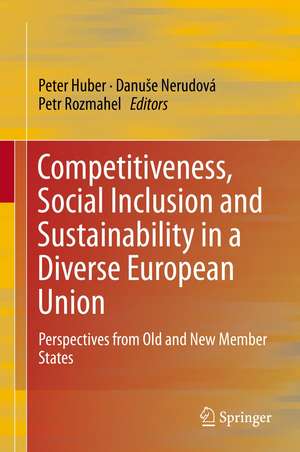

Competitiveness, Social Inclusion and Sustainability in a Diverse European Union: Perspectives from Old and New Member States

Editat de Peter Huber, Danuše Nerudová, Petr Rozmahelen Limba Engleză Hardback – 24 iul 2015

| Toate formatele și edițiile | Preț | Express |

|---|---|---|

| Paperback (1) | 636.80 lei 6-8 săpt. | |

| Springer International Publishing – 15 oct 2016 | 636.80 lei 6-8 săpt. | |

| Hardback (1) | 643.00 lei 6-8 săpt. | |

| Springer International Publishing – 24 iul 2015 | 643.00 lei 6-8 săpt. |

Preț: 643.00 lei

Preț vechi: 756.47 lei

-15% Nou

Puncte Express: 965

Preț estimativ în valută:

123.05€ • 133.62$ • 103.36£

123.05€ • 133.62$ • 103.36£

Carte tipărită la comandă

Livrare economică 23 aprilie-07 mai

Preluare comenzi: 021 569.72.76

Specificații

ISBN-13: 9783319172989

ISBN-10: 3319172980

Pagini: 200

Ilustrații: VIII, 212 p. 31 illus., 17 illus. in color.

Dimensiuni: 155 x 235 x 20 mm

Greutate: 0.49 kg

Ediția:1st ed. 2016

Editura: Springer International Publishing

Colecția Springer

Locul publicării:Cham, Switzerland

ISBN-10: 3319172980

Pagini: 200

Ilustrații: VIII, 212 p. 31 illus., 17 illus. in color.

Dimensiuni: 155 x 235 x 20 mm

Greutate: 0.49 kg

Ediția:1st ed. 2016

Editura: Springer International Publishing

Colecția Springer

Locul publicării:Cham, Switzerland

Public țintă

ResearchCuprins

Introduction.- Patterns of Heterogeneity: The Competitiveness of the EU Countries: Multi-dimensional Cluster Analysis Approach.- Long-Run Heterogeneity Across the EU Countries.- Sustainable Development in the EU.- Policies for Competitiveness, Social Inclusion and Sustainability in the EU: Current Developments in Corporate Social Responsibility in the EU.- The Internationalisation of Small and Medium-Sized Enterprises as a Path to Competitiveness.- Key Aspects of Competitiveness: Focus on European Small and Medium-Sized Enterprises.- Pigouvian Carbon Tax Rate: Can It Help the European Union Achieve Sustainability?- Strategies and Instruments - The Potential for Policy Learning: A Lesson for the Contemporary European Periphery from the Transition Process of the CEE Countries.- Geospatial Infrastructure for European Union Sustainable Development.- Reforming Welfare States.

Notă biografică

Peter Huber, born in 1967, is a researcher at the Austrian Institute of Economic Research. He studied Economics at the University of Economics and Business Administration in Vienna, the University of Innsbruck and the Institute of Advanced Studies, Vienna where he also worked as a research assistant. Since 2012 he is acting as vice-director for external co-ordination at WIFO. His main research interests are in regional economics and the analysis of migration and commuting patterns in Europe.

Danuše Nerudová, Ph.D., Born in 1979, works as associate professor and head of the department of accounting and taxation and a lecturer at the Faculty of Business and Economics at the Mendel University in Brno. Her expertise is in the field of international taxation and tax policy. She has contributed and led numerous projects analyzing the impact of tax harmonization on the Czech Republic or the European Union. Her research primarily focuses on tax harmonization especially in the field of direct taxation, possibilities of financial sector taxation and on taxes as the revenues of national and EU budgets. Currently, she is the lead partner of the project “The quantification of the impact of the introduction of Common Consolidated Corporate Tax Base on the budget revenues of the Czech Republic” financed by a grant from the Czech research grant agency (GACR).

Petr Rozmahel, born in 1977, is as an associate professor at the Mendel University in Brno. He is the head of the Research Centre at the Faculty of Business and Economics at the Mendel University. In his research he focuses on economic and monetary integration processes in Europe. In particular he concentrates on analysis of convergence processes of the Central and Eastern European countries towards the EU and Euro area at national as well as regional levels. At the university he also works as lecturer of basic and advanced courses of Macro and Microeconomics.

Danuše Nerudová, Ph.D., Born in 1979, works as associate professor and head of the department of accounting and taxation and a lecturer at the Faculty of Business and Economics at the Mendel University in Brno. Her expertise is in the field of international taxation and tax policy. She has contributed and led numerous projects analyzing the impact of tax harmonization on the Czech Republic or the European Union. Her research primarily focuses on tax harmonization especially in the field of direct taxation, possibilities of financial sector taxation and on taxes as the revenues of national and EU budgets. Currently, she is the lead partner of the project “The quantification of the impact of the introduction of Common Consolidated Corporate Tax Base on the budget revenues of the Czech Republic” financed by a grant from the Czech research grant agency (GACR).

Petr Rozmahel, born in 1977, is as an associate professor at the Mendel University in Brno. He is the head of the Research Centre at the Faculty of Business and Economics at the Mendel University. In his research he focuses on economic and monetary integration processes in Europe. In particular he concentrates on analysis of convergence processes of the Central and Eastern European countries towards the EU and Euro area at national as well as regional levels. At the university he also works as lecturer of basic and advanced courses of Macro and Microeconomics.

Textul de pe ultima copertă

This book brings together the work of researchers in Eastern and Western Europe, who analyze competitiveness, social exclusion and sustainability from a range of perspectives. It examines the key challenges faced by the EU in its efforts to establish a socially inclusive and greener path to growth, and develops policy recommendations to simultaneously achieve the EU 2020 agenda’s long-term goals and address the current economic crisis in Europe.

Caracteristici

Addresses key issues in the EU economic policy debate, offering a quick overview for scholars and policymakers Presents detailed case studies of EU economic policy in several European countries Pays particular attention to the perspective of researchers from new EU member states