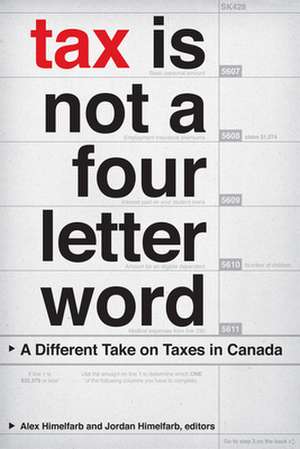

Tax is Not a Four-Letter Word: Canadian Commentaries

Editat de Alex Himelfarb, Jordan Himelfarben Limba Engleză Paperback – 31 aug 2013

Preț: 161.86 lei

Nou

30.97€ • 33.75$ • 26.10£

Carte tipărită la comandă

Livrare economică 23 aprilie-07 mai

Specificații

ISBN-10: 1554588324

Pagini: 304

Ilustrații: black & white illustrations

Dimensiuni: 152 x 231 x 19 mm

Greutate: 0.43 kg

Ediția:New.

Editura: Wilfrid Laurier University Press

Seria Canadian Commentaries

Cuprins

Table of Contents for Tax Is Not a Four-Letter Word: A Different Take on Taxes in Canada, edited by Alex Himelfarb and and Jordan Himelfarb

Preface

Introduction: Tax Is Not a Four-Letter Word | Alex Himelfarb and Jordan Himelfarb

Part 1: The Conversation Today

Chapter 1: The Economic Consequences of Taxing (and Spending) | Jim Stanford

Chapter 2: Taxes and Transfers in Canada: The Federal Dimension | Robin Boadway

Chapter 3: Taxes and Public Services | Hugh Mackenzie

Chapter 4: Benefits from Public Services | Hugh Mackenzie

Chapter 5: Canadian Public Opinion on Taxes | Frank Graves

Part 2: How We Got Here

Chapter 6: Taxation and the Neo-liberal Counter-Revolution: The Canadian Case | Matt Fodor

Chapter 7: A Brief Potted History of Ottawa's Tax Cut Mania | Eugene Lang and Philip DeMont

Chapter 8: Tax Cuts and Other Cheap Parlour Tricks | Trish Hennessey

Part 3: A Different Take on Taxes

Chapter 9: Towards A Fair Canadian Tax System | Marc Lee and Iglika Ivanova

Chapter 10: Carbon Taxes: Can a Good Policy Become Good Politics? | Stéphane Dion

Chapter 11: How Small Changes Can Make a Big Difference: The Case of Financial Transaction Taxes | Toby Sanger

Chapter 12: We Need to Simplify and Re-focus the Tax System | C. Scott Clark

Part 4: How to Get There

Chapter 13: Canada's Conservative Ideological Infrastructure: Brewing a Cup of Cappuccino Conservatism | Paul Saurette and Shane Gunster

Conclusion

Contributors

Index

Contributor Biographies (alphabetically)

Robin Boadway received his Ph.D. in Economics from Queen's University and has taught there since 1973, with year-long interruptions to take up a post-doctoral fellowship at the University of Chicago (1976-77) and visiting scholar positions at the University of Oxford (1980-81) and University Catholique de Louvain (1986-87). He was President of the Canadian Economics Association (1996-97) and servied as the Editor of the Canadian Journal of Economics (1987-93) and Journal of Public Economics from 2003-2008. Professor Boadway was made a Fellow of the Royal Society of Canada in 1986 and an Officer of the Order of Canada in 2008, and was the Distinguished CES Fellow at the University of Munich in 2009. He is currently President of the International Institute of Public Finance.

Scott Clark is currently President of C. S. Clark Consulting. Mr. Clark served as Deputy Minister of Finance (1997-2000), and Senior Adviser to the Prime Minister (2001). Mr. Clark was Canada's Executive Director to the International Monetary Fund (1989-1992), Canada's G-7 Deputy (1992-1994), and Canada's Executive Director to the European Bank for Reconstruction and Development (2001-2006). Mr. Clark has a PhD in Economics from the University of California at Berkeley. Mr. Clark is a frequent commentator on public policy issues on CBC radio and TV, CTV, and BNN. He comments regularly on Public policy issues (with Peter Devries) at www.3dpolicy.ca.

Philip DeMont, an economist, veteran financial journalist and former Ontario government adviser, is co-author (with Eugene Lang) of Turning Point: Moving Beyond Neoconservatism.

Stéphane Dion was Minister of Intergovernmental Affairs between 1996 and 2003, longer than any other Canadian since Confederation. In that capacity, he was instrumental in bringing countless federal-provincial negotiations to fruition and played a major role in the promotion of Canadian unity. As Minister of the Environment from 2004 to 2005, he secured one of the greenest budgets in the history of Canada and contributed to the rescue of the Kyoto Protocol while chairing the UN Conference on Climate Change, held in Montreal in 2005. In 2006, having been elected as Leader of the Liberal Party of Canada, he proposed a visionary plan to make Canada richer, fairer and greener, with its core being a green tax shift that would have included a revenue neutral carbon tax. Following the 2008 election, he retained his seat as Member of Parliament for Saint-Laurent-Cartierville, a seat he has won seven times in a row since 1996. Before entering politics, Stéphane Dion taught Political Science at Université de Moncton and Université de Montréal. As an academic and politician, he has authored numerous publications on a wide array of Canadian and international issues, including the complexities of climate change negotiations, global environmental policies, and universal carbon pricing. Born in Quebec City, he studied at Université Laval before obtaining a Doctorate in Sociology from the Institut d'études politiques in Paris, France. He was awarded an Honorary Doctorate by the Carlos III University of Madrid.

Matt Fodor is a Ph.D. candidate in the Department of Political Science at York University. His research interests include social democracy, Canadian politics and the impact of neoliberalism on politics and public policy. He as published numerous articles and papers in these areas.

As founder of EKOS Research Associates Inc., Frank Graves is one of the country's leading applied social researchers, directing some of the largest and most challenging social research assignments conducted in Canada. Under the leadership of Mr. Graves, EKOS has earned a reputation for creative and rigorous research in the areas of public policy, social policy and program evaluation and as a leader in innovative survey techniques and methodology. Mr. Graves graduated from Carleton University with an M.A. in Sociology and has completed doctoral coursework in Sociology.

Shane Gunster teaches in the School of Communication at Simon Fraser University. His current research interests include communication about environmental issues (especially climate change) and the politics of energy.

Trish Hennessy is director of the Canadian Centre for Policy Alternatives' (CCPA) Ontario office. Trish is the founding director of the CCPA's income inequality project. She is a former newspaper journalist and has an M.A. in Sociology from OISE/University of Toronto, a B.S.W. from Carlton University, and a B.A. in Sociology from Queen's University.

Iglika Ivanova is an Economist and Public Interest Researcher at the BC Office of the Canadian Centre for Policy Alternatives. She is a frequent media commentator and public speaker on BC public policy issues, and has authored numerous studies and articles for the CCPA. Iglika researches and writes on issues of government finance, taxation and privatization, and how they relate to the accessibility and quality of public services in BC. Her other research investigates issues and trends in the Canadian labour market, and in particular income inequality and low wage work.

Eugene Lang is Co-founder, Canada 2020, and teaches in the Graduate School of Public and International Affairs at Glendon College, York University. An award winning and best-selling author, Lang has co-written two books on Canadian public policy and has published over one hundred articles and essays. He worked in the federal government for twelve years, including at Finance Canada, and was educated at The University of Western Ontario, Queen's University, and the London School of Economics, where he studied as a Chevening Scholar.

Marc Lee is Senior Economist for the Centre for Policy Alternatives where he writes on a variety of economic and social policy issues. He has published on a wide range of topics from poverty and inequality to globalization and international trade to public services and regulation. Marc is the Co-Director of the Climate Justice Project, a five-year research partnership with the University of British Columbia, examining the links between climate change policies and social justice. Despite being "classically trained,&rduqo; with an MA in Economics, Marc was the past Chair of the Progressive Economics Forum, a national network of heterodox economists.

Hugh Mackenzie is principal in an economic consulting business, Hugh Mackenzie and Associates, based in Toronto. He has worked for over 40 years in a variety of capacities related to public policy development in the trade union movement, the private sector, and at all three levels of government. He is presently part of a team at the Canadian Centre for Policy Alternatives conducting a series of research studies on income and wealth inequality in Canada. As part of the CCPA Alternative Budget project, he produces an annual review of the Ontario budget. He is the author of a regular series of in-depth analyses of the funding of elementary and secondary education in Ontario. He holds a Masters degree in economics from the University of Wisconsin (Madison).

Toby Sanger works as the economist for the Canadian Union of Public Employees and previously served as the chief economist for the Yukon government, principal economic policy advisor to the Ontario Minister of Finance, economic advisor to First Nations and as a consulting economist. Among other projects, he initiated the successful Ontario Savings Bond and the Yukon Micro-Loan Programs. He produces CUPE's quarterly Economy at Work publication and has published on a wide range of issues, including Fair Shares: How Banks, Brokers and the Financial Industry Can Pay Fairer Taxes (Canadian Centre for Policy Alternatives, 2011).

Jim Stanford is one of Canada's best-known economists. He works for the Canadian Auto Workers union, and writes a regular economics column for the Globe and Mail. He received his Ph.D. in Economics from the New School for Social Research in New York City, and is the author of Economics for Everyone (Canadian Centre for Policy Alternatives, 2008). He was the founding chairperson of the Progressive Economics Forum, Canada's network of progressive economists.

Paul Saurette is Associate Professor, School of Political Studies, University of Ottawa. He received his Ph.D., Political Science, Johns Hopkins University, Baltimore, 2001. His current research interests include Ideology and politics of Conservatism and the "Right". He is the author of The Kantian Imperative: Humiliation, Common Sense, Politics (University of Toronto Press, 2005).