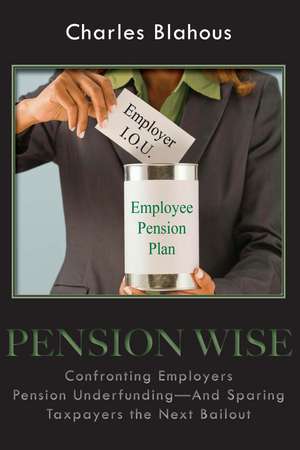

Pension Wise: Confronting Employer Pension Underfunding – And Sparing Taxpayers the Next Bailout: Hoover Institution Press Publication, cartea 597

Autor Charles Blahousen Limba Engleză Hardback – 17 noi 2010

America’s insurance system for single-employer pension plans, operated by the Pension Benefit Guaranty Corporation (PBGC), is under serious financial strain. In Pension Wise: Confronting Employer Pension Underfunding—And Sparing Taxpayers the Next Bailout, Charles Blahous—one of the nation’s foremost retirement security experts—explains the origins and dangers of current underfunding in our single-employer defined-benefit pension system and offers principles to underlie a solution.

Blahous details both the technical reasons behind pension plan underfunding and the political considerations that prioritize the near-term financial demands of employers and pension beneficiaries over the long-term fiscal health of the pension insurance system. The author also presents the fundamental value judgments concerning who should bear the cost of filling the PBGC shortfall and to what extent the risk of financing pension benefits should continue to be shifted away from plan sponsors, either to other employers or to taxpayers at large. Although acknowledging that there are no obviously correct answers, he suggests a range of reforms to improve the pension insurance system’s operation and to resolve its projected shortfall.

Blahous details both the technical reasons behind pension plan underfunding and the political considerations that prioritize the near-term financial demands of employers and pension beneficiaries over the long-term fiscal health of the pension insurance system. The author also presents the fundamental value judgments concerning who should bear the cost of filling the PBGC shortfall and to what extent the risk of financing pension benefits should continue to be shifted away from plan sponsors, either to other employers or to taxpayers at large. Although acknowledging that there are no obviously correct answers, he suggests a range of reforms to improve the pension insurance system’s operation and to resolve its projected shortfall.

Din seria Hoover Institution Press Publication

-

Preț: 110.71 lei

Preț: 110.71 lei -

Preț: 128.04 lei

Preț: 128.04 lei -

Preț: 334.65 lei

Preț: 334.65 lei -

Preț: 386.46 lei

Preț: 386.46 lei -

Preț: 125.04 lei

Preț: 125.04 lei -

Preț: 182.45 lei

Preț: 182.45 lei -

Preț: 89.04 lei

Preț: 89.04 lei -

Preț: 94.51 lei

Preț: 94.51 lei -

Preț: 63.13 lei

Preț: 63.13 lei - 36%

Preț: 83.74 lei

Preț: 83.74 lei -

Preț: 115.44 lei

Preț: 115.44 lei -

Preț: 152.27 lei

Preț: 152.27 lei -

Preț: 98.13 lei

Preț: 98.13 lei -

Preț: 96.24 lei

Preț: 96.24 lei -

Preț: 141.93 lei

Preț: 141.93 lei -

Preț: 138.11 lei

Preț: 138.11 lei - 16%

Preț: 109.69 lei

Preț: 109.69 lei -

Preț: 96.94 lei

Preț: 96.94 lei - 18%

Preț: 177.68 lei

Preț: 177.68 lei - 16%

Preț: 110.15 lei

Preț: 110.15 lei - 16%

Preț: 109.23 lei

Preț: 109.23 lei - 21%

Preț: 136.07 lei

Preț: 136.07 lei - 13%

Preț: 118.14 lei

Preț: 118.14 lei - 16%

Preț: 184.30 lei

Preț: 184.30 lei - 17%

Preț: 108.43 lei

Preț: 108.43 lei - 18%

Preț: 135.27 lei

Preț: 135.27 lei - 10%

Preț: 62.62 lei

Preț: 62.62 lei - 16%

Preț: 109.86 lei

Preț: 109.86 lei -

Preț: 88.16 lei

Preț: 88.16 lei - 15%

Preț: 112.63 lei

Preț: 112.63 lei -

Preț: 84.93 lei

Preț: 84.93 lei - 17%

Preț: 144.55 lei

Preț: 144.55 lei - 16%

Preț: 72.61 lei

Preț: 72.61 lei - 18%

Preț: 177.64 lei

Preț: 177.64 lei - 16%

Preț: 146.32 lei

Preț: 146.32 lei - 16%

Preț: 108.60 lei

Preț: 108.60 lei - 16%

Preț: 110.04 lei

Preț: 110.04 lei - 16%

Preț: 72.15 lei

Preț: 72.15 lei - 16%

Preț: 109.95 lei

Preț: 109.95 lei - 15%

Preț: 150.77 lei

Preț: 150.77 lei - 16%

Preț: 110.21 lei

Preț: 110.21 lei - 18%

Preț: 142.32 lei

Preț: 142.32 lei - 18%

Preț: 178.88 lei

Preț: 178.88 lei - 17%

Preț: 108.35 lei

Preț: 108.35 lei - 13%

Preț: 64.35 lei

Preț: 64.35 lei - 13%

Preț: 116.81 lei

Preț: 116.81 lei

Preț: 141.79 lei

Preț vechi: 172.46 lei

-18% Nou

Puncte Express: 213

Preț estimativ în valută:

27.14€ • 29.49$ • 22.81£

27.14€ • 29.49$ • 22.81£

Carte indisponibilă temporar

Doresc să fiu notificat când acest titlu va fi disponibil:

Se trimite...

Preluare comenzi: 021 569.72.76

Specificații

ISBN-13: 9780817912147

ISBN-10: 0817912142

Pagini: 90

Dimensiuni: 152 x 229 x 13 mm

Greutate: 0.31 kg

Ediția:1st Edition

Editura: Hoover Institution Press

Colecția Hoover Institution Press

Seria Hoover Institution Press Publication

ISBN-10: 0817912142

Pagini: 90

Dimensiuni: 152 x 229 x 13 mm

Greutate: 0.31 kg

Ediția:1st Edition

Editura: Hoover Institution Press

Colecția Hoover Institution Press

Seria Hoover Institution Press Publication

Notă biografică

One of the nation’s foremost retirement policy experts, Chuck Blahous serves as one of two public trustees for the Social Security and Medicare programs. Blahous served as deputy director of President George W. Bush’s National Economic Council, and before that as executive director of the president’s bipartisan Social Security Commission and as Special Assistant for Economic Policy. Blahous previously served as legislative and policy director for U.S. Senators Alan Simpson and Judd Gregg. Blahous’s career in public ser vice began when he was named the American Physical Society’s 1989–90 Congressional Science Fellow. He lives in Rockville, Maryland, with his wife and daughter.

Cuprins

List of Figures and Tables

Acknowledgments

Abstract

Introduction

The Nature of Single-Employer Defined-Benefit Pensions

The Nation’s Pension Insurance System: The Condition of the PBGC

The Magnitude of Pension Underfunding Nationwide

Technical Reasons for Pension Underfunding

Pension Plan Assets

Pension Plan Liabilities

Addressing Underfunding: Statutory Contribution Requirements

Other Funding Safeguards Established by the PPA

Premiums

Recent Developments: Legislation and the Financial Markets’ Plunge

Additional Reasons for Underfunding: Structural Issues Facing the PBGC

Political Economy Factors

Pension Funding Policy Principles: Separating Measurement Accuracy from Value Judgments

Can the Hole be Filled? Separating Fairness from Risk Issues

Going Forward: General Principles for Pension Insurance System Reform

Conclusions and Recommendations

Notes

Bibliography

About the Author

Index

Textul de pe ultima copertă

The crisis in America’s single-employer defined benefit pension plans

Underfunding in our pension system: a growing systemic risk

Saving the Pension Benefit Guaranty Corporation from the political process

By late 2009, the deficit in the pension insurance programs of the Pension Benefit Guaranty Corporation (PBGC) had roughly doubled over the course of a single year, from less than $11 billion to more than $22 billion, marking the eighth consecutive year that PBGC’s outlook remained firmly in the red. The currently projected deficit of the PBGC, as well as underfunding in the pension system generally, embodies a significant national fiscal problem, with no clear path to allocating the costs of its resolution.

Pension Wise: Confronting Employer Pension Underfunding—And Sparing Taxpayers the Next Bailout examines the current crisis in our single-employer defined benefit pension plans and outlines principles to undergird a solution. Charles Blahous details both the technical reasons behind pension plan underfunding—in particular, persistent and often deliberate inaccuracy in measurement—and the political considerations that prioritize the near-term financial demands of employers and pension beneficiaries over the long-term fiscal health of the pension insurance system. The author also presents the fundamental value judgments concerning who should bear the cost of filling the PBGC shortfall and to what extent the risk of financing pension benefits should continue to be shifted away from plan sponsors, either to other employers or to taxpayers at large. Although acknowledging that there are no obviously correct answers, he suggests a range of reforms to improve the pension insurance system’s operation and to resolve its projected shortfall.

Charles Blahous, one of the nation’s foremost retirement security experts, serves as one of two public trustees for the Social Security and Medicare programs. Blahous served as deputy director of President George W. Bush’s National Economic Council and, before that, as executive director of president’s bipartisan Social Security Commission and special assistant for economic policy.

Underfunding in our pension system: a growing systemic risk

Saving the Pension Benefit Guaranty Corporation from the political process

By late 2009, the deficit in the pension insurance programs of the Pension Benefit Guaranty Corporation (PBGC) had roughly doubled over the course of a single year, from less than $11 billion to more than $22 billion, marking the eighth consecutive year that PBGC’s outlook remained firmly in the red. The currently projected deficit of the PBGC, as well as underfunding in the pension system generally, embodies a significant national fiscal problem, with no clear path to allocating the costs of its resolution.

Pension Wise: Confronting Employer Pension Underfunding—And Sparing Taxpayers the Next Bailout examines the current crisis in our single-employer defined benefit pension plans and outlines principles to undergird a solution. Charles Blahous details both the technical reasons behind pension plan underfunding—in particular, persistent and often deliberate inaccuracy in measurement—and the political considerations that prioritize the near-term financial demands of employers and pension beneficiaries over the long-term fiscal health of the pension insurance system. The author also presents the fundamental value judgments concerning who should bear the cost of filling the PBGC shortfall and to what extent the risk of financing pension benefits should continue to be shifted away from plan sponsors, either to other employers or to taxpayers at large. Although acknowledging that there are no obviously correct answers, he suggests a range of reforms to improve the pension insurance system’s operation and to resolve its projected shortfall.

Charles Blahous, one of the nation’s foremost retirement security experts, serves as one of two public trustees for the Social Security and Medicare programs. Blahous served as deputy director of President George W. Bush’s National Economic Council and, before that, as executive director of president’s bipartisan Social Security Commission and special assistant for economic policy.

Descriere

One of the nation’s foremost retirement security experts explains the origins and dangers of underfunding in our pension system and outlines the options for solving the problem and preventing the next taxpayer-financed bailout.