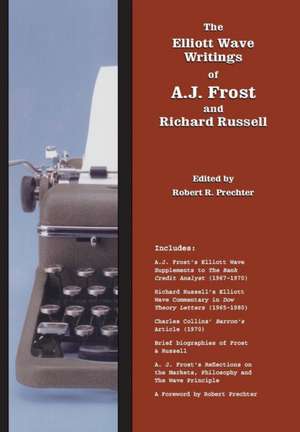

The Elliott Wave Writings of A.J. Frost and Richard Russell

Autor A J Frost, Richard Russell Editat de Robert Prechteren Limba Engleză Hardback – 12 ian 2017

Preț: 467.55 lei

Preț vechi: 525.35 lei

-11% Nou

Puncte Express: 701

Preț estimativ în valută:

89.46€ • 93.41$ • 74.04£

89.46€ • 93.41$ • 74.04£

Carte disponibilă

Livrare economică 14-28 martie

Preluare comenzi: 021 569.72.76

Specificații

ISBN-13: 9781616040284

ISBN-10: 1616040289

Pagini: 428

Dimensiuni: 161 x 240 x 27 mm

Greutate: 0.82 kg

Editura: New Classics Library

ISBN-10: 1616040289

Pagini: 428

Dimensiuni: 161 x 240 x 27 mm

Greutate: 0.82 kg

Editura: New Classics Library

Notă biografică

A.J. Frost was A. Hamilton Bolton's successor as the reigning dean of the Wave Principle. Everything he ever published on the subject is in this book. In his 1967 and 1970 Elliott Wave supplements to "The Bank Credit Analyst", Frost forecasted the ending level for the 1966-1974 bear market in the Dow to the point and entertains us with two spirited Q&A's. Also included is the 1968 supplement by Russell L. Hall, which was co-written with Frost. We've spiced up the volume with letters between Dr. Max Resnick and which was co-written with Frost. We've spiced up the volume with letters between Dr. Max Resnick and Charles J. Collins, which fill the space of the missing 1969 BCA supplement. These reprints complete the presentation of the BCA's entire Elliott Wave output. Another treat is a long-lost article by Collins from the April 17, 1970 issue of Barron's. We added some more spice with a number of newspaper articles covering Frost's opinions when he wasn't being published. The incomparable Richard Russell of "Dow Theory Letters", who conferred often with Frost, brilliantly blazed the market's trail in the 1970s. Every word Russell wrote about the Wave Principle is here, including one of the greatest market calls of all time: his recognition of the end of the bear market at the December 1974 low. Ending our tome is a delightful section revealing some of A.J.'s more general thoughts on the Wave Principle and markets. It's the fun part. You can read it first or for dessert.