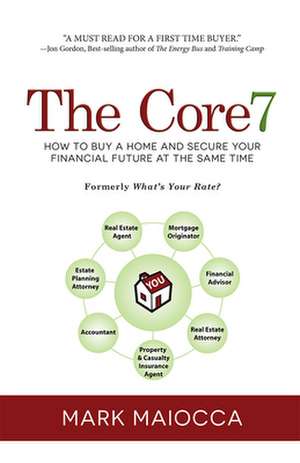

What's Your Rate?: How to Buy a Home and Secure Your Financial Future at the Same Time

Autor Mark Maioccaen Limba Engleză Paperback – 9 aug 2012 – vârsta de la 18 până la 10 ani

What Every Homeowner Needs to Know Before They Sign on the Dotted Line

Thinking about buying a home? The dream of home ownership has become a reality for millions of people in the last few years.

With this book in hand, now it can be yours too.

What’s Your Rate? How to Buy a Home and Secure Your Financial Future at the Same Time offers a unique perspective into the process of buying a home. At the same time, it helps you to formulate a financial plan and put together your financial team. Don’t neglect to consider your insurance needs, investment strategies, college funding, estate planning or passing on a legacy. These critical factors are often overlooked while transacting what is, for most people, the single largest purchase they’ll ever make—their home.

This definitive guide is unique in that all of the home buying and financial planning information is related through a compelling narrative centered on a young family—a family probably a lot like yours. They have grown out of their apartment and they are expecting a third child. When a suggestion from a trusted friend is followed—after a discouraging beginning into the home buying process—an all-encompassing plan soon unfolds.

Learn how to assemble your team of trusted advisors and put together a comprehensive plan for the future. This is a must read for anyone considering buying a home, and for the Core-7 business professional looking to create a system to help in that endeavor.

Preț: 96.04 lei

Nou

18.38€ • 19.96$ • 15.44£

Carte disponibilă

Livrare economică 01-15 aprilie

Specificații

ISBN-10: 1599323419

Pagini: 238

Dimensiuni: 152 x 229 x 13 mm

Greutate: 0.34 kg

Editura: Advantage Media Group

Recenzii

—Jon Gordon, Best-selling author of The Energy Bus and Training Camp

—Sue Woodard, President, Content & Publishing, Mortgage Success Source, LLC

— Jules Vanden Berge, Business Coach, Buffini & Company

Notă biografică

Cuprins

INTRODUCTION

CHAPTER 1

The Sign

CHAPTER 2

A Home of Our Own

CHAPTER 3

What¿s Your Rate?

CHAPTER 4

Failure

CHAPTER 5

Tom¿s Nightmare

CHAPTER 6

John and the Core 7: A Point in the Right Direction

CHAPTER 7

The Real Estate Agent

CHAPTER 8

The Home Search Begins: Getting Ahead of the House

CHAPTER 9

The Mortgage Originator: The Loan Consultation

CHAPTER 10

The Financial Advisor: A Plan Tied to Values

CHAPTER 11

Ready to Buy

CHAPTER 12

The Real Estate Attorney

CHAPTER 13

The Re-consultation: Firming Up the Details

CHAPTER 14

The Property and Casualty Insurance Agent: Vital Protection from Lawsuits

CHAPTER 15

A Special Closing Gift

CHAPTER 16

The Financial Plan: Tying It All Together

CHAPTER 17

The Estate Planning Attorney: A Plan for When You Are Gone

CHAPTER 18

The Accountant

CHAPTER 19

Gratitude

CHAPTER 20

Legacy: The Plan Comes to Fruition

ACKNOWLEDGMENTS

BIBLIOGRAPHY