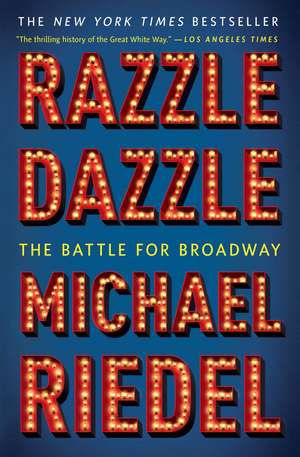

Razzle Dazzle: The Battle for Broadway

Autor Michael Riedelen Limba Engleză Paperback – 11 noi 2020

“A rich, lovely, debut history of New York theater in the 1970s and eighties” (Kirkus Reviews, starred review), Razzle Dazzle is a narrative account of the people and the money and the power that turned New York’s gritty back alleys and sex-shops into the glitzy, dazzling Great White Way.

In the mid-1970s Times Square was the seedy symbol of New York’s economic decline. Its once shining star, the renowned Shubert Organization, was losing theaters to make way for parking lots and losing money. Bernard Jacobs and Jerry Schoenfeld, two ambitious board members, saw the crumbling company was ripe for takeover and staged a coup and staved off corporate intrigue, personal betrayals and criminal investigations. Once Jacobs and Schoenfeld solidified their power, they turned a collapsed theater-owning holding company into one of the most successful entertainment empires in the world, spearheading the revitalization of Broadway and the renewal of Times Square.

“For those interested in the business behind the greasepaint, at a riveting time in Broadway’s and New York’s history, this is the ticket” (USA TODAY). Michael Riedel tells the stories of the Shubert Organization and the shows that re-built a city in grand style—including Cats, A Chorus Line, and Mamma Mia!—revealing the backstage drama that often rivaled what transpired onstage, exposing bitter rivalries, unlikely alliances, and inside gossip. “The trouble with Razzle Dazzle is…you can’t put the damn thing down” (Huffington Post).

Preț: 114.42 lei

Nou

Puncte Express: 172

Preț estimativ în valută:

21.90€ • 23.80$ • 18.41£

21.90€ • 23.80$ • 18.41£

Carte tipărită la comandă

Livrare economică 21 aprilie-05 mai

Preluare comenzi: 021 569.72.76

Specificații

ISBN-13: 9781451672176

ISBN-10: 1451672179

Pagini: 464

Ilustrații: 2x8pg b&w inserts

Dimensiuni: 140 x 213 x 28 mm

Greutate: 0.43 kg

Editura: Simon&Schuster

Colecția Simon & Schuster

ISBN-10: 1451672179

Pagini: 464

Ilustrații: 2x8pg b&w inserts

Dimensiuni: 140 x 213 x 28 mm

Greutate: 0.43 kg

Editura: Simon&Schuster

Colecția Simon & Schuster

Notă biografică

Michael Riedel has been the theater columnist for the New York Post since 1998. New York magazine has called his column a “must-read” for the theater world. Michael began his radio career as regular on the Imus in the Morning show in 2011. In 2017 WOR, New York’s oldest and highest-rated station, asked him to cohost its morning show with well-known sportscaster Len Berman. The Len Berman and Michael Riedel in the Morning show is the highest-rated morning radio program in the New York City area. Michael’s book Razzle Dazzle: The Battle for Broadway won the Marfield Prize for arts writing in 2015 and is widely considered to be the successor to William Goldman’s celebrated 1967 book about Broadway, The Season. A graduate of Columbia University, Michael lives in the West Village.

Extras

Razzle Dazzle

This is a very weird way to begin an investigation, David Clurman thought as he listened to the anonymous caller on the other end of the line.

A special assistant to the powerful New York State attorney general, Louis J. Lefkowitz, Clurman knew nothing about the economics of the Broadway theater. His speciality was real estate and securities. At thirty-five, he’d already made a name for himself as a tough investigator of the city’s powerful real estate magnates, authoring the first law in New York state history regulating the sales of co-ops and condominiums.

Important, to be sure; glamorous, hardly.

But here he was, sitting in his office at 80 Centre Street in the spring of 1963, listening to a fast-talking, agitated, self-described “angel,” which, as the caller explained to Clurman, was showbiz slang for backers of Broadway shows.

“I’m not going to give you my name,” the angel said. “But you should look into what goes on with the money on Broadway.”

Clurman asked why the angel was concerned.

“Well, I made an investment in a play, and the producer used the money to buy a lobster boat in Montauk.”

“A lobster boat?” Clurman said. This was indeed a strange way to begin an investigation.

But Clurman, who could smell flimflam down to the paperclips, was interested. He spent nearly an hour on the phone with the tipster, getting a crash course in the murky world of Broadway financing. Investors, it seemed, were in the dark about everything—production costs, weekly running costs, where the money they invested went, whether the shows were fully capitalized or not, how much they lost when they closed. Sometimes their money went into the productions they wanted to support; sometimes it wound up in shows they didn’t even know about. And sometimes it went to buy lobster boats in Montauk.

Producers wanted to take an angel’s money, give him a hug on opening night, give him some money if the show worked, and if it didn’t, well, that’s Broadway—it’s a crap shoot. Move on to the next show, next season. It’s going to be a surefire hit. Stick with me, the producers seemed to say, because I have a script on my desk right now that’s a winner.

“What about accountants?” Clurman asked. “Don’t you get a complete accounting of the production after it closes?”

“Accountants?” the caller responded, laughing. They just accept whatever documents the producers give them. Ledgers, balance sheets, profit and loss statements—they don’t exist on Broadway. Angels were like slot machine players. Bewitched by the twinkling lights, they put in quarter after quarter, hoping to hit the jackpot. And if they did—if they backed The Music Man, My Fair Lady, Oliver!—the quarters come so fast, who thought about where all those other quarters went?

Broadway’s a casino, New York City’s very own Las Vegas.

“Everything he told me was so antithetical to the whole idea of disclosure that it amazed me,” Clurman said, remembering the phone call nearly fifty years later.

Clurman thanked the caller and hung up. Something was going on here, he thought, something worth investigating. You can’t have a business in New York City—a business as high profile and as important to the life of the city as Broadway—that doesn’t abide by basic rules of accounting.

Financially, it sounded like the Wild, Wild West—with tap shoes.

Clurman left his office on the way to lunch, passing the room for “the boys,” as Attorney General Lefkowitz called the reporters who covered him. Lefkowitz, popular, charming, a politician who loved to be in the papers, liked the boys and had given them a room of their own near his office in the state office building. As Clurman walked by, he ran into Lawrence O’Kane, a reporter for the New York Times. Clurman liked O’Kane. He was smart, curious, fair. They’d talked about a number of cases Clurman had investigated, and he found O’Kane to be a good sounding board.

Clurman asked O’Kane if he knew anything about the theater. The Times, after all, was located on West Forty-Third Street, right in the heart of Broadway. It covered the theater aggressively and its critics and theater reporters—Brooks Atkinson, Sam Zolotow, Louis Funke—were, to Times readers, household names.

Not really, O’Kane said. Why?

Clurman recounted his conversation with the angel. He was talking to O’Kane as a friend, telling him about this odd call. There were no names mentioned, no talk of an investigation, just a general discussion about some funny business on Broadway.

O’Kane was interested. Clurman said he’d tell him if anything came of it.

• • •

The next morning, on his way to the subway, Clurman bought a copy of the New York Times. Standing on the platform, he glanced at the headlines above the fold—KENNEDY MEETING WITH MACMILLAN LIKELY JUNE 29–30; RISE IN TEEN-AGE JOBLESS PUSHES U.S. RATE TO 5.9%. Then he looked at the stories below the fold. One caught his eye. FINANCING PRACTICES IN THEATER UNDER BROADWAY INQUIRY BY STATE.

“A ‘far-reaching’ investigation of theatrical practices—both on and Off-Broadway—is under way in the office of the State Attorney General,” the article began. Lefkowitz, O’Kane wrote, “decided to make the investigation after a preliminary study had given indications of ‘peculiar’ financing methods in the industry and a possible need for corrective legislation.”

Clurman was stunned. Holy God, he thought. What is going on? He’d never dreamed that a casual conversation with one of the boys would wind up as front-page news in the New York Times. His preliminary study consisted of a few notes he’d scribbled on a yellow legal pad during the phone call.

When he arrived at 80 Centre Street, Lefkowitz summoned him to his office. “How come you didn’t tell me about this?” Lefkowitz demanded.

Clurman explained that he thought his conversation with O’Kane had been casual. It was not in any way, he said, an official announcement. Still, he added, it might be worth looking into the financial practices of Broadway. And, as this morning’s Times proved, it would get headlines.

“Can I conduct an inquiry into this to see what’s going on?” he asked.

Lefkowitz, enticed by headlines, gave him the go ahead.

Underneath his quiet, scholarly demeanor, Clurman had the investigating zeal of Inspector Javert. Let the hunt begin, he thought.

• • •

That morning, in Shubert Alley, the town square of Broadway, everybody was on edge. There had been investigations in the past about money flying around the theater. They always seemed to coincide with the election of the attorney general. But they never amounted to much. This one, however, made the front page of the New York Times, which meant that it was serious. Emanuel “Manny” Azenberg, then a young company manager, recalled, “Everybody that day was walking around with a little brown spot on the back of their pants.”

• • •

Clurman didn’t know where to begin. He was now in charge of a “far-reaching” investigation into the financial practices of Broadway about which, aside from being a casual theatergoer who had enjoyed My Fair Lady, he knew nothing.

And then he got another call.

If you were a lawyer in 1963, Morris Ernst was a name you knew. A founder of the American Civil Liberties Union, Ernst represented Random House in its fight to get James Joyce’s Ulysses published in the United States despite state-by-state laws against obscenity. A fixture of New York society, he had been close to Franklin Roosevelt, Harry Truman, and several Supreme Court justices. He loved the theater, and numbered among his friends Edna Ferber, Groucho Marx, E. B. White, and Charles Addams.

Ernst told Clurman he knew some people who were interested in his investigation. He invited Clurman to his apartment at Two Fifth Avenue that night for an informal meeting. Nothing official, he stressed. He just wanted to introduce Clurman to some theater people who, he thought, might be able to help him. “They think your investigation needs to be amplified,” Ernst said.

When Clurman arrived at Two Fifth Avenue, just north of Washington Square Park, he was introduced to an impressive array of theater people. Leland Hayward, tall, patrician, elegant, the son of a United States senator, seemed to be the leader. His productions included South Pacific, Mister Roberts, and Gypsy.

Gilbert Miller, son of the legendary producer Henry Miller, was there, too. Gilbert specialized in high-class plays—Shaw’s Candida, Anouilh’s Ring Around the Moon, Eliot’s The Cocktail Party.

Another impressive figure was Roger Stevens, one of the founders of the Kennedy Center for the Performing Arts and the National Endowment for the Arts. Dickie Moore, one-time child actor who starred in the Our Gang series, was there representing the Actors’ Equity Association, for which he was the public relations director. Representing the Dramatists Guild was Russel Crouse, coauthor of the book to The Sound of Music.

“This was not a bunch of little guys who invest in the theater,” Clurman recalled. “These were some very notable people.”

Hayward took the floor. Clurman’s investigation into the financial practices on Broadway was essential, he said. Clurman remembered thinking how unusual it was “for the people I was talking to want to be investigated.” But Hayward said too many of his colleagues were “kidnapping” investors’ money, and the investors were getting fed up. Money was becoming harder and harder to raise, and Broadway itself was in a precarious position. Its so-called golden age—from 1940 to 1960—was winding down. There had only been seventeen new shows in the 1962–63 season, many of them flops.

When Hayward finished speaking, somebody called out from the back of the room, “What about the ice?”

“Ice.” Other than being something you put in your drink, Clurman did not know the term. The room fell silent, and then Clurman’s education began.

Ice—ticket corruption—went as far back as Jenny Lind’s sold-out performances in 1850.1 “It has been a thriving fungus ever since,” William Goldman noted in his classic theater book, The Season.

Other theater historians say ticket corruption goes back much further, to ancient Athens, where you had to bribe someone to get a ticket for a sold-out run of Medea at the Theater of Dionysus.

Whatever its murky history, ice is a function of supply and demand. Broadway theaters seat, at most, eighteen hundred people. If a show’s a hit, a lot more than eighteen hundred people want to see it, and they want to see it from the best seat possible. The show is, of course, sold out, but somebody, usually a ticket broker, can help—for a price considerably higher than the face value of the ticket. To get that ticket, the broker has to bribe someone, usually someone in the box office. And that bribe—the difference between the face value of the ticket and the amount the broker paid to get his hands on it—is the ice.

The producers explained to Clurman how this black market worked. The top ticket price for a musical at the time was about ten dollars. This was, of course, before computers, so the tickets were hard tickets, kept in racks in the box offices. The men who ran the box offices controlled the tickets. Arthur Cantor, a producer and publicist in the early sixties, was desperate to get a pair of seats for a client to Neil Simon’s hit play Barefoot in the Park at the Biltmore Theatre. He called in a lot of favors, but to no avail. And then one afternoon, walking through Shubert Alley, he ran into the box office treasurer at the Biltmore. He asked if he could help. The treasurer smiled and said, “Let me see what the Rabbi has.” He pulled out a fistful of tickets—that weekend’s best orchestra locations.

A broker might pay a box office man five, ten, fifteen dollars above face value, depending on the popularity of the show, to get a ticket. The broker would then resell that ticket for as much as fifty dollars. The box office man pocketed the bribe, which because it was cash, was untraceable. It melted away, just like ice.

For years, the box office treasurers never asked for a raise. They didn’t need to. They were running, as one producer said, “their very own concession stand.”

There was a law on the books for years governing the reselling of tickets in New York. It restricted the broker markup to just a dollar fifty plus a fifteen-cent tax. The producers said nobody ever paid any attention to the law.

How much ice was there? Clurman wondered. No one could say for certain, but it flowed down Broadway as if a giant iceberg up in Washington Heights had melted. And, of course, no one ever paid taxes on ice.

Hayward and the others were upset that the ice was going to box office people (and others) who had nothing to do with creating the show. Money was being made off the work of producers, writers, directors. Many weren’t seeing any of it. Investors, too, were getting screwed.

And so was the public. Tickets were not available to hit shows because brokers had scooped them up. Brokers’ offices lined the side streets of Times Square. (Some were legitimate, but many were just hole-in-the-wall scalpers.) You had to have connections—or be willing to pay astronomical prices—to get into, say, Stop the World—I Want to Get Off! Hayward himself had once called the box office of one of his shows and been told the performance that night was sold out. But when he arrived at the theater he was dismayed to see rows of empty seats. The brokers had not been able to unload all their tickets.2

The regular theatergoer, Hayward said, was getting fed up with being told the show was sold out when brokers had tickets.

Clurman told the group, “If this relates to the use of funds that are coming in from investors, I suppose I could say I have jurisdiction to go into it.”

A solemn man with dark eyes whom Clurman had not noticed jumped up from his seat in the corner of the room and said, “This man knows the jokes!” The solemn man began to smile. Clurman recognized him—Richard Rodgers, composer of Oklahoma!, Carousel, and The King and I.

Rodgers, a producer as well as composer, hated ice. People were pocketing huge amounts of money from his hit shows, and neither he nor his investors ever saw a penny of it. He’d had fights with theater owners about ticket corruption.

In 1946, Rodgers and Oscar Hammerstein produced Irving Berlin’s Annie Get Your Gun, starring Ethel Merman. Its out-of-town tryout was in Philadelphia at a Shubert theater. A local reporter went to the box office the day tickets went on sale and was told nothing in the orchestra was available for the run of the show. She was suspicious since the musical hadn’t even been advertised in the papers yet. So she called Oscar Hammerstein. He was flabbergasted. “Richard Rodgers and I have nothing to do with the distributions of tickets,” he said.3 Rodgers and Hammerstein were furious. They called Lee Shubert, the head of the company. Lee called the box office manager in Philadelphia and bellowed, “Get those goddamned tickets back, you hear me? I don’t want to know anything except you get those tickets!”

Orchestra seats to Annie Get Your Gun in Philadelphia became available. And Dick Rodgers became interested in what went on in the box offices of his shows.

• • •

Clurman left the meeting after nearly three hours determined to investigate Broadway. From what he’d heard, ticket scalping and misuse of investor money was out of control. Over the next six months, he interviewed, and in some cases subpoenaed, nearly three hundred people in the theater, from producers to theater owners, box office staffers to employees of companies that serviced Broadway productions. Some cooperated, but many took the Fifth Amendment.

But Clurman got hold of hotel records, which revealed that hundreds and hundreds of tickets had been directed to hotel concierges. He subpoenaed records from major New York corporations—banks and several textile companies—that paid huge amounts to brokers to secure seats to hit shows for their clients. He also found informants—“some pretty horrible little people,” he would say years later—who agreed to cooperate with his investigation.

As he nosed around Broadway he began to get some strange phone calls. One person told him, “Don’t stand too close to the edge of the subway platform.” Another caller asked if “he liked chorus girls.” When he said he wasn’t interested, the caller replied, “Oh, you’re that kind. Do you want some chorus boys?”

What Clurman uncovered during his six-month examination of Broadway stunned even so seasoned an investigator as himself. It wasn’t just that money was flying around, unaccounted for. Or that bribes were being paid under the table. He discovered a “train of aggravated corruption. Everybody,” he recalled, “was having a ball—and nobody was watching.”

There were scams of all sorts, about which angels knew nothing. For instance, if three trucks were required to bring scenery down from the shop to the theater, the trucking company might make out a bill for four—and the producer could pocket the money for the fourth, nonexistent, truck.

Suppliers of scenery, costumes, and lights admitted to giving kickbacks to producers and general managers (the people who run the day-to-day operations of a production) in exchange for contracts. On any one show, the kickbacks could amount to several thousand dollars.

Clurman, an expert in accounting, was shocked to discover such clauses in investment papers as this: “Our audit was conducted in accordance with generally accepted theatrical accounting principles. Such statements as to the operations and cash position of theatrical ventures do not customarily require the rendering of an opinion. No direct verification of assets or liabilities was undertaken.”

In plain English: “We have no idea if these statements are true.”

Clurman subpoenaed records from some productions, and discovered that on one show, which had been produced for $500,000, the books were kept in pencil. The numbers were smudged.

But the real money was in the ice. Clurman discovered that it wasn’t limited to box office personnel. Many people—theater owners, general managers, producers—were taking their cut. Anybody with access to tickets could flip them to brokers, including writers, directors, designers, and stars, who, in their contracts, were guaranteed at least two prime orchestra seats—“house seats”—a night.

Rudy Vallee, one of the stars of How to Succeed in Business Without Really Trying, openly shopped his house seats around Times Square to the highest bidder, usually the Hollywood Ticket Office.

It was said that Frederick Loewe, the composer of Brigadoon and My Fair Lady, traded his house seats for fur coats from friends in the garment business. Many a chorus girl in a Frederick Loewe show was known to keep warm in the winter with one of Freddie’s furs. Clurman discovered that a Broadway leading lady—whose name he would not give up even fifty years after the fact—had a deal with a broker who paid her $10,000 a year for her house seats. A well-known Broadway producer had bags of cash delivered to his East Side town house every night.

The bigger the hit, the more the ice. And at that point, the longest-running show in Broadway history was My Fair Lady, which opened March 15, 1956, at the Mark Hellinger Theatre and closed September 29, 1962, after 2,717 performances. A few months after My Fair Lady opened, a Russian submarine, the Myest, disappeared in the Baltic Sea. The day news of the sinking appeared in the papers, Bernie Hart, general manager of My Fair Lady (and the brother of the director Moss Hart) told his staff that the Russians had located the sub. “It broke through the ice,” he said, laughing, “at the Hellinger!”I

Stanley Stahl, a Times Square real estate magnate, bought the Hellinger during the run of My Fair Lady. He did so, according to his friend Arthur Rubin, so he could get a cut of the ice from the box office.

My Fair Lady was produced by CBS, which put up $360,000. But even executives at CBS couldn’t get tickets to the show without going through brokers. Marion Branch, a secretary at CBS, told Clurman that she bought as many as five pairs of seats a week from brokers. She paid $50 a ticket—$500 a week, she said ($3,500 today)—and gave them to CBS clients.

During the course of his investigation, Clurman discovered that the distribution of tickets and bribes wasn’t limited to Broadway box offices. He discovered that one theater chain had centralized the black market in tickets. The Shubert Organization controlled seventeen of Broadway’s best theaters. The company also owned the Sardi Building on West Forty-Fourth Street, named after the famed Broadway restaurant housed on the ground floor. Four floors above Sardi’s was a room—504—set aside for a special purpose. Here brokers or their runners went to buy tickets for shows in Shubert theaters. Sometimes there was a line out the door. Clurman found a former runner—Melvin D. Hecht, a twenty-six-year-old “freelance writer” from Philadelphia—who told him that, every Monday, he would deliver an envelope stuffed with cash to a man in 504.4 The man was Murray Helwitz, a distant cousin of the three Shubert Brothers—Sam, Lee, and J. J.—who had founded the mighty theatrical empire.

The money was divided up in room 504 and distributed up and down the chain of command. A company manager who worked at a Shubert show at the time said, “I was going on vacation once, and the box office treasurer came up to me, handed me an envelope and said, ‘Have fun, kid.’ There was a hundred dollars in cash in the envelope.”

Manny Azenberg recalled, “Everybody knew about the ice. You couldn’t wait to become important so that you got your envelope.”II

The ticketing scandal reached right into the heart of Broadway’s biggest landlord—the Shubert Organization. Clurman spoke to many Shubert employees, many of whom took the Fifth Amendment. But two employees, he would later say, were “very helpful to my investigation.” They were J. J. Shubert’s lawyers and advisors—Gerald Schoenfeld and Bernard B. Jacobs. Middle-aged, low-key, always in the background, they seemed, Clurman would later say, to understand that the company was in peril. Several people in the organization were collecting hundreds of thousands of dollars—perhaps millions—every year without reporting any of it to the Internal Revenue Service.

“Along came these two guys, these two lawyers, and I got to know them,” Clurman said. “They were not stupid people. They were helpful. It was hard to figure out what their motivation was, but they were very helpful.”

In 2005, when the Shubert Organization renamed the Plymouth Theatre after Gerald Schoenfeld, then chairman of the board, Clurman sent him a note. “I want to congratulate you,” he wrote. “And I really believe that you’re one of the people who helped save the theater in 1963.”

• • •

Clurman had to make a decision. He had enough evidence—kickbacks, bribes, diverted funds—to bring down Broadway, not least its most powerful entity, the Shubert Organization. He believed that the ice flowed to the top of the company, right into the executive offices of Lawrence Shubert Lawrence Jr., the president and chief operating officer. But if Clurman brought the Shuberts down he might decimate Broadway itself. Who, after all, would look after those seventeen theaters, especially as Times Square was getting seedier and seedier and the theater business itself was losing ground to television? He went to his boss to talk it over. Lefkowitz agreed. We’ll hold hearings, he said, put them on notice, pass some laws governing theater investing and ticket distribution. But Broadway was vital to New York. It could not be wiped out.

“It would have been easy to indict a multitude of people,” Clurman said. “I knew some of these guys hated me, but I don’t think they realized that I saved their necks.”

• • •

Clurman opened his public hearings on Broadway’s financial practices on December 10, 1963. He began with a headline-grabbing number. Based on the evidence collected, the attorney general estimated that at least $10 million ($75 million today) in ice was collected each year on Broadway. All of it was in cash and tax-free. Most Broadway productions failed, Clurman pointed out. In the 1961–62 season, investors lost nearly $6 million, he calculated. But the well connected were hauling in millions—at the expense of other people’s money.

Broadway producers, general managers, box office personnel, and other theater people gathered at 80 Centre Street, and were called on to testify. One of the first to speak was David Merrick, then the most powerful producer on Broadway. Merrick’s string of hit shows included Fanny, Look Back in Anger, Irma La Douce, and Carnival!.

Merrick took the stand and said he knew little about ice. What he did know, he said, was rumor and conjecture. The term itself, he believed, was a turn-of-the-century political expression meaning “incidental campaign expenses.”

Clurman and just about everybody else in the room had to stifle laughs. David Merrick didn’t know about ice? His right-hand man was Jack Schlissel, as tough a general manager as they came on Broadway. Schlissel was Merrick’s enforcer. He did the negotiating, the hiring, and often, the firing. “He was a worm,” Richard Seff, a veteran agent, says. “Slimy.” His name, in Yiddish, meant “key” (shlisl), and the joke around Broadway was that if you wanted to get at the ice on a Merrick show, you had to have the key. Schlissel and Merrick made hundreds of thousands of dollars from ice.

Informants told Clurman that Merrick’s offices above the St. James were almost as busy in the black market for tickets as room 504 in the Sardi Building. What Clurman didn’t know was that as soon as news of his investigation broke, Merrick contacted his longtime property man and ordered him to remove filing cabinets from his office in the middle of the night and dump them into the Hudson River. The cabinets contained Merrick’s secret accounts of the cash flowing in from the ice, the kickbacks, and the various other schemes he was running. And here was David Merrick claiming he only knew the term as incidental campaign expenses.

Merrick’s other schemes—of which his investors and Clurman were unaware—included a little side business with the souvenir program. Merrick and Schlissel had a deal with a small-time printer named Abe Zamachansky. He printed the souvenir programs for Merrick’s shows. They were sold in the lobby for a dollar. It doesn’t sound like much, but on a hit show, playing a fifteen-hundred-seat theater eight times a week, packed with theatergoers who might want to take something home to remember their night on Broadway, those dollars added up. At the end of the week, Zamachansky would split the profits with Merrick and Schlissel. “No one got a piece of that but the three of them,” said an old associate of Merrick’s. “No one. No investors. No creative people. Nobody. It was a very profitable business. And when the creative people started demanding their share, Merrick stopped doing the book!”

As Clurman had discovered, financial documentation for Broadway shows was sketchy, at best. If Merrick’s investors had any idea how to read their contracts, they might—might—have discovered that a certain company was entitled to buy, at minimal cost, all the lighting and electrical equipment from Merrick’s shows when they closed. Merrick owned the company. He shipped the equipment to a warehouse in upstate New York and then rented it out to other shows in New York and around the country. The original investors in the show that had closed paid for lighting equipment. But only Merrick pocketed the money from its subsequent rental. Another small fortune was being made off Broadway’s oblivious angels.

Clurman called others to the stand. Every box office treasurer, he recalled, took the Fifth Amendment. But the CBS secretary, Marion Branch, testified, and so, too, did Melvin D. Hecht, the runner. He told about the payoffs he made every Monday morning to box office treasurers. He also said he carried two envelopes. One contained checks for the regular box office price of the tickets. The other contained cash. He distributed the checks to the box office.

“What did you do with the cash?” Clurman asked.

“I delivered it in person to an individual in an office building.”

Clurman had instructed Hecht not to name the person or the building, but everybody in the room knew he was talking about Murray Helwitz, the Shubert iceman, who worked out of room 504 in the Sardi Building.

After Hecht was done, Alvin Cooperman, a Shubert executive, took the stand and announced that the Shubert Organization “deplores any unethical practices in ticket selling and production investing.” Any Shubert employee who accepted ice “would be summarily dismissed.”5

Again, much of the room had to stifle a laugh.

At the end of the day, Merrick asked if he could return to the stand. He said he was “appalled” at what he’d learned that day, and he was “happy and delighted” that the attorney general was exposing such practices and “cleaning out the vermin.” He congratulated Lefkowitz and called the hearing “the best show of the season.”6

• • •

On December 26, 1963—just two weeks after the hearings that engulfed the Shubert Organization in scandal—J. J. Shubert, the last of the three brothers who built the empire, died of a cerebral hemorrhage in his penthouse apartment on the eleventh floor of the Sardi Building. He was eighty-six. On Broadway they called him the “Phantom,” as no one had seen him in years. It was an ironic nickname, though no one knew it at the time. Twenty-five years later, another phantom, the one with the mask, would make more money for the Shubert Organization than any other show in its one-hundred-year history.

J. J.’s dementia had set in around 1958, and by 1960 his mind was gone. He was bedridden in his apartment, surrounded by Louis XIV furniture he’d collected on long-ago trips to Europe. He was attended to by nurses and by his second wife, who let few people into the apartment. Those old confidants who were allowed to see this belligerent, brutal old despot said his face seemed fixed in a scowl.

Above a massive fireplace in his living room hung a painting of his only son, John, at the age of eight dressed like Little Lord Fauntleroy. J. J. had trained John to take over the Shubert empire. But in November 1962, John had died from a heart attack on a train to Clearwater, Florida. He was fifty-three.

The Shubert lawyers, Gerald Schoenfeld and Bernard B. Jacobs, fearing the news would kill the old man—or perhaps that he would not have grasped it at all—never told J. J. that his only direct heir, the only direct heir to his empire, was dead.

I. Bernie Hart was thought to be one of the funniest men on Broadway, much funnier than Moss, who with George S. Kaufman wrote the classic comedies You Can’t Take It with You and The Man Who Came to Dinner. After Moss’s play The Climate of Eden got slaughtered by the critics in Philadephia, Moss and Bernie took the train back to New York. As soon as they arrived, they headed to the Little Bar at Sardi’s. “Did you see those reviews, Bernie?” Moss said. “How are we ever going to get out of Philadelphia with those reviews? There is no way we can get out of Philadelphia with those reviews.” Bernie replied, “Moss, relax. We got out of Egypt. We’ll get out of Philadelphia.”

II. Five years later, Azenberg was offered his envelope. He was the general manager of Two Gentlemen of Verona, and it came by way of the box office. He met with his business partner, Eugene Wolsk, and they decided not to take it. “After the ’63 investigation, it was a felony,” Azenberg said.

CHAPTER ONE

The Ice Age

This is a very weird way to begin an investigation, David Clurman thought as he listened to the anonymous caller on the other end of the line.

A special assistant to the powerful New York State attorney general, Louis J. Lefkowitz, Clurman knew nothing about the economics of the Broadway theater. His speciality was real estate and securities. At thirty-five, he’d already made a name for himself as a tough investigator of the city’s powerful real estate magnates, authoring the first law in New York state history regulating the sales of co-ops and condominiums.

Important, to be sure; glamorous, hardly.

But here he was, sitting in his office at 80 Centre Street in the spring of 1963, listening to a fast-talking, agitated, self-described “angel,” which, as the caller explained to Clurman, was showbiz slang for backers of Broadway shows.

“I’m not going to give you my name,” the angel said. “But you should look into what goes on with the money on Broadway.”

Clurman asked why the angel was concerned.

“Well, I made an investment in a play, and the producer used the money to buy a lobster boat in Montauk.”

“A lobster boat?” Clurman said. This was indeed a strange way to begin an investigation.

But Clurman, who could smell flimflam down to the paperclips, was interested. He spent nearly an hour on the phone with the tipster, getting a crash course in the murky world of Broadway financing. Investors, it seemed, were in the dark about everything—production costs, weekly running costs, where the money they invested went, whether the shows were fully capitalized or not, how much they lost when they closed. Sometimes their money went into the productions they wanted to support; sometimes it wound up in shows they didn’t even know about. And sometimes it went to buy lobster boats in Montauk.

Producers wanted to take an angel’s money, give him a hug on opening night, give him some money if the show worked, and if it didn’t, well, that’s Broadway—it’s a crap shoot. Move on to the next show, next season. It’s going to be a surefire hit. Stick with me, the producers seemed to say, because I have a script on my desk right now that’s a winner.

“What about accountants?” Clurman asked. “Don’t you get a complete accounting of the production after it closes?”

“Accountants?” the caller responded, laughing. They just accept whatever documents the producers give them. Ledgers, balance sheets, profit and loss statements—they don’t exist on Broadway. Angels were like slot machine players. Bewitched by the twinkling lights, they put in quarter after quarter, hoping to hit the jackpot. And if they did—if they backed The Music Man, My Fair Lady, Oliver!—the quarters come so fast, who thought about where all those other quarters went?

Broadway’s a casino, New York City’s very own Las Vegas.

“Everything he told me was so antithetical to the whole idea of disclosure that it amazed me,” Clurman said, remembering the phone call nearly fifty years later.

Clurman thanked the caller and hung up. Something was going on here, he thought, something worth investigating. You can’t have a business in New York City—a business as high profile and as important to the life of the city as Broadway—that doesn’t abide by basic rules of accounting.

Financially, it sounded like the Wild, Wild West—with tap shoes.

Clurman left his office on the way to lunch, passing the room for “the boys,” as Attorney General Lefkowitz called the reporters who covered him. Lefkowitz, popular, charming, a politician who loved to be in the papers, liked the boys and had given them a room of their own near his office in the state office building. As Clurman walked by, he ran into Lawrence O’Kane, a reporter for the New York Times. Clurman liked O’Kane. He was smart, curious, fair. They’d talked about a number of cases Clurman had investigated, and he found O’Kane to be a good sounding board.

Clurman asked O’Kane if he knew anything about the theater. The Times, after all, was located on West Forty-Third Street, right in the heart of Broadway. It covered the theater aggressively and its critics and theater reporters—Brooks Atkinson, Sam Zolotow, Louis Funke—were, to Times readers, household names.

Not really, O’Kane said. Why?

Clurman recounted his conversation with the angel. He was talking to O’Kane as a friend, telling him about this odd call. There were no names mentioned, no talk of an investigation, just a general discussion about some funny business on Broadway.

O’Kane was interested. Clurman said he’d tell him if anything came of it.

• • •

The next morning, on his way to the subway, Clurman bought a copy of the New York Times. Standing on the platform, he glanced at the headlines above the fold—KENNEDY MEETING WITH MACMILLAN LIKELY JUNE 29–30; RISE IN TEEN-AGE JOBLESS PUSHES U.S. RATE TO 5.9%. Then he looked at the stories below the fold. One caught his eye. FINANCING PRACTICES IN THEATER UNDER BROADWAY INQUIRY BY STATE.

“A ‘far-reaching’ investigation of theatrical practices—both on and Off-Broadway—is under way in the office of the State Attorney General,” the article began. Lefkowitz, O’Kane wrote, “decided to make the investigation after a preliminary study had given indications of ‘peculiar’ financing methods in the industry and a possible need for corrective legislation.”

Clurman was stunned. Holy God, he thought. What is going on? He’d never dreamed that a casual conversation with one of the boys would wind up as front-page news in the New York Times. His preliminary study consisted of a few notes he’d scribbled on a yellow legal pad during the phone call.

When he arrived at 80 Centre Street, Lefkowitz summoned him to his office. “How come you didn’t tell me about this?” Lefkowitz demanded.

Clurman explained that he thought his conversation with O’Kane had been casual. It was not in any way, he said, an official announcement. Still, he added, it might be worth looking into the financial practices of Broadway. And, as this morning’s Times proved, it would get headlines.

“Can I conduct an inquiry into this to see what’s going on?” he asked.

Lefkowitz, enticed by headlines, gave him the go ahead.

Underneath his quiet, scholarly demeanor, Clurman had the investigating zeal of Inspector Javert. Let the hunt begin, he thought.

• • •

That morning, in Shubert Alley, the town square of Broadway, everybody was on edge. There had been investigations in the past about money flying around the theater. They always seemed to coincide with the election of the attorney general. But they never amounted to much. This one, however, made the front page of the New York Times, which meant that it was serious. Emanuel “Manny” Azenberg, then a young company manager, recalled, “Everybody that day was walking around with a little brown spot on the back of their pants.”

• • •

Clurman didn’t know where to begin. He was now in charge of a “far-reaching” investigation into the financial practices of Broadway about which, aside from being a casual theatergoer who had enjoyed My Fair Lady, he knew nothing.

And then he got another call.

If you were a lawyer in 1963, Morris Ernst was a name you knew. A founder of the American Civil Liberties Union, Ernst represented Random House in its fight to get James Joyce’s Ulysses published in the United States despite state-by-state laws against obscenity. A fixture of New York society, he had been close to Franklin Roosevelt, Harry Truman, and several Supreme Court justices. He loved the theater, and numbered among his friends Edna Ferber, Groucho Marx, E. B. White, and Charles Addams.

Ernst told Clurman he knew some people who were interested in his investigation. He invited Clurman to his apartment at Two Fifth Avenue that night for an informal meeting. Nothing official, he stressed. He just wanted to introduce Clurman to some theater people who, he thought, might be able to help him. “They think your investigation needs to be amplified,” Ernst said.

When Clurman arrived at Two Fifth Avenue, just north of Washington Square Park, he was introduced to an impressive array of theater people. Leland Hayward, tall, patrician, elegant, the son of a United States senator, seemed to be the leader. His productions included South Pacific, Mister Roberts, and Gypsy.

Gilbert Miller, son of the legendary producer Henry Miller, was there, too. Gilbert specialized in high-class plays—Shaw’s Candida, Anouilh’s Ring Around the Moon, Eliot’s The Cocktail Party.

Another impressive figure was Roger Stevens, one of the founders of the Kennedy Center for the Performing Arts and the National Endowment for the Arts. Dickie Moore, one-time child actor who starred in the Our Gang series, was there representing the Actors’ Equity Association, for which he was the public relations director. Representing the Dramatists Guild was Russel Crouse, coauthor of the book to The Sound of Music.

“This was not a bunch of little guys who invest in the theater,” Clurman recalled. “These were some very notable people.”

Hayward took the floor. Clurman’s investigation into the financial practices on Broadway was essential, he said. Clurman remembered thinking how unusual it was “for the people I was talking to want to be investigated.” But Hayward said too many of his colleagues were “kidnapping” investors’ money, and the investors were getting fed up. Money was becoming harder and harder to raise, and Broadway itself was in a precarious position. Its so-called golden age—from 1940 to 1960—was winding down. There had only been seventeen new shows in the 1962–63 season, many of them flops.

When Hayward finished speaking, somebody called out from the back of the room, “What about the ice?”

“Ice.” Other than being something you put in your drink, Clurman did not know the term. The room fell silent, and then Clurman’s education began.

Ice—ticket corruption—went as far back as Jenny Lind’s sold-out performances in 1850.1 “It has been a thriving fungus ever since,” William Goldman noted in his classic theater book, The Season.

Other theater historians say ticket corruption goes back much further, to ancient Athens, where you had to bribe someone to get a ticket for a sold-out run of Medea at the Theater of Dionysus.

Whatever its murky history, ice is a function of supply and demand. Broadway theaters seat, at most, eighteen hundred people. If a show’s a hit, a lot more than eighteen hundred people want to see it, and they want to see it from the best seat possible. The show is, of course, sold out, but somebody, usually a ticket broker, can help—for a price considerably higher than the face value of the ticket. To get that ticket, the broker has to bribe someone, usually someone in the box office. And that bribe—the difference between the face value of the ticket and the amount the broker paid to get his hands on it—is the ice.

The producers explained to Clurman how this black market worked. The top ticket price for a musical at the time was about ten dollars. This was, of course, before computers, so the tickets were hard tickets, kept in racks in the box offices. The men who ran the box offices controlled the tickets. Arthur Cantor, a producer and publicist in the early sixties, was desperate to get a pair of seats for a client to Neil Simon’s hit play Barefoot in the Park at the Biltmore Theatre. He called in a lot of favors, but to no avail. And then one afternoon, walking through Shubert Alley, he ran into the box office treasurer at the Biltmore. He asked if he could help. The treasurer smiled and said, “Let me see what the Rabbi has.” He pulled out a fistful of tickets—that weekend’s best orchestra locations.

A broker might pay a box office man five, ten, fifteen dollars above face value, depending on the popularity of the show, to get a ticket. The broker would then resell that ticket for as much as fifty dollars. The box office man pocketed the bribe, which because it was cash, was untraceable. It melted away, just like ice.

For years, the box office treasurers never asked for a raise. They didn’t need to. They were running, as one producer said, “their very own concession stand.”

There was a law on the books for years governing the reselling of tickets in New York. It restricted the broker markup to just a dollar fifty plus a fifteen-cent tax. The producers said nobody ever paid any attention to the law.

How much ice was there? Clurman wondered. No one could say for certain, but it flowed down Broadway as if a giant iceberg up in Washington Heights had melted. And, of course, no one ever paid taxes on ice.

Hayward and the others were upset that the ice was going to box office people (and others) who had nothing to do with creating the show. Money was being made off the work of producers, writers, directors. Many weren’t seeing any of it. Investors, too, were getting screwed.

And so was the public. Tickets were not available to hit shows because brokers had scooped them up. Brokers’ offices lined the side streets of Times Square. (Some were legitimate, but many were just hole-in-the-wall scalpers.) You had to have connections—or be willing to pay astronomical prices—to get into, say, Stop the World—I Want to Get Off! Hayward himself had once called the box office of one of his shows and been told the performance that night was sold out. But when he arrived at the theater he was dismayed to see rows of empty seats. The brokers had not been able to unload all their tickets.2

The regular theatergoer, Hayward said, was getting fed up with being told the show was sold out when brokers had tickets.

Clurman told the group, “If this relates to the use of funds that are coming in from investors, I suppose I could say I have jurisdiction to go into it.”

A solemn man with dark eyes whom Clurman had not noticed jumped up from his seat in the corner of the room and said, “This man knows the jokes!” The solemn man began to smile. Clurman recognized him—Richard Rodgers, composer of Oklahoma!, Carousel, and The King and I.

Rodgers, a producer as well as composer, hated ice. People were pocketing huge amounts of money from his hit shows, and neither he nor his investors ever saw a penny of it. He’d had fights with theater owners about ticket corruption.

In 1946, Rodgers and Oscar Hammerstein produced Irving Berlin’s Annie Get Your Gun, starring Ethel Merman. Its out-of-town tryout was in Philadelphia at a Shubert theater. A local reporter went to the box office the day tickets went on sale and was told nothing in the orchestra was available for the run of the show. She was suspicious since the musical hadn’t even been advertised in the papers yet. So she called Oscar Hammerstein. He was flabbergasted. “Richard Rodgers and I have nothing to do with the distributions of tickets,” he said.3 Rodgers and Hammerstein were furious. They called Lee Shubert, the head of the company. Lee called the box office manager in Philadelphia and bellowed, “Get those goddamned tickets back, you hear me? I don’t want to know anything except you get those tickets!”

Orchestra seats to Annie Get Your Gun in Philadelphia became available. And Dick Rodgers became interested in what went on in the box offices of his shows.

• • •

Clurman left the meeting after nearly three hours determined to investigate Broadway. From what he’d heard, ticket scalping and misuse of investor money was out of control. Over the next six months, he interviewed, and in some cases subpoenaed, nearly three hundred people in the theater, from producers to theater owners, box office staffers to employees of companies that serviced Broadway productions. Some cooperated, but many took the Fifth Amendment.

But Clurman got hold of hotel records, which revealed that hundreds and hundreds of tickets had been directed to hotel concierges. He subpoenaed records from major New York corporations—banks and several textile companies—that paid huge amounts to brokers to secure seats to hit shows for their clients. He also found informants—“some pretty horrible little people,” he would say years later—who agreed to cooperate with his investigation.

As he nosed around Broadway he began to get some strange phone calls. One person told him, “Don’t stand too close to the edge of the subway platform.” Another caller asked if “he liked chorus girls.” When he said he wasn’t interested, the caller replied, “Oh, you’re that kind. Do you want some chorus boys?”

What Clurman uncovered during his six-month examination of Broadway stunned even so seasoned an investigator as himself. It wasn’t just that money was flying around, unaccounted for. Or that bribes were being paid under the table. He discovered a “train of aggravated corruption. Everybody,” he recalled, “was having a ball—and nobody was watching.”

There were scams of all sorts, about which angels knew nothing. For instance, if three trucks were required to bring scenery down from the shop to the theater, the trucking company might make out a bill for four—and the producer could pocket the money for the fourth, nonexistent, truck.

Suppliers of scenery, costumes, and lights admitted to giving kickbacks to producers and general managers (the people who run the day-to-day operations of a production) in exchange for contracts. On any one show, the kickbacks could amount to several thousand dollars.

Clurman, an expert in accounting, was shocked to discover such clauses in investment papers as this: “Our audit was conducted in accordance with generally accepted theatrical accounting principles. Such statements as to the operations and cash position of theatrical ventures do not customarily require the rendering of an opinion. No direct verification of assets or liabilities was undertaken.”

In plain English: “We have no idea if these statements are true.”

Clurman subpoenaed records from some productions, and discovered that on one show, which had been produced for $500,000, the books were kept in pencil. The numbers were smudged.

But the real money was in the ice. Clurman discovered that it wasn’t limited to box office personnel. Many people—theater owners, general managers, producers—were taking their cut. Anybody with access to tickets could flip them to brokers, including writers, directors, designers, and stars, who, in their contracts, were guaranteed at least two prime orchestra seats—“house seats”—a night.

Rudy Vallee, one of the stars of How to Succeed in Business Without Really Trying, openly shopped his house seats around Times Square to the highest bidder, usually the Hollywood Ticket Office.

It was said that Frederick Loewe, the composer of Brigadoon and My Fair Lady, traded his house seats for fur coats from friends in the garment business. Many a chorus girl in a Frederick Loewe show was known to keep warm in the winter with one of Freddie’s furs. Clurman discovered that a Broadway leading lady—whose name he would not give up even fifty years after the fact—had a deal with a broker who paid her $10,000 a year for her house seats. A well-known Broadway producer had bags of cash delivered to his East Side town house every night.

The bigger the hit, the more the ice. And at that point, the longest-running show in Broadway history was My Fair Lady, which opened March 15, 1956, at the Mark Hellinger Theatre and closed September 29, 1962, after 2,717 performances. A few months after My Fair Lady opened, a Russian submarine, the Myest, disappeared in the Baltic Sea. The day news of the sinking appeared in the papers, Bernie Hart, general manager of My Fair Lady (and the brother of the director Moss Hart) told his staff that the Russians had located the sub. “It broke through the ice,” he said, laughing, “at the Hellinger!”I

Stanley Stahl, a Times Square real estate magnate, bought the Hellinger during the run of My Fair Lady. He did so, according to his friend Arthur Rubin, so he could get a cut of the ice from the box office.

My Fair Lady was produced by CBS, which put up $360,000. But even executives at CBS couldn’t get tickets to the show without going through brokers. Marion Branch, a secretary at CBS, told Clurman that she bought as many as five pairs of seats a week from brokers. She paid $50 a ticket—$500 a week, she said ($3,500 today)—and gave them to CBS clients.

During the course of his investigation, Clurman discovered that the distribution of tickets and bribes wasn’t limited to Broadway box offices. He discovered that one theater chain had centralized the black market in tickets. The Shubert Organization controlled seventeen of Broadway’s best theaters. The company also owned the Sardi Building on West Forty-Fourth Street, named after the famed Broadway restaurant housed on the ground floor. Four floors above Sardi’s was a room—504—set aside for a special purpose. Here brokers or their runners went to buy tickets for shows in Shubert theaters. Sometimes there was a line out the door. Clurman found a former runner—Melvin D. Hecht, a twenty-six-year-old “freelance writer” from Philadelphia—who told him that, every Monday, he would deliver an envelope stuffed with cash to a man in 504.4 The man was Murray Helwitz, a distant cousin of the three Shubert Brothers—Sam, Lee, and J. J.—who had founded the mighty theatrical empire.

The money was divided up in room 504 and distributed up and down the chain of command. A company manager who worked at a Shubert show at the time said, “I was going on vacation once, and the box office treasurer came up to me, handed me an envelope and said, ‘Have fun, kid.’ There was a hundred dollars in cash in the envelope.”

Manny Azenberg recalled, “Everybody knew about the ice. You couldn’t wait to become important so that you got your envelope.”II

The ticketing scandal reached right into the heart of Broadway’s biggest landlord—the Shubert Organization. Clurman spoke to many Shubert employees, many of whom took the Fifth Amendment. But two employees, he would later say, were “very helpful to my investigation.” They were J. J. Shubert’s lawyers and advisors—Gerald Schoenfeld and Bernard B. Jacobs. Middle-aged, low-key, always in the background, they seemed, Clurman would later say, to understand that the company was in peril. Several people in the organization were collecting hundreds of thousands of dollars—perhaps millions—every year without reporting any of it to the Internal Revenue Service.

“Along came these two guys, these two lawyers, and I got to know them,” Clurman said. “They were not stupid people. They were helpful. It was hard to figure out what their motivation was, but they were very helpful.”

In 2005, when the Shubert Organization renamed the Plymouth Theatre after Gerald Schoenfeld, then chairman of the board, Clurman sent him a note. “I want to congratulate you,” he wrote. “And I really believe that you’re one of the people who helped save the theater in 1963.”

• • •

Clurman had to make a decision. He had enough evidence—kickbacks, bribes, diverted funds—to bring down Broadway, not least its most powerful entity, the Shubert Organization. He believed that the ice flowed to the top of the company, right into the executive offices of Lawrence Shubert Lawrence Jr., the president and chief operating officer. But if Clurman brought the Shuberts down he might decimate Broadway itself. Who, after all, would look after those seventeen theaters, especially as Times Square was getting seedier and seedier and the theater business itself was losing ground to television? He went to his boss to talk it over. Lefkowitz agreed. We’ll hold hearings, he said, put them on notice, pass some laws governing theater investing and ticket distribution. But Broadway was vital to New York. It could not be wiped out.

“It would have been easy to indict a multitude of people,” Clurman said. “I knew some of these guys hated me, but I don’t think they realized that I saved their necks.”

• • •

Clurman opened his public hearings on Broadway’s financial practices on December 10, 1963. He began with a headline-grabbing number. Based on the evidence collected, the attorney general estimated that at least $10 million ($75 million today) in ice was collected each year on Broadway. All of it was in cash and tax-free. Most Broadway productions failed, Clurman pointed out. In the 1961–62 season, investors lost nearly $6 million, he calculated. But the well connected were hauling in millions—at the expense of other people’s money.

Broadway producers, general managers, box office personnel, and other theater people gathered at 80 Centre Street, and were called on to testify. One of the first to speak was David Merrick, then the most powerful producer on Broadway. Merrick’s string of hit shows included Fanny, Look Back in Anger, Irma La Douce, and Carnival!.

Merrick took the stand and said he knew little about ice. What he did know, he said, was rumor and conjecture. The term itself, he believed, was a turn-of-the-century political expression meaning “incidental campaign expenses.”

Clurman and just about everybody else in the room had to stifle laughs. David Merrick didn’t know about ice? His right-hand man was Jack Schlissel, as tough a general manager as they came on Broadway. Schlissel was Merrick’s enforcer. He did the negotiating, the hiring, and often, the firing. “He was a worm,” Richard Seff, a veteran agent, says. “Slimy.” His name, in Yiddish, meant “key” (shlisl), and the joke around Broadway was that if you wanted to get at the ice on a Merrick show, you had to have the key. Schlissel and Merrick made hundreds of thousands of dollars from ice.

Informants told Clurman that Merrick’s offices above the St. James were almost as busy in the black market for tickets as room 504 in the Sardi Building. What Clurman didn’t know was that as soon as news of his investigation broke, Merrick contacted his longtime property man and ordered him to remove filing cabinets from his office in the middle of the night and dump them into the Hudson River. The cabinets contained Merrick’s secret accounts of the cash flowing in from the ice, the kickbacks, and the various other schemes he was running. And here was David Merrick claiming he only knew the term as incidental campaign expenses.

Merrick’s other schemes—of which his investors and Clurman were unaware—included a little side business with the souvenir program. Merrick and Schlissel had a deal with a small-time printer named Abe Zamachansky. He printed the souvenir programs for Merrick’s shows. They were sold in the lobby for a dollar. It doesn’t sound like much, but on a hit show, playing a fifteen-hundred-seat theater eight times a week, packed with theatergoers who might want to take something home to remember their night on Broadway, those dollars added up. At the end of the week, Zamachansky would split the profits with Merrick and Schlissel. “No one got a piece of that but the three of them,” said an old associate of Merrick’s. “No one. No investors. No creative people. Nobody. It was a very profitable business. And when the creative people started demanding their share, Merrick stopped doing the book!”

As Clurman had discovered, financial documentation for Broadway shows was sketchy, at best. If Merrick’s investors had any idea how to read their contracts, they might—might—have discovered that a certain company was entitled to buy, at minimal cost, all the lighting and electrical equipment from Merrick’s shows when they closed. Merrick owned the company. He shipped the equipment to a warehouse in upstate New York and then rented it out to other shows in New York and around the country. The original investors in the show that had closed paid for lighting equipment. But only Merrick pocketed the money from its subsequent rental. Another small fortune was being made off Broadway’s oblivious angels.

Clurman called others to the stand. Every box office treasurer, he recalled, took the Fifth Amendment. But the CBS secretary, Marion Branch, testified, and so, too, did Melvin D. Hecht, the runner. He told about the payoffs he made every Monday morning to box office treasurers. He also said he carried two envelopes. One contained checks for the regular box office price of the tickets. The other contained cash. He distributed the checks to the box office.

“What did you do with the cash?” Clurman asked.

“I delivered it in person to an individual in an office building.”

Clurman had instructed Hecht not to name the person or the building, but everybody in the room knew he was talking about Murray Helwitz, the Shubert iceman, who worked out of room 504 in the Sardi Building.

After Hecht was done, Alvin Cooperman, a Shubert executive, took the stand and announced that the Shubert Organization “deplores any unethical practices in ticket selling and production investing.” Any Shubert employee who accepted ice “would be summarily dismissed.”5

Again, much of the room had to stifle a laugh.

At the end of the day, Merrick asked if he could return to the stand. He said he was “appalled” at what he’d learned that day, and he was “happy and delighted” that the attorney general was exposing such practices and “cleaning out the vermin.” He congratulated Lefkowitz and called the hearing “the best show of the season.”6

• • •

On December 26, 1963—just two weeks after the hearings that engulfed the Shubert Organization in scandal—J. J. Shubert, the last of the three brothers who built the empire, died of a cerebral hemorrhage in his penthouse apartment on the eleventh floor of the Sardi Building. He was eighty-six. On Broadway they called him the “Phantom,” as no one had seen him in years. It was an ironic nickname, though no one knew it at the time. Twenty-five years later, another phantom, the one with the mask, would make more money for the Shubert Organization than any other show in its one-hundred-year history.

J. J.’s dementia had set in around 1958, and by 1960 his mind was gone. He was bedridden in his apartment, surrounded by Louis XIV furniture he’d collected on long-ago trips to Europe. He was attended to by nurses and by his second wife, who let few people into the apartment. Those old confidants who were allowed to see this belligerent, brutal old despot said his face seemed fixed in a scowl.

Above a massive fireplace in his living room hung a painting of his only son, John, at the age of eight dressed like Little Lord Fauntleroy. J. J. had trained John to take over the Shubert empire. But in November 1962, John had died from a heart attack on a train to Clearwater, Florida. He was fifty-three.

The Shubert lawyers, Gerald Schoenfeld and Bernard B. Jacobs, fearing the news would kill the old man—or perhaps that he would not have grasped it at all—never told J. J. that his only direct heir, the only direct heir to his empire, was dead.

I. Bernie Hart was thought to be one of the funniest men on Broadway, much funnier than Moss, who with George S. Kaufman wrote the classic comedies You Can’t Take It with You and The Man Who Came to Dinner. After Moss’s play The Climate of Eden got slaughtered by the critics in Philadephia, Moss and Bernie took the train back to New York. As soon as they arrived, they headed to the Little Bar at Sardi’s. “Did you see those reviews, Bernie?” Moss said. “How are we ever going to get out of Philadelphia with those reviews? There is no way we can get out of Philadelphia with those reviews.” Bernie replied, “Moss, relax. We got out of Egypt. We’ll get out of Philadelphia.”

II. Five years later, Azenberg was offered his envelope. He was the general manager of Two Gentlemen of Verona, and it came by way of the box office. He met with his business partner, Eugene Wolsk, and they decided not to take it. “After the ’63 investigation, it was a felony,” Azenberg said.

Recenzii

“This book is a love letter to Broadway, both a splendid history of this American institution and a wonderful account of how art gets made. It made me fall for Broadway’s magic all over again: its history and its myths, its heroes and its villains, its up and its downs, its dirt and its dish, its failure and its glory.”

“There have only been a handful of books in history that have come close to accurately depicting the energy and drive that run the business of Broadway. Michael Riedel’s Razzle Dazzle joins that very short list that includes William Goldman’s legendary The Season and Richard Maney’s classic Fanfare—and is every bit the equal of those books that those of us who love Broadway can recite by heart.”

“Razzle Dazzle is a fantastically fun book, full of high energy, anecdotes, and wit. Michael Riedel lays bare the secret history of Broadway in all its grease paint, shady dealings, and shining moments. Written with love but also a piercing eye, this is one show no one should miss.”

Riedel brings enthusiasm and authority to this rich, lively debut history of New York theater in the 1970s and '80s…. Riedel masterfully builds suspense as he chronicles productions from idea to stage to reviews to Tony Awards. A captivating gift to theater lovers.

"Riedel may be known, where he is known, for his sharp wit and sharper tongue, but when it comes to Broadway as an institution, as a history, and as a legend, he’s very much a man in love."

“Just finished RAZZLE DAZZLE, a vivid page-turner that’s basically a history of Broadway by longtime theater observer Michael Riedel. It starts with a ticket-scalping scandal that practically brought down the industry, then flashes back to the sharp-elbowed early days of the Shubert empire, and then fills in with anecdotes both well-known (to aficionados) and long-forgotten (by nearly everyone). Startling deaths, unexpected demolitions, backstage gossip, inside stories — it’s every bit as theatrical as its subject matter.”

"Michael Riedel’s new book, Razzle Dazzle, brings this gritty world [of 1970's and 80's Broadway] back to life.... Riedel unearths treasures from the recent past and contextualizes events that would otherwise be too easily forgotten."

"The trouble with Razzle Dazzle, Michael Riedel's new book about Broadway, is that from the first page -- on which a man complains to the attorney general's office that "I made an investment in a play, and the producer used the money to buy a lobster boat in Montauk" -- you can't put the damn thing down.... Riedel subtitles his book "The Battle for Broadway," and he follows through by giving us a fascinating, eye-popping view of all the bloody carnage."

“If you've ever wondered how Times Square got its name, how the great New York theatres were built and who they were named after; or how on Broadway the word 'ice' can also mean corruption, Michael Riedel's revealing book on the history of the Great White Way will be a brilliant gift for any reader. It’s an epic and entertaining study of the stage and the impresarios and artists who became not just legends—but very wealthy ones at that. And while there may still be some 'ice' melting on the streets of mid-town, Riedel shows us that what the scalpers, producers and bookies, in and around Shubert Alley, were doing with kickbacks and bribes, makes the moral decay in Washington look like a badly run lemonade stand. Riedel's journey unfolds faster than a curtain going up on opening night; and his nimble choreography with language brings a full understanding and appreciation of how the artistry, decisions, and backstage shenanigans made these men and women of Broadway titans of the American theater. A must read.”

“Razzle Dazzle: The Battle for Broadway byMichael Riedel, the New York Post's flamboyantly mischievous Broadwaycolumnist, tells the thrilling history of the larger-than-life impresarios whohelped transform the Great White Way from cultural ugly duckling in the seedy1970s to the grand billion-dollar swan it is today.”

– Los Angeles Times

“There have only been a handful of books in history that have come close to accurately depicting the energy and drive that run the business of Broadway. Michael Riedel’s Razzle Dazzle joins that very short list that includes William Goldman’s legendary The Season and Richard Maney’s classic Fanfare—and is every bit the equal of those books that those of us who love Broadway can recite by heart.”

“Razzle Dazzle is a fantastically fun book, full of high energy, anecdotes, and wit. Michael Riedel lays bare the secret history of Broadway in all its grease paint, shady dealings, and shining moments. Written with love but also a piercing eye, this is one show no one should miss.”

Riedel brings enthusiasm and authority to this rich, lively debut history of New York theater in the 1970s and '80s…. Riedel masterfully builds suspense as he chronicles productions from idea to stage to reviews to Tony Awards. A captivating gift to theater lovers.

"Riedel may be known, where he is known, for his sharp wit and sharper tongue, but when it comes to Broadway as an institution, as a history, and as a legend, he’s very much a man in love."

“Just finished RAZZLE DAZZLE, a vivid page-turner that’s basically a history of Broadway by longtime theater observer Michael Riedel. It starts with a ticket-scalping scandal that practically brought down the industry, then flashes back to the sharp-elbowed early days of the Shubert empire, and then fills in with anecdotes both well-known (to aficionados) and long-forgotten (by nearly everyone). Startling deaths, unexpected demolitions, backstage gossip, inside stories — it’s every bit as theatrical as its subject matter.”

"Michael Riedel’s new book, Razzle Dazzle, brings this gritty world [of 1970's and 80's Broadway] back to life.... Riedel unearths treasures from the recent past and contextualizes events that would otherwise be too easily forgotten."

"The trouble with Razzle Dazzle, Michael Riedel's new book about Broadway, is that from the first page -- on which a man complains to the attorney general's office that "I made an investment in a play, and the producer used the money to buy a lobster boat in Montauk" -- you can't put the damn thing down.... Riedel subtitles his book "The Battle for Broadway," and he follows through by giving us a fascinating, eye-popping view of all the bloody carnage."

“If you've ever wondered how Times Square got its name, how the great New York theatres were built and who they were named after; or how on Broadway the word 'ice' can also mean corruption, Michael Riedel's revealing book on the history of the Great White Way will be a brilliant gift for any reader. It’s an epic and entertaining study of the stage and the impresarios and artists who became not just legends—but very wealthy ones at that. And while there may still be some 'ice' melting on the streets of mid-town, Riedel shows us that what the scalpers, producers and bookies, in and around Shubert Alley, were doing with kickbacks and bribes, makes the moral decay in Washington look like a badly run lemonade stand. Riedel's journey unfolds faster than a curtain going up on opening night; and his nimble choreography with language brings a full understanding and appreciation of how the artistry, decisions, and backstage shenanigans made these men and women of Broadway titans of the American theater. A must read.”

“Razzle Dazzle: The Battle for Broadway byMichael Riedel, the New York Post's flamboyantly mischievous Broadwaycolumnist, tells the thrilling history of the larger-than-life impresarios whohelped transform the Great White Way from cultural ugly duckling in the seedy1970s to the grand billion-dollar swan it is today.”

– Los Angeles Times

Descriere

A vivid page-turner detailing the rise, fall, and redemption of Broadway.