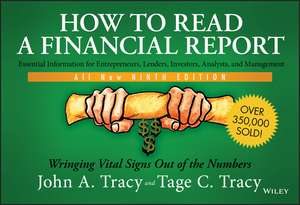

How to Read a Financial Report, Ninth Edition – Wringing Vital Signs Out of the Numbers

Autor JA Tracyen Limba Engleză Paperback – 18 mar 2020

The updated new edition of the comprehensive guide to reading and understanding financial reports

Financial reports are used to provide a range of vital information, including an organization’s cash flow, financial condition, and profit performance (aka The Big Three Financial Statements). Financial statements are often complex and extremely difficult to understand for anyone other than accounting and finance professionals. How to Read a Financial Report enablesinvestors, lenders, business leaders, analysts, and managers to read, analyze, and interpret financial accounting reports. Designed specifically for non-specialists, this reader-friendly resource covers the fundamentals of financial reporting in jargon-free English. Topics such as sales revenue & recognition, costs of goods sold, sources & uses of capital/cash, non-cash expenses (e.g., depreciation expense), income tax obligations, understanding profits & financial stability, and financial statement ratios & analysis are covered throughout the book.

Now in its ninth edition, this bestselling guide has been thoroughly revised to reflect changes in accounting and financial reporting rules, current practices, and recent trends. New and expanded content explains managing cash flow, illustrates the deceitful misrepresentation of profits in some financial reports (aka Financial Engineering), and more. Further, end-of-chapter activities help readers learn the intricacies of the balance sheet and cash flow statement, while updated sections address shifts in regulatory standards. Written by two highly experienced experts in financial accounting, this resource:

- Enables readers to cut through the noise and focus on what financial reports and financial statements are really saying about a company

- Clarifies commonly misunderstood aspects of financial reporting and how companies can “financially engineer” operating results

- Offers comprehensive, step-by-step guidance on analyzing financial reports

- Provides numerous examples and explanations of various types of financial reports and analysis tools

Preț: 138.55 lei

Nou

26.52€ • 28.82$ • 22.29£

Carte disponibilă

Livrare economică 31 martie-14 aprilie

Specificații

ISBN-10: 1119606462

Pagini: 208

Dimensiuni: 174 x 252 x 11 mm

Greutate: 0.34 kg

Ediția:9th Edition

Editura: Wiley

Locul publicării:Hoboken, United States

Cuprins

List of Exhibits vii Preface to the Ninth Edition ix Part One--Fundamentals 1 Starting with Cash Flows 3 2 Two Bedrock Financial Statements 11 3 Reporting Cash Flows 21 4 Fitting Together Financial Statements 27 Part Two--Connections 5 Sales Revenue and Accounts Receivable 37 6 Cost of Goods Sold Expense and Inventory 43 7 Inventory and Accounts Payable 49 8 Operating Expenses and Accounts Payable 55 9 Operating Expenses and Prepaid Expenses 61 10 Depreciation Expense and Property, Plant, and Equipment 67 11 Accruing Liability for Unpaid Expenses 77 12 Income Tax Expense and Its Liability 83 13 Net Income and Retained Earnings, and Earnings per Share (EPS) 89 14 Cash Flow from Operating (Profit-Seeking) Activities 97 15 Cash Flows from Investing and Financing Activities 107 Part Three--Using Financial Statements 16 Footnotes and Management Discussions 117 17 Financial Statement Ratios and Analysis 129 18 Financial Engineering 147 19 CPAs and Financial Reports 155 20 Basic Questions, Basic Answers 163 About the Authors 179 Index 181