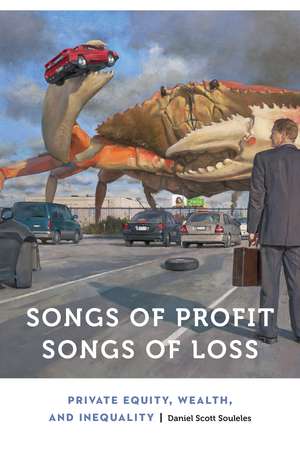

Songs of Profit, Songs of Loss: Private Equity, Wealth, and Inequality: Anthropology of Contemporary North America

Autor Daniel Scott Soulelesen Limba Engleză Paperback – 31 mai 2019

Since the early 1980s, private equity investors have heralded and shepherded massive changes in American capitalism. From outsourcing to excessive debt taking, private equity investment helped normalize once-taboo business strategies while growing into an over $3 trillion industry in control of thousands of companies and millions of workers. Daniel Scott Souleles opens a window into the rarefied world of private equity investing through ethnographic fieldwork on private equity financiers. Songs of Profit, Songs of Loss documents how and why investors buy, manage, and sell the companies that they do; presents the ins and outs of private equity deals, management, and valuation; and explains the historical context that gave rise to private equity and other forms of investor-led capitalism.

In addition to providing invaluable ethnographic insight, Songs of Profit, Songs of Loss is also an anthropological study of inequality as Souleles connects the core components of financial capitalism to economic disparities. Souleles uses local ideas of “value” and “time” to frame the ways private equity investors comprehend their work and to show how they justify the prosperity and poverty they create. Throughout, Souleles argues that understanding private equity investors as contrasted with others in society writ large is essential to fully understanding private equity within the larger context of capitalism in the United States.

In addition to providing invaluable ethnographic insight, Songs of Profit, Songs of Loss is also an anthropological study of inequality as Souleles connects the core components of financial capitalism to economic disparities. Souleles uses local ideas of “value” and “time” to frame the ways private equity investors comprehend their work and to show how they justify the prosperity and poverty they create. Throughout, Souleles argues that understanding private equity investors as contrasted with others in society writ large is essential to fully understanding private equity within the larger context of capitalism in the United States.

| Toate formatele și edițiile | Preț | Express |

|---|---|---|

| Paperback (1) | 248.99 lei 6-8 săpt. | |

| Nebraska – 31 mai 2019 | 248.99 lei 6-8 săpt. | |

| Hardback (1) | 460.58 lei 6-8 săpt. | |

| Nebraska – 31 mai 2019 | 460.58 lei 6-8 săpt. |

Preț: 248.99 lei

Nou

Puncte Express: 373

Preț estimativ în valută:

47.65€ • 49.97$ • 39.66£

47.65€ • 49.97$ • 39.66£

Carte tipărită la comandă

Livrare economică 01-15 aprilie

Preluare comenzi: 021 569.72.76

Specificații

ISBN-13: 9781496214782

ISBN-10: 1496214781

Pagini: 264

Ilustrații: 4 illustrations, 6 tables, 1 glossary, index

Dimensiuni: 152 x 229 x 21 mm

Greutate: 0.39 kg

Editura: Nebraska

Colecția University of Nebraska Press

Seria Anthropology of Contemporary North America

Locul publicării:United States

ISBN-10: 1496214781

Pagini: 264

Ilustrații: 4 illustrations, 6 tables, 1 glossary, index

Dimensiuni: 152 x 229 x 21 mm

Greutate: 0.39 kg

Editura: Nebraska

Colecția University of Nebraska Press

Seria Anthropology of Contemporary North America

Locul publicării:United States

Notă biografică

Daniel Scott Souleles is an assistant professor at Copenhagen Business School.

Cuprins

List of Illustrations and Tables

1. Who Gets Rich, and Why?

2. Where Did Private Equity Come From?

3. Who Are They?

4. What Do They Do?

5. How Are They Any Different?

6. How Do You Study Them?

7. Where’s the Value?

8. Do We Even Have Time?

9. To Buy or Not to Buy?

10. What Should We Think of Ourselves?

Acknowledgments

Appendix: Informants

Glossary

Notes

References

Index

1. Who Gets Rich, and Why?

2. Where Did Private Equity Come From?

3. Who Are They?

4. What Do They Do?

5. How Are They Any Different?

6. How Do You Study Them?

7. Where’s the Value?

8. Do We Even Have Time?

9. To Buy or Not to Buy?

10. What Should We Think of Ourselves?

Acknowledgments

Appendix: Informants

Glossary

Notes

References

Index

Recenzii

“Songs of Profit, Songs of Loss addresses the recent financial catastrophe through a study of private equity companies. The sequence of argument follows the anthropologist’s journey as a field researcher in a movement made compelling by his jargon-free and fluent prose.”—Keith Hart, coauthor of Economic Anthropology: History, Ethnography, Critique