable tool to evaluate where to use the limited resources in order to succeed with the challenging task of securing liquidity for future growth, while still staying in control."

—Steen Donner, CEO of Scion DTU, Science and Technology Park, Technical University of Denmark, Denmark

Notă biografică

Uffe Bundgaard-Jørgensen has a 40-year career as an advisor on investment matters around the globe, including the World Bank and European Union. For 10 years he was CEO of a large Danish venture capital fund and has also served as a member of the board of numerous SMEs. Since 2000 he is CEO of InvestorNet-Gate2Growth, during which he has developed and conducted more than 150 ‘How to Attract Investors’ and ‘Horizon 2020 SME Instrument’ master classes throughout Europe.

Three co-authors from InvestorNet-Gate2Growth, all with an MSc degree from Copenhagen Business School, have provided direct and valuable contributions to the cases and the analysis: Rasmus Egvad has many years of experience working with private investors and coaching companies on how to attract funding. Louise Pierrel Mikkelsen has many years experience in screening, selecting and developing business cases, also for EU-supported business cases. Carmen Bianca Socaciu has extensive experience in practical business coaching.

Three co-authors from InvestorNet-Gate2Growth, all with an MSc degree from Copenhagen Business School, have provided direct and valuable contributions to the cases and the analysis: Rasmus Egvad has many years of experience working with private investors and coaching companies on how to attract funding. Louise Pierrel Mikkelsen has many years experience in screening, selecting and developing business cases, also for EU-supported business cases. Carmen Bianca Socaciu has extensive experience in practical business coaching.

Descriere

Based on the author’s 30 years’ experience as investor and advisor, this book includes real-life examples of how and why investors make mistakes and even fail. The focus is on attracting and convincing investors to invest in innovative businesses. The book explains who investors are (VC funds and business angels), how they react and think. It provides guidance on ensuring that all relevant elements are covered in a business plan, including preparing and presenting a business opportunity in a convincing way and answering investor questions.