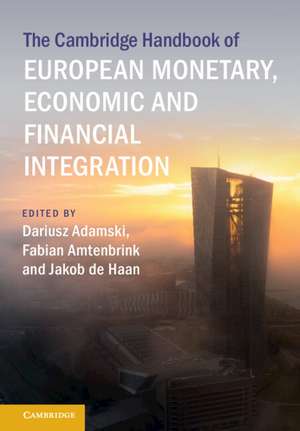

The Cambridge Handbook of European Monetary, Economic and Financial Integration: Cambridge Law Handbooks

Editat de Dariusz Adamski, Fabian Amtenbrink, Jakob De Haanen Limba Engleză Hardback – 30 oct 2023

Din seria Cambridge Law Handbooks

-

Preț: 304.01 lei

Preț: 304.01 lei - 23%

Preț: 1305.60 lei

Preț: 1305.60 lei - 20%

Preț: 198.47 lei

Preț: 198.47 lei - 14%

Preț: 1082.13 lei

Preț: 1082.13 lei -

Preț: 299.93 lei

Preț: 299.93 lei -

Preț: 232.94 lei

Preț: 232.94 lei - 23%

Preț: 1141.69 lei

Preț: 1141.69 lei -

Preț: 215.26 lei

Preț: 215.26 lei -

Preț: 281.74 lei

Preț: 281.74 lei - 23%

Preț: 1364.75 lei

Preț: 1364.75 lei - 23%

Preț: 1051.30 lei

Preț: 1051.30 lei - 14%

Preț: 1285.59 lei

Preț: 1285.59 lei - 23%

Preț: 1139.30 lei

Preț: 1139.30 lei - 23%

Preț: 1162.90 lei

Preț: 1162.90 lei -

Preț: 317.77 lei

Preț: 317.77 lei - 23%

Preț: 1109.50 lei

Preț: 1109.50 lei - 23%

Preț: 1177.27 lei

Preț: 1177.27 lei - 20%

Preț: 1216.58 lei

Preț: 1216.58 lei - 23%

Preț: 1062.18 lei

Preț: 1062.18 lei - 23%

Preț: 860.96 lei

Preț: 860.96 lei -

Preț: 331.33 lei

Preț: 331.33 lei -

Preț: 468.73 lei

Preț: 468.73 lei - 14%

Preț: 873.14 lei

Preț: 873.14 lei - 23%

Preț: 1221.80 lei

Preț: 1221.80 lei -

Preț: 305.05 lei

Preț: 305.05 lei - 23%

Preț: 1296.11 lei

Preț: 1296.11 lei - 23%

Preț: 1365.80 lei

Preț: 1365.80 lei - 23%

Preț: 1403.54 lei

Preț: 1403.54 lei -

Preț: 357.37 lei

Preț: 357.37 lei -

Preț: 534.56 lei

Preț: 534.56 lei - 23%

Preț: 1111.56 lei

Preț: 1111.56 lei - 23%

Preț: 1069.73 lei

Preț: 1069.73 lei - 23%

Preț: 1248.43 lei

Preț: 1248.43 lei -

Preț: 399.90 lei

Preț: 399.90 lei - 14%

Preț: 872.75 lei

Preț: 872.75 lei - 23%

Preț: 1479.50 lei

Preț: 1479.50 lei - 23%

Preț: 1097.31 lei

Preț: 1097.31 lei -

Preț: 393.60 lei

Preț: 393.60 lei -

Preț: 442.21 lei

Preț: 442.21 lei - 23%

Preț: 1133.10 lei

Preț: 1133.10 lei

Preț: 1097.19 lei

Preț vechi: 1424.91 lei

-23% Nou

Puncte Express: 1646

Preț estimativ în valută:

209.94€ • 219.22$ • 173.37£

209.94€ • 219.22$ • 173.37£

Carte tipărită la comandă

Livrare economică 15-29 aprilie

Preluare comenzi: 021 569.72.76

Specificații

ISBN-13: 9781009364690

ISBN-10: 1009364693

Pagini: 800

Dimensiuni: 264 x 185 x 39 mm

Greutate: 1.24 kg

Editura: Cambridge University Press

Colecția Cambridge University Press

Seria Cambridge Law Handbooks

Locul publicării:Cambridge, United Kingdom

ISBN-10: 1009364693

Pagini: 800

Dimensiuni: 264 x 185 x 39 mm

Greutate: 1.24 kg

Editura: Cambridge University Press

Colecția Cambridge University Press

Seria Cambridge Law Handbooks

Locul publicării:Cambridge, United Kingdom

Cuprins

Part I. The Economic and Monetary Union: Political, Economic and Legal Rationales: 1. Conceptual foundations of economic and monetary union: the economic dimension Barry Eichengreen; 2. Theorizing economic and monetary union – between concepts and pragmatism Amy Verdun; 3. Monetary union and the single currency Harold James; 4. On the misalignment of monetary, economic and political integration in European economic and monetary union Fabian Amtenbrink; 5. Ideas, interests, and power: Germany's complex balancing act in the process of economic and monetary union in Europe Kenneth Dyson; 6. Coping with economic crises through learning by doing: an evolving policy response Iain Begg; 7. The political economy of reinsurance Waltraud Schelkle; 8. Euro crises, the productivity slowdown and the EMU Nauro F. Campos; Part II. The Monetary Dimension: 9. The overburdened monetary policy mandate of the ECB Dariusz Adamski; 10. Government bond buying by the European Central Bank: leadership versus accountability Michele Chang; 11. ECB monetary policies: the increasing importance of communication Jakob de Haan; 12. From market to green economics: impact on monetary and financial policies Dirk Schoenmaker and Hans Stegeman; 13. The politics of monetary union and the democratic legitimacy of the ECB as a strategic actor Sebastian Diessner; 14. How can courts contribute to accountability in EU monetary policy? Ana Bobić and Mark Dawson; Part III. The Economic and Fiscal Dimensions: 15. Reviving the case for policy coordination in EMU Maria Demertzis, Marta Domínguez Jiménez and Nicola Viegi; 16. Ten years of the European semester: from sovereign debt crisis to COVID-19 Crisis Edgars Eihmanis; 17. The EU fiscal rules: principle, policy and reform prospects Menelaos Markakis; 18. National fiscal policy in EMU: insufficient sustainability and stabilisation? Jakob de Haan and Bram Gootjes; 19. The politics of fiscal integration in Eurozone reforms and next generation EU Fabio Wasserfallen; 20. Adjustments in economic crises: the different outcomes of the sovereign debt and pandemic crises in Europe Sergio Fabbrini and Andrea Capati; 21. Designing a permanent EU-wide stabilisation facility Roel Beetsma and George Kopits; 22. Enhancing private and public risk-sharing: lessons from the Literature and Reflections on the Covid-19 crisis Jacopo Cimadomo, Esther Gordo Mora and Alessandra Anna Palazzo; Part IV. Financial Integration: 23. Banking regulation in Europe: from reaction to thinking ahead Katarzyna Parchimowicz; 24. The politics behind the creation of the banking union Elena Ríos Camacho; 25. Failing banks within the banking union at the crossroads: a great step forward – with many loose ends Jens-Hinrich Binder; 26. The banking union: supervision and crisis management Willem Pieter de Groen; 27. The reemergence of market-based finance? The politics of capital markets union Giuseppe Montalbano and Markus Haverland; 28. The European strategy on digital finance and its interplay with capital markets integration in the EU Diego Valiante, Marco Lamandini and David Ramos Muñoz; 29. Regulating crypto and cyberware in the EU Karel Lannoo.

Descriere

This volume offers an interdisciplinary and multidisciplinary analysis of the past, present and future of European economic, monetary, and financial integration.