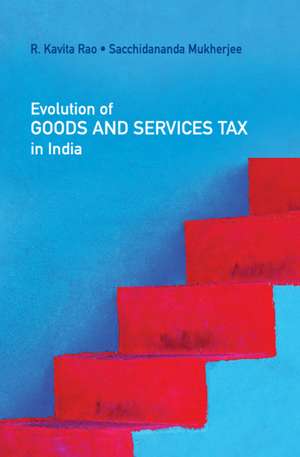

Evolution of Goods and Services Tax in India

Autor R. Kavita Rao, Sacchidananda Mukherjeeen Limba Engleză Hardback – 22 mai 2019

Preț: 636.18 lei

Preț vechi: 714.81 lei

-11% Nou

Puncte Express: 954

Preț estimativ în valută:

121.75€ • 126.64$ • 100.51£

121.75€ • 126.64$ • 100.51£

Carte tipărită la comandă

Livrare economică 14-28 aprilie

Preluare comenzi: 021 569.72.76

Specificații

ISBN-13: 9781108473965

ISBN-10: 1108473962

Pagini: 230

Dimensiuni: 158 x 236 x 18 mm

Greutate: 0.46 kg

Editura: Cambridge University Press

Colecția Cambridge University Press

Locul publicării:Cambridge, United Kingdom

ISBN-10: 1108473962

Pagini: 230

Dimensiuni: 158 x 236 x 18 mm

Greutate: 0.46 kg

Editura: Cambridge University Press

Colecția Cambridge University Press

Locul publicării:Cambridge, United Kingdom

Cuprins

List of tables; Acknowledgements; List of abbreviations; Introduction; Part I. Genesis and Evolution of GST in India: 1. Decades of indirect tax reforms in India: a journey towards Goods and Services Tax (GST); 2. Towards GST: choices and trade-offs with Amaresh Bagchi; 3. Goods and Services Tax: the Thirteenth Finance Commission and the way forward; 4. Present state of Goods and Services Tax (GST) reform in India; Part II. Revenue Neutrality of GST: 5. Estimation of revenue neutral rates for Goods and Services Tax in India; 6. New assumptions, new estimates: scrutinising a new report on revenue neutral rate; 7. Exploring policy options to include petroleum, natural gas and electricity under the Goods and Services Tax (GST) Regime in India; Part III. GST Administration and Possible Impacts of GST on Indian Economy: 8. Administration of GST: can we continue with present structures?; 9. Goods and Services Tax: performance and progress; 10. Conclusion: impact of GST and what might happen; Index.

Notă biografică

Descriere

Studies the evolution of GST in India since the Report of the Indirect Taxation Enquiry Committee of 1977.