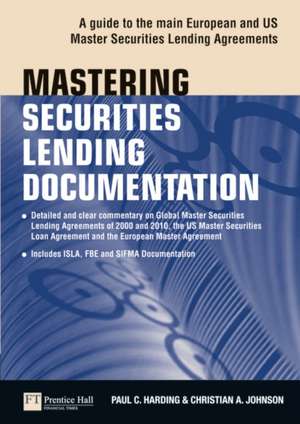

Mastering Securities Lending Documentation: A Practical Guide to the Main European and Us Master Securities Lending Agreements: Financial Times

Autor Paul Harding, Christian Johnsonen Limba Engleză Paperback – 31 oct 2011

Mastering Securities Lending Documentation is a practical guide to understanding the negotiation of these master agreements used in the United Kingdom, United States and Europe. It is an essential handbook for anyone involved in negotiating these agreements and includes:

- An introduction to the history and operations of the market

- A clear, user-friendly explanation of all paragraphs of the master agreements

- An easy-to use split page format with the original text and commentary

- Examples of commonly negotiated additions and amendments and their implications

- Answers to legal, risk and operational questions

Preț: 790.00 lei

Preț vechi: 963.42 lei

-18% Nou

Puncte Express: 1185

Preț estimativ în valută:

151.19€ • 157.26$ • 124.81£

151.19€ • 157.26$ • 124.81£

Carte disponibilă

Livrare economică 24 martie-07 aprilie

Livrare express 07-13 martie pentru 62.50 lei

Preluare comenzi: 021 569.72.76

Specificații

ISBN-13: 9780273734970

ISBN-10: 0273734970

Pagini: 792

Dimensiuni: 172 x 50 x 241 mm

Greutate: 1.34 kg

Ediția:1

Editura: FT Press

Seria Financial Times

Locul publicării:Harlow, United Kingdom

ISBN-10: 0273734970

Pagini: 792

Dimensiuni: 172 x 50 x 241 mm

Greutate: 1.34 kg

Ediția:1

Editura: FT Press

Seria Financial Times

Locul publicării:Harlow, United Kingdom

Cuprins

Chapter 1: Introduction to the securities lending market (30 pages)

-Size of market according to latest industry figures.

-Types of securities loan transactions.

- Differences between repos and securities loans

-Main players

-Regulatory infrastructure in the UK and USA.

-The influence of automation.

-How a deal is done from start to finish.

Chapter 2: Risk issues ( 5 pages)

- Counterparty risk

- Issuer risk

- Market risk

- Operational risk

- Legal risk

- Collateralised nature of the product.

Chapter 3: Legal issues (8 pages)

- Nature of the transaction

- Ownership of the securities

- Drawbacks of recharacterisation

- English law legal opinion by Richard Sykes QC

- SIFMA legal opinions

Chapter 4: Evolution of master agreement documentation (6 pages)

- Inefficiency in documenting trades in the market's early days.

- Documentation standardisation in the 1990s.

- Description of the different master agreements

- The benefits they confer.

Chapter 5: Section by section clear analysis of the Global Master Securities Lending Agreement (2000) (65 pages).

The idea is as before to have a block of Global Master Securities Lending Agreement (2000) text highlighted on a page and a clear explanation of it underneath.

Chapter 6: Section by section clear analysis of the Global Master Securities Lending Agreement (2009) (75 pages).

Same format.

Chapter 7: Section by section clear analysis of the European Master Agreement and its Product Annex for Securities Loans (2004) (58 pages)

Same format.

Chapter 8: Section by section clear analysis of the US Master Securities Lending Agreement (70 pages)

Same format.

Chapter 9: The credit crunch and likely future of the securities lending market (6 pages)

Chapters 5, 6 and 8 are the hub of the book because negotiators need core knowledge of these master agreements and awareness of possible variations proposed in their Schedules and their implications.

-Size of market according to latest industry figures.

-Types of securities loan transactions.

- Differences between repos and securities loans

-Main players

-Regulatory infrastructure in the UK and USA.

-The influence of automation.

-How a deal is done from start to finish.

Chapter 2: Risk issues ( 5 pages)

- Counterparty risk

- Issuer risk

- Market risk

- Operational risk

- Legal risk

- Collateralised nature of the product.

Chapter 3: Legal issues (8 pages)

- Nature of the transaction

- Ownership of the securities

- Drawbacks of recharacterisation

- English law legal opinion by Richard Sykes QC

- SIFMA legal opinions

Chapter 4: Evolution of master agreement documentation (6 pages)

- Inefficiency in documenting trades in the market's early days.

- Documentation standardisation in the 1990s.

- Description of the different master agreements

- The benefits they confer.

Chapter 5: Section by section clear analysis of the Global Master Securities Lending Agreement (2000) (65 pages).

The idea is as before to have a block of Global Master Securities Lending Agreement (2000) text highlighted on a page and a clear explanation of it underneath.

Chapter 6: Section by section clear analysis of the Global Master Securities Lending Agreement (2009) (75 pages).

Same format.

Chapter 7: Section by section clear analysis of the European Master Agreement and its Product Annex for Securities Loans (2004) (58 pages)

Same format.

Chapter 8: Section by section clear analysis of the US Master Securities Lending Agreement (70 pages)

Same format.

Chapter 9: The credit crunch and likely future of the securities lending market (6 pages)

Chapters 5, 6 and 8 are the hub of the book because negotiators need core knowledge of these master agreements and awareness of possible variations proposed in their Schedules and their implications.

Notă biografică

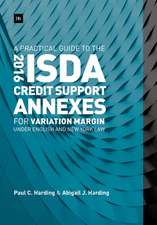

Paul Harding is the founder and managing director of Derivatives Documentation Limited, a derivatives consultancy and project management company based in the City of London providing negotiation, recruitment and in-house training services in derivatives documentation. He has also written A Practical Guide to the 2003 ISDA Credit Derivatives Definitions and A Practical Guide to Using Repo Master Agreements (Euromoney Books, 2004).

Textul de pe ultima copertă

Securities lending master agreements are vital for covering securities loans between contracting parties. They also offer legal and credit protection and a close-out netting procedure if a party defaults or goes bankrupt. These agreements are widely used by banks, securities houses, pension funds, hedge funds and insurance companies. " "

"Mastering Securities Lending Documentation" is a practical guide to understanding the negotiation of these master agreements used in the United Kingdom, United States and Europe. It is an essential handbook for anyone involved in negotiating these agreements and includes:

- An introduction to the history and operations of the market

- A clear, user-friendly explanation of all paragraphs of the master agreements

- An easy-to use split page format with the original text and commentary

- Examples of commonly negotiated additions and amendments and their implications

- Answers to legal, risk and operational questions