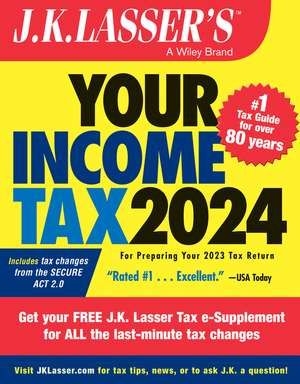

J.K. Lasser′s Your Income Tax 2024 – For Preparing Your 2023 Tax Return: J.K. Lasser

Autor J.K Lasseren Limba Engleză Paperback – 22 noi 2023

J.K. Lasser's Your Income Tax 2024: For Preparing Your 2023 Tax Return delivers practical and hands-on guidance for everyday people preparing to file their taxes for the 2023 calendar year. You'll find timely and up-to-date info about the latest changes to the US tax code, as well as worksheets and forms you can use to make filing your taxes easier. You'll get the most current insight on how to maximize your credits and deductions, keeping more money in your pocket and out.

In the latest edition of this celebrated and best-selling series, you'll find:

- Special features that walk you through the most recent Tax Court decisions and IRS rulings that determine how your deductions and credits will work

- Simple tips and tricks on how to properly file your taxes, as well as tax planning strategies that save you and your family money

- Brand new info about the latest legislation from Congress and how it impacts you

Preț: 201.00 lei

Nou

Puncte Express: 302

Preț estimativ în valută:

38.47€ • 41.80$ • 32.34£

38.47€ • 41.80$ • 32.34£

Carte disponibilă

Livrare economică 31 martie-14 aprilie

Livrare express 14-20 martie pentru 62.98 lei

Preluare comenzi: 021 569.72.76

Specificații

ISBN-13: 9781394223497

ISBN-10: 1394223498

Pagini: 928

Dimensiuni: 218 x 277 x 52 mm

Greutate: 1.38 kg

Ediția:3 ed

Editura: Wiley

Seria J.K. Lasser

Locul publicării:Hoboken, United States

ISBN-10: 1394223498

Pagini: 928

Dimensiuni: 218 x 277 x 52 mm

Greutate: 1.38 kg

Ediția:3 ed

Editura: Wiley

Seria J.K. Lasser

Locul publicării:Hoboken, United States

Cuprins

What's New for 2023 xxvii Tax News for 2023 xxvii Key Tax Numbers for 2023 xxx Tax-Saving Opportunities for 2023 and Beyond xxxii Expiring Provisions xxxiii Filing Basics 1 Filing Status 9 Reporting Your Income 35 Wages, Salary, and Other Compensation 37 Fringe Benefits 56 Dividend and Interest Income 81 Reporting Property Sales 109 Tax-Free Exchanges of Property 158 Retirement and Annuity Income 172 Income From Real Estate Rentals and Royalties 262 Loss Restrictions: Passive Activities and At-Risk Limits 282 Other Income 312 Claiming Deductions 337 Deductions Allowed in Figuring Adjusted Gross Income 339 Claiming the Standard Deduction or Itemized Deductions 345 Charitable Contribution Deductions 352 Itemized Deduction for Interest Expenses 379 Deductions for Taxes 397 Medical and Dental Expense Deductions 406 Casualty and Theft Losses and Involuntary Conversions 426 Other Itemized Deductions 451 Travel and Meal Expense Deductions 454 Personal Tax Computations 475 Dependents 477 Figuring Your Regular Income Tax Liability 491 Alternative Minimum Tax (AMT) 496 Computing the "Kiddie Tax" on Your Child's Unearned Income 504 Personal Tax Credits Reduce Your Tax Liability 510 Tax Withholdings 534 Estimated Tax Payments 542 Additional Medicare Tax and Net Investment Income Tax 548 Tax Planning 555 Tax Savings for Residence Sales 557 Tax Rules for Investors in Securities 575 Tax Savings for Investors in Real Estate 592 Tax Rules for Investors in Mutual Funds 606 Educational Tax Benefits 615 Special Tax Rules for Senior Citizens and the Disabled 634 Members of the Armed Forces 649 How To Treat Foreign Earned Income 657 Planning Alimony and Marital Settlements 668 Other Taxes 673 Gift and Estate Tax Planning Basics 679 Business Tax Planning 689 Income or Loss From Your Business or Profession 691 Retirement and Medical Plans for Self-Employed 721 Claiming Depreciation Deductions 734 Deducting Car and Truck Expenses 751 Sales of Business Property 766 Figuring Self-Employment Tax 773 Filing Your Return and the Process After You File 783 Filing Your Return 785 Filing Refund Claims, and Amended Returns 794 If the IRS Examines Your Return 798 2023 Tax Forms 811 Glossary 857 Index 863