Numerical Methods for Finance

Editat de John Miller, David Edelman, John Applebyen Limba Engleză Paperback – 19 sep 2019

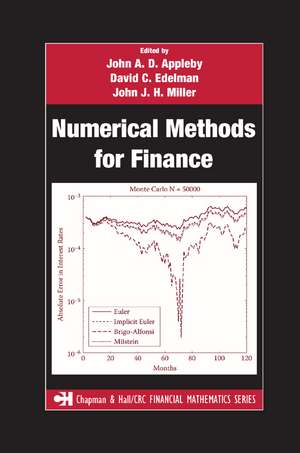

Presenting state-of-the-art methods in this area, the book first discusses the coherent risk measures theory and how it applies to practical risk management. It then proposes a new method for pricing high-dimensional American options, followed by a description of the negative inter-risk diversification effects between credit and market risk. After evaluating counterparty risk for interest rate payoffs, the text considers strategies and issues concerning defined contribution pension plans and participating life insurance contracts. It also develops a computationally efficient swaption pricing technology, extracts the underlying asset price distribution implied by option prices, and proposes a hybrid GARCH model as well as a new affine point process framework. In addition, the book examines performance-dependent options, variance reduction, Value at Risk (VaR), the differential evolution optimizer, and put-call-futures parity arbitrage opportunities.

Sponsored by DEPFA Bank, IDA Ireland, and Pioneer Investments, this concise and well-illustrated book equips practitioners with the necessary information to make important financial decisions.

Preț: 489.26 lei

Preț vechi: 575.60 lei

-15% Nou

Puncte Express: 734

Preț estimativ în valută:

93.63€ • 97.39$ • 77.30£

93.63€ • 97.39$ • 77.30£

Carte tipărită la comandă

Livrare economică 14-28 aprilie

Preluare comenzi: 021 569.72.76

Specificații

ISBN-13: 9780367388591

ISBN-10: 0367388596

Pagini: 312

Dimensiuni: 156 x 234 x 23 mm

Greutate: 0.45 kg

Ediția:1

Editura: CRC Press

Colecția Chapman and Hall/CRC

ISBN-10: 0367388596

Pagini: 312

Dimensiuni: 156 x 234 x 23 mm

Greutate: 0.45 kg

Ediția:1

Editura: CRC Press

Colecția Chapman and Hall/CRC

Public țintă

Professional Practice & DevelopmentCuprins

Coherent Measures of Risk into Everyday Market Practice. Pricing High-Dimensional American Options Using Local Consistency Conditions. Adverse Inter-Risk Diversification Effects for FX Forwards. Counterparty Risk under Correlation between Default and Interest Rates. Optimal Dynamic Asset Allocation for Defined Contribution Pension Plans. On High-Performance Software Development for the Numerical Simulation of Life Insurance Policies. An Efficient Numerical Method for Pricing Interest Rate Swaptions. Empirical Testing of Local Cross Entropy as a Method for Recovering Asset's Risk-Neutral PDF from Option Prices. Using Intraday Data to Forecast Daily Volatility: A Hybrid Approach. Pricing Credit from the Top Down with Affine Point Processes. Valuation of Performance-Dependent Options in a Black-Scholes Framework. Variance Reduction through Multilevel Monte Carlo Path Calculations. Value at Risk and Self-Similarity. Parameter Uncertainty in Kalman Filter Estimation of the CIR Term Structure Model. EDDIE for Discovering Arbitrage Opportunities. Index.

Notă biografică

John A. D. Appleby , David C. Edelman, John J. H. Miller

Descriere

Featuring international contributors from both industry and academia, Numerical Methods for Finance explores new and relevant numerical methods for the solution of practical problems in finance. It provides valuable, practical information about credit risks, exotic/hybrid options, retirement plans/pensions, life insurance, portfolio selection, incentive schemes, and interest rate modeling. The book presents a variety of novel mathematical methods involving finite-difference, Monte Carlo, and fast Fourier transform techniques. It also offers realistic alternatives to the VaR approach used in financial risk management practice and identifies potential pitfalls of standard methodologies.