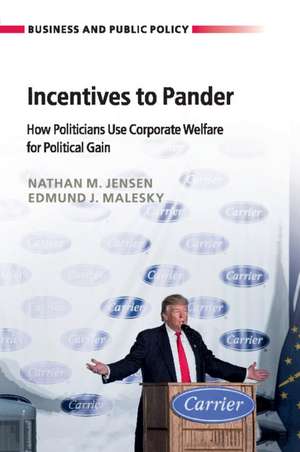

Incentives to Pander: How Politicians Use Corporate Welfare for Political Gain: Business and Public Policy

Autor Nathan M. Jensen, Edmund J. Maleskyen Limba Engleză Paperback – 12 iun 2019

| Toate formatele și edițiile | Preț | Express |

|---|---|---|

| Paperback (1) | 284.17 lei 6-8 săpt. | |

| Cambridge University Press – 12 iun 2019 | 284.17 lei 6-8 săpt. | |

| Hardback (1) | 693.36 lei 6-8 săpt. | |

| Cambridge University Press – 14 mar 2018 | 693.36 lei 6-8 săpt. |

Din seria Business and Public Policy

-

Preț: 200.05 lei

Preț: 200.05 lei -

Preț: 280.53 lei

Preț: 280.53 lei - 11%

Preț: 581.22 lei

Preț: 581.22 lei -

Preț: 285.37 lei

Preț: 285.37 lei -

Preț: 236.78 lei

Preț: 236.78 lei -

Preț: 286.13 lei

Preț: 286.13 lei -

Preț: 429.00 lei

Preț: 429.00 lei - 14%

Preț: 695.95 lei

Preț: 695.95 lei -

Preț: 252.59 lei

Preț: 252.59 lei -

Preț: 301.92 lei

Preț: 301.92 lei -

Preț: 284.98 lei

Preț: 284.98 lei -

Preț: 287.66 lei

Preț: 287.66 lei - 11%

Preț: 630.49 lei

Preț: 630.49 lei -

Preț: 284.56 lei

Preț: 284.56 lei -

Preț: 225.58 lei

Preț: 225.58 lei - 11%

Preț: 582.34 lei

Preț: 582.34 lei -

Preț: 238.34 lei

Preț: 238.34 lei -

Preț: 231.44 lei

Preț: 231.44 lei - 32%

Preț: 543.25 lei

Preț: 543.25 lei

Preț: 284.17 lei

Nou

Puncte Express: 426

Preț estimativ în valută:

54.39€ • 56.56$ • 45.51£

54.39€ • 56.56$ • 45.51£

Carte tipărită la comandă

Livrare economică 15-29 martie

Preluare comenzi: 021 569.72.76

Specificații

ISBN-13: 9781108408530

ISBN-10: 1108408532

Pagini: 270

Dimensiuni: 153 x 230 x 18 mm

Greutate: 0.37 kg

Editura: Cambridge University Press

Colecția Cambridge University Press

Seria Business and Public Policy

Locul publicării:Cambridge, United Kingdom

ISBN-10: 1108408532

Pagini: 270

Dimensiuni: 153 x 230 x 18 mm

Greutate: 0.37 kg

Editura: Cambridge University Press

Colecția Cambridge University Press

Seria Business and Public Policy

Locul publicării:Cambridge, United Kingdom

Cuprins

1. Introduction: the global competition for capital meets local politics; 2. A theory of the political use of investment incentives; 3. Incentives and the competition for investment within countries and around the world; 4. The economic case against investment incentives; 5. Economic or political competition? Allocation and oversight of US incentives; 6. Money for money: campaign contributions in exchange for financial incentives?; 7. Political pandering in the United States: a survey experiment on incentives and investment; 8. Pandering upward: tax incentives and credit claiming in authoritarian countries; 9. The distributional effects of investment incentives; 10. Potential policy solutions to the pandering problem; 11. Final thoughts.

Recenzii

'The puzzle of investment incentives like tax breaks and regulatory exemptions is that although they are generally inefficient, governments around the world - from Kansas to Vietnam - use them to attract investors. In this provocative and wide-ranging book, Jensen and Malesky show that politicians choose these policies because they reap political benefits from doing so. By identifying the political logic that drives inefficient policies, this book reveals how citizens may press for better policymaking.' Thomas Pepinsky, Cornell University, New York

'Is all politics local? In this intriguing study, Jensen and Malesky show that though separated by geography and political systems, politicians in the United States, Canada, Russia, and Vietnam all use fiscal policy to generate and sustain political support. The authors masterfully weave a variety of evidence - individual level surveys and original data on policymakers' incentives - to show how short term fiscal policies often have dramatically negative long term consequences.' David Leblang, University of Virginia

'Is all politics local? In this intriguing study, Jensen and Malesky show that though separated by geography and political systems, politicians in the United States, Canada, Russia, and Vietnam all use fiscal policy to generate and sustain political support. The authors masterfully weave a variety of evidence - individual level surveys and original data on policymakers' incentives - to show how short term fiscal policies often have dramatically negative long term consequences.' David Leblang, University of Virginia

Notă biografică

Descriere

An examination of why politicians choose to employ targeted tax incentives to firms that are inefficient and distortionary.