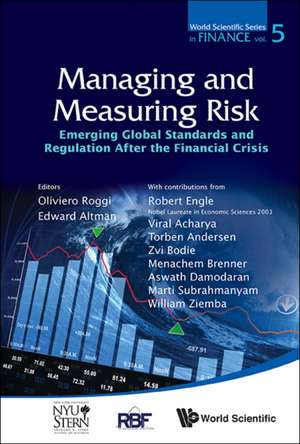

Managing and Measuring Risk: World Scientific Series in Finance, cartea 5

Editat de Edward I. Altman, Oliviero Roggien Limba Engleză Hardback – 19 feb 2013

Din seria World Scientific Series in Finance

- 15%

Preț: 457.74 lei

Preț: 457.74 lei -

Preț: 288.57 lei

Preț: 288.57 lei - 15%

Preț: 629.55 lei

Preț: 629.55 lei -

Preț: 251.62 lei

Preț: 251.62 lei -

Preț: 262.27 lei

Preț: 262.27 lei - 18%

Preț: 951.51 lei

Preț: 951.51 lei - 18%

Preț: 726.90 lei

Preț: 726.90 lei - 18%

Preț: 872.60 lei

Preț: 872.60 lei -

Preț: 267.75 lei

Preț: 267.75 lei -

Preț: 381.16 lei

Preț: 381.16 lei -

Preț: 269.66 lei

Preț: 269.66 lei - 15%

Preț: 691.31 lei

Preț: 691.31 lei - 18%

Preț: 1113.30 lei

Preț: 1113.30 lei - 15%

Preț: 611.33 lei

Preț: 611.33 lei - 15%

Preț: 618.86 lei

Preț: 618.86 lei -

Preț: 315.77 lei

Preț: 315.77 lei

Preț: 1051.83 lei

Preț vechi: 1282.71 lei

-18% Nou

Puncte Express: 1578

Preț estimativ în valută:

201.32€ • 209.38$ • 168.71£

201.32€ • 209.38$ • 168.71£

Carte tipărită la comandă

Livrare economică 13-27 martie

Preluare comenzi: 021 569.72.76

Specificații

ISBN-13: 9789814417495

ISBN-10: 9814417491

Pagini: 520

Dimensiuni: 155 x 231 x 33 mm

Greutate: 0.84 kg

Editura: World Scientific Publishing Company

Seria World Scientific Series in Finance

ISBN-10: 9814417491

Pagini: 520

Dimensiuni: 155 x 231 x 33 mm

Greutate: 0.84 kg

Editura: World Scientific Publishing Company

Seria World Scientific Series in Finance

Cuprins

The Evolution of Risk Management: New Standards for Risk Measurement and Measurement. An Evolutionary Perspective of the Risk Management Discipline during the Financial Crisis (Oliviero Roggi); Sovereign and Systemic Risk: Toward A Bottom-Up Approach to Assessing Sovereign Default Risk: An Update (Edward Altman); Measuring Systemic Risk (Robert Engle et al.); Taxing Systemic Risk (Viral Acharya et al.); Liquidity: Liquidity and Efficiency in Three Related Foreign Exchange Options Markets (Menachem Brenner and Ben Schreiber); Illiquidity or Credit Deterioration: A Study of Liquidity in the US Corporate Bond Market during Financial Crises (Marti Subrahmanyam et al.); Risk Management: Integrated Wealth and Risk Management: First Principles (Zvi Bodie); Analyzing the Impact of Effective Risk Management: Innovation and Capital Structure Effects (Torben Andersen); Credit Risk: Modelling Credit Risk for SMEs: Evidence from the US Market (Edward Altman and Gabriele Sabato); Predicting SME Default Risk. Does A Regional Model Make Sense? (Oliviero Roggi and Alessandro Giannozzi); Credit Loss and Systematic Loss Given Default (Jon Frye and Michael Jacobs Jr.); Equity Risk and Market Crashes: Equity Risk Premiums (ERP): Determinants, Estimation and Implications - The 2012 Edition (Aswath Damodaran); Stock Market Crashes in 2007 - 2009: Were We Able to Predict Them? (Sebastien Lleoyz and William Ziemba).