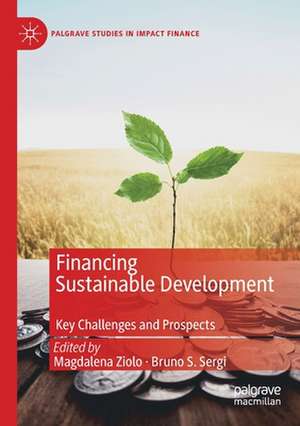

Financing Sustainable Development: Key Challenges and Prospects: Palgrave Studies in Impact Finance

Editat de Magdalena Ziolo, Bruno S. Sergien Limba Engleză Paperback – 9 aug 2020

| Toate formatele și edițiile | Preț | Express |

|---|---|---|

| Paperback (1) | 941.34 lei 6-8 săpt. | |

| Springer International Publishing – 9 aug 2020 | 941.34 lei 6-8 săpt. | |

| Hardback (1) | 951.91 lei 6-8 săpt. | |

| Springer International Publishing – 9 aug 2019 | 951.91 lei 6-8 săpt. |

Din seria Palgrave Studies in Impact Finance

-

Preț: 319.44 lei

Preț: 319.44 lei - 18%

Preț: 991.24 lei

Preț: 991.24 lei - 15%

Preț: 687.30 lei

Preț: 687.30 lei - 18%

Preț: 1002.31 lei

Preț: 1002.31 lei -

Preț: 484.85 lei

Preț: 484.85 lei - 15%

Preț: 690.44 lei

Preț: 690.44 lei - 18%

Preț: 720.22 lei

Preț: 720.22 lei - 18%

Preț: 898.58 lei

Preț: 898.58 lei - 18%

Preț: 947.98 lei

Preț: 947.98 lei - 18%

Preț: 943.88 lei

Preț: 943.88 lei - 18%

Preț: 999.45 lei

Preț: 999.45 lei - 18%

Preț: 937.86 lei

Preț: 937.86 lei - 18%

Preț: 778.63 lei

Preț: 778.63 lei -

Preț: 422.90 lei

Preț: 422.90 lei - 18%

Preț: 942.31 lei

Preț: 942.31 lei - 15%

Preț: 701.06 lei

Preț: 701.06 lei - 18%

Preț: 996.91 lei

Preț: 996.91 lei - 18%

Preț: 948.92 lei

Preț: 948.92 lei -

Preț: 397.99 lei

Preț: 397.99 lei - 15%

Preț: 688.96 lei

Preț: 688.96 lei - 15%

Preț: 702.05 lei

Preț: 702.05 lei -

Preț: 417.30 lei

Preț: 417.30 lei - 18%

Preț: 998.66 lei

Preț: 998.66 lei - 15%

Preț: 686.18 lei

Preț: 686.18 lei - 18%

Preț: 733.33 lei

Preț: 733.33 lei -

Preț: 452.79 lei

Preț: 452.79 lei - 18%

Preț: 736.01 lei

Preț: 736.01 lei - 15%

Preț: 640.06 lei

Preț: 640.06 lei - 15%

Preț: 642.36 lei

Preț: 642.36 lei - 18%

Preț: 892.59 lei

Preț: 892.59 lei

Preț: 941.34 lei

Preț vechi: 1147.97 lei

-18% Nou

Puncte Express: 1412

Preț estimativ în valută:

180.15€ • 187.38$ • 148.72£

180.15€ • 187.38$ • 148.72£

Carte tipărită la comandă

Livrare economică 15-29 aprilie

Preluare comenzi: 021 569.72.76

Specificații

ISBN-13: 9783030165246

ISBN-10: 3030165248

Pagini: 375

Ilustrații: XXVI, 375 p. 39 illus.

Dimensiuni: 148 x 210 mm

Greutate: 0.48 kg

Ediția:1st ed. 2019

Editura: Springer International Publishing

Colecția Palgrave Macmillan

Seria Palgrave Studies in Impact Finance

Locul publicării:Cham, Switzerland

ISBN-10: 3030165248

Pagini: 375

Ilustrații: XXVI, 375 p. 39 illus.

Dimensiuni: 148 x 210 mm

Greutate: 0.48 kg

Ediția:1st ed. 2019

Editura: Springer International Publishing

Colecția Palgrave Macmillan

Seria Palgrave Studies in Impact Finance

Locul publicării:Cham, Switzerland

Cuprins

1. Introduction.- 2. Sustainability in Finance and Economics.- 3. Sustainable Development Versus Green Banking: Where Is the Link?.- 4. Sustainability, Innovation, and Efficiency: A Key Relationship.- 5. Socially Responsible Financial Markets.- 6. Institutional Investments and Responsible Investing.- 7. Patronage in the Financing of Social and Sustainable Projects.- 8. Sustainable Capital Market.- 9. Sustainable Public Finance and Debt Management.- 10. Environmental, Social and Governance Risk versus Company Performance.- 11. Sustainable Financial Systems.- 12. Green Finance Concept: Framework and Consumerism.- 13. Public–Private Partnerships as a Mechanism of Financing of Sustainable Development.- 14. Social Reporting of Egyptian Islamic Banks: Insights from Post-Revolution Era.

Notă biografică

Magdalena Ziolo is Associate Professor, PhD at University of Szczecin, Poland. Her research and teaching scope focus on finance, banking and sustainability. She has received scholarships from the Dekaban-Liddle Foundation (University of Glasgow, Scotland, 2013) and Impakt Erasmus + (Ulan Bator, Mongolia, 2017). She is a member of State Quality Council, Kosovo Accreditation Agency. Her achievements encompass more than 120 reviewed papers and academic books.

Bruno S. Sergi is an Instructor at Harvard University, an Associate of the Harvard University Davis Center for Russian and Eurasian Studies and Harvard Ukrainian Research Institute. He is the series editor of the Cambridge Elements in the Economics of Emerging Markets. Concurrently, he teaches International Economics at the University of Messina, Italy, and is a cofounder and Scientific Director of the International Center for Emerging Markets Research at RUDN University in Moscow. He has published over150 articles in professional journals and several books as author, coauthor, editor and co-editor.

Bruno S. Sergi is an Instructor at Harvard University, an Associate of the Harvard University Davis Center for Russian and Eurasian Studies and Harvard Ukrainian Research Institute. He is the series editor of the Cambridge Elements in the Economics of Emerging Markets. Concurrently, he teaches International Economics at the University of Messina, Italy, and is a cofounder and Scientific Director of the International Center for Emerging Markets Research at RUDN University in Moscow. He has published over150 articles in professional journals and several books as author, coauthor, editor and co-editor.

Textul de pe ultima copertă

This book is among the first to address the issue of assessing the efficiency of sustainable development financing from a theoretical and methodical point of view. The innovative nature of research is expressed through the study of new phenomena in finance including sustainable financial systems, sustainable finance, ESG risk and individual and institutional motivations of financial managers in the sustainability concept. The book aims to draw attention to the significant gap in the existing research.The concept of Sustainable Development, if placed in an economic category, requires a lot of attention, but seeing the cognitive category from the perspective of the discipline of finance, the latter is unsatisfactory, with questions remaining unanswered. At the same time, the rank problem, its strategic dimension and the amount of financial resources allocated and disbursed for the purposes of focusing around sustainable development, identification of financial phenomena accompanyingthis category is seen as a priority. Most measures financing Sustainable Development and measures of public spending efficiency are measures subject to rigor and rules due to their specificity, which means actions aimed at increasing efficiency are treated as a priority. This book will be of interest to leading representatives of academia, practitioners, executives, officials, and graduate students in economics, finance, management, statistics, law and political sciences.

Caracteristici

Provides new and original knowledge about Sustainable Finance and its role in the economy Proposes a new methodology of conducting research in the sustainable finance scope Discovers new phenomenas in sustainable finance including ESG risk and attitudes of financial managers towards ESG risk