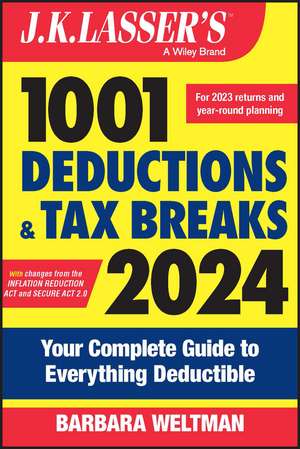

J.K. Lasser′s 1001 Deductions and Tax Breaks 2024 – Your Complete Guide to Everything Deductible: J.K. Lasser

Autor B Weltmanen Limba Engleză Paperback – 8 noi 2023

In the newest edition of J.K. Lasser's 1001 Deductions and Tax Breaks 2024: Your Complete Guide to Everything Deductible, expert small business tax lawyer Barbara Weltman walks you through every relevant tax deduction and credit you're entitled to claim on your 2023 tax return as well as new breaks for 2024. You'll find countless money-saving opportunities and ensure you don't overpay on your taxes, giving Uncle Sam exactly what you're legally required to give him--and not a penny more!

You'll also find:

- A complimentary new e-supplement containing the latest developments from the Internal Revenue Service (IRS) and Congress

- Step-by-step instructions on how to claim every deduction that applies to you, complete with record-keeping requirements and dollar limits

- The latest tax rulings, laws, and cases that impact your 2023-24 tax return

Din seria J.K. Lasser

-

Preț: 112.99 lei

Preț: 112.99 lei -

Preț: 153.04 lei

Preț: 153.04 lei - 9%

Preț: 534.86 lei

Preț: 534.86 lei -

Preț: 189.13 lei

Preț: 189.13 lei -

Preț: 63.57 lei

Preț: 63.57 lei -

Preț: 134.65 lei

Preț: 134.65 lei -

Preț: 119.10 lei

Preț: 119.10 lei

Preț: 119.47 lei

Nou

Puncte Express: 179

Preț estimativ în valută:

22.87€ • 23.52$ • 18.97£

22.87€ • 23.52$ • 18.97£

Carte indisponibilă temporar

Doresc să fiu notificat când acest titlu va fi disponibil:

Se trimite...

Preluare comenzi: 021 569.72.76

Specificații

ISBN-13: 9781394190645

ISBN-10: 1394190646

Pagini: 464

Dimensiuni: 152 x 229 x 25 mm

Greutate: 0.44 kg

Editura: Wiley

Seria J.K. Lasser

Locul publicării:Hoboken, United States

ISBN-10: 1394190646

Pagini: 464

Dimensiuni: 152 x 229 x 25 mm

Greutate: 0.44 kg

Editura: Wiley

Seria J.K. Lasser

Locul publicării:Hoboken, United States

Notă biografică

BARBARA WELTMAN is an attorney and a nationally recognized expert in taxation for small businesses, as well as the author of many top-selling books on taxes and finance, including J.K. Lasser's Small Business Taxes. She is also the publisher of Idea of the Day(R), is quoted regularly in major publications (including the New York Times, the Wall Street Journal, and Consumer Reports), and is an award-winning blogger. Visit her at www.BigIdeasForSmallBusiness.com.

Cuprins

Introduction vii

1. You and Your Family 1

2. Medical Expenses 27

3. Education Costs 75

4. Your Home 110

5. Retirement Savings 146

6. Charitable Giving 191

7. Your Car 222

8. Investing 238

9. Travel 272

10. Real Estate 293

11. Borrowing and Interest 322

12. Insurance and Catastrophes 336

13. Your Job 351

14. Your Business 371

15. Miscellaneous Items 399

Appendix A. Items Adjusted Annually for Inflation 423

Appendix B. Checklist of Tax-Free Items 429

Appendix C. Checklist of Nondeductible Items 433

Appendix D. Common Mistakes to Avoid 439

Index 443