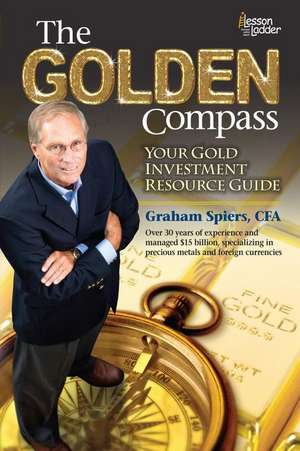

The Golden Compass: Your Gold Investment Resource Guide

Autor Graham Spiersen Limba Engleză Paperback – 8 ian 2013 – vârsta de la 18 până la 10 ani

For the past decade, gold prices have been on a breathtaking ascent and have reached some of the highest recorded summits in modern history. Many investors speculate that these values will rise even further.

History has shown us that the strength or weakness of the global economy determines the value of this iconic precious metal. Rising gold prices often coincide with weakening currencies and economic uncertainty and act as a “compass” indicating the direction the economy is heading. Being able to read this compass is critical!

Beginning with the credit crisis of 2008 and the deep recession that followed, our Treasury has engaged in massive stimulus programs by borrowing and spending almost $1 trillion and our central bank (the Fed) has supported a massive and unprecedented expansion of the money supply—both threatening to weaken our currency and trigger a painful cascade of inflation.

The meteoric rise in the value of gold reflects a common, global perception that world currencies, particularly the U.S. dollar, are under threat. When investors distrust the stability of a nation’s currency—especially a currency as important to global commerce as the dollar—they look for hard assets of true value that can protect their hard-earned wealth. Learn how you, too, can safeguard your wealth, hedge against adversity, and diversify your portfolio through gold investing.

In this book, you will find answers to those questions on everyone’s mind:

· Why is the price of gold increasing so quickly and dramatically?

· What do these increases tell us about the health of the overall economy?

· Can gold be a safe haven for wealth and a hedge against economic turmoil?

· What does the modern investor need to know about gold?

· Where and how can I buy or invest in gold?

History has shown us that the strength or weakness of the global economy determines the value of this iconic precious metal. Rising gold prices often coincide with weakening currencies and economic uncertainty and act as a “compass” indicating the direction the economy is heading. Being able to read this compass is critical!

Beginning with the credit crisis of 2008 and the deep recession that followed, our Treasury has engaged in massive stimulus programs by borrowing and spending almost $1 trillion and our central bank (the Fed) has supported a massive and unprecedented expansion of the money supply—both threatening to weaken our currency and trigger a painful cascade of inflation.

The meteoric rise in the value of gold reflects a common, global perception that world currencies, particularly the U.S. dollar, are under threat. When investors distrust the stability of a nation’s currency—especially a currency as important to global commerce as the dollar—they look for hard assets of true value that can protect their hard-earned wealth. Learn how you, too, can safeguard your wealth, hedge against adversity, and diversify your portfolio through gold investing.

In this book, you will find answers to those questions on everyone’s mind:

· Why is the price of gold increasing so quickly and dramatically?

· What do these increases tell us about the health of the overall economy?

· Can gold be a safe haven for wealth and a hedge against economic turmoil?

· What does the modern investor need to know about gold?

· Where and how can I buy or invest in gold?

Preț: 80.60 lei

Nou

Puncte Express: 121

Preț estimativ în valută:

15.43€ • 16.76$ • 12.97£

15.43€ • 16.76$ • 12.97£

Carte disponibilă

Livrare economică 31 martie-14 aprilie

Preluare comenzi: 021 569.72.76

Specificații

ISBN-13: 9780984865727

ISBN-10: 0984865721

Pagini: 154

Dimensiuni: 152 x 229 x 8 mm

Greutate: 0.21 kg

Ediția:Nouă

Editura: Lesson Ladder Inc

ISBN-10: 0984865721

Pagini: 154

Dimensiuni: 152 x 229 x 8 mm

Greutate: 0.21 kg

Ediția:Nouă

Editura: Lesson Ladder Inc

Recenzii

"Graham Spiers is the consummate investment professional. The depth and breadth of his background is virtually irreplaceable. His career spans corporate interest rate, foreign exchange and commodity exposure risk management, institutional asset management, and private wealth management. He has managed global multi-billion dollar portfolios across all major primary and alternative asset classes, and his employers have been the “Who’s Who” of the investment business. Along the way, he has been a trader and a trading desk manager. His grounding in investment theory, economics, and market psychology along with his years of experience has established a unique wisdom that is without equal." -- Jeffrey C. Donahue, Ph.D., Chief Financial Officer, Ostendo Technologies

"Graham's depth of knowledge and breadth of experience across several markets provides a holistic perspective on the opportunities and challenges thoughtful investors should consider at all stages of the investment cycle." -- Christopher Ray, CFA, Head of US investments and Partner at Mercer Investment Management

"Over the years Graham has shown a unique ability to see through the daily noise that distracts so many of us and has developed a skill to identify the longer-term structural issues that will impact global financial markets. Whether managing commodity and currency exposures for the finance divisions of large multinational firms, or building investment portfolios for endowments, foundations and high net worth individuals, he has displayed the knowledge, patience and confidence that has guided so many to long-term success." -- John Serhant retired Head of High Net Worth Business and Vice-Chairman of State Street Global Advisors

"Graham's depth of knowledge and breadth of experience across several markets provides a holistic perspective on the opportunities and challenges thoughtful investors should consider at all stages of the investment cycle." -- Christopher Ray, CFA, Head of US investments and Partner at Mercer Investment Management

"Over the years Graham has shown a unique ability to see through the daily noise that distracts so many of us and has developed a skill to identify the longer-term structural issues that will impact global financial markets. Whether managing commodity and currency exposures for the finance divisions of large multinational firms, or building investment portfolios for endowments, foundations and high net worth individuals, he has displayed the knowledge, patience and confidence that has guided so many to long-term success." -- John Serhant retired Head of High Net Worth Business and Vice-Chairman of State Street Global Advisors

Notă biografică

Graham Spiers began his career in the early 1970s, just as the Nixon administration abandoned the Bretton Woods agreement, ending the dollar’s fixed price to gold and launching the modern-day version of floating foreign exchange rates which remains with us today. For the next twenty years his work focused on managing large corporate exposures to precious metals and foreign currencies. He implemented numerous strategies to both protect companies from exposures in their operating divisions and to trade and seek profit from exposures in their finance divisions.

After attaining the Chartered Financial Analyst (CFA) designation in 1992 his career focus shifted to managing global capital market portfolios. For several years he managed and actively traded a $6 billion portfolio of currency positions for clients of State Street Global Advisors. Later, as a senior portfolio manager for Putnam Investments, he managed global balanced portfolios with holdings in all asset classes, including stocks, bonds, currencies and commodities with an aggregate value of $15 billion. In this role he managed several large mutual funds and numerous institutional separate accounts for corporations, endowments, foundations and high net worth investors.

For the past eight years he has been the Chief Investment Officer of a High Net Worth investment advisory firm where he has managed global portfolios for a diverse group of clients. Graham served in the U.S. Navy and received a BBA from Nichols College.

After attaining the Chartered Financial Analyst (CFA) designation in 1992 his career focus shifted to managing global capital market portfolios. For several years he managed and actively traded a $6 billion portfolio of currency positions for clients of State Street Global Advisors. Later, as a senior portfolio manager for Putnam Investments, he managed global balanced portfolios with holdings in all asset classes, including stocks, bonds, currencies and commodities with an aggregate value of $15 billion. In this role he managed several large mutual funds and numerous institutional separate accounts for corporations, endowments, foundations and high net worth investors.

For the past eight years he has been the Chief Investment Officer of a High Net Worth investment advisory firm where he has managed global portfolios for a diverse group of clients. Graham served in the U.S. Navy and received a BBA from Nichols College.

Descriere

For the past decade, gold prices have been on a breathtaking ascent and have reached some of the highest recorded summits in modern history. Many investors speculate that these values will rise even further.

History has shown us that the strength or weakness of the global economy determines the value of this iconic precious metal. Rising gold prices often coincide with weakening currencies and economic uncertainty and act as a “compass” indicating the direction the economy is heading. Being able to read this compass is critical!

Beginning with the credit crisis of 2008 and the deep recession that followed, our Treasury has engaged in massive stimulus programs by borrowing and spending almost $1 trillion and our central bank (the Fed) has supported a massive and unprecedented expansion of the money supply—both threatening to weaken our currency and trigger a painful cascade of inflation.

The meteoric rise in the value of gold reflects a common, global perception that world currencies, particularly the U.S. dollar, are under threat. When investors distrust the stability of a nation’s currency—especially a currency as important to global commerce as the dollar—they look for hard assets of true value that can protect their hard-earned wealth. Learn how you, too, can safeguard your wealth, hedge against adversity, and diversify your portfolio through gold investing.

In this book, you will find answers to those questions on everyone’s mind:

· Why is the price of gold increasing so quickly and dramatically?

· What do these increases tell us about the health of the overall economy?

· Can gold be a safe haven for wealth and a hedge against economic turmoil?

· What does the modern investor need to know about gold?

· Where and how can I buy or invest in gold?

History has shown us that the strength or weakness of the global economy determines the value of this iconic precious metal. Rising gold prices often coincide with weakening currencies and economic uncertainty and act as a “compass” indicating the direction the economy is heading. Being able to read this compass is critical!

Beginning with the credit crisis of 2008 and the deep recession that followed, our Treasury has engaged in massive stimulus programs by borrowing and spending almost $1 trillion and our central bank (the Fed) has supported a massive and unprecedented expansion of the money supply—both threatening to weaken our currency and trigger a painful cascade of inflation.

The meteoric rise in the value of gold reflects a common, global perception that world currencies, particularly the U.S. dollar, are under threat. When investors distrust the stability of a nation’s currency—especially a currency as important to global commerce as the dollar—they look for hard assets of true value that can protect their hard-earned wealth. Learn how you, too, can safeguard your wealth, hedge against adversity, and diversify your portfolio through gold investing.

In this book, you will find answers to those questions on everyone’s mind:

· Why is the price of gold increasing so quickly and dramatically?

· What do these increases tell us about the health of the overall economy?

· Can gold be a safe haven for wealth and a hedge against economic turmoil?

· What does the modern investor need to know about gold?

· Where and how can I buy or invest in gold?