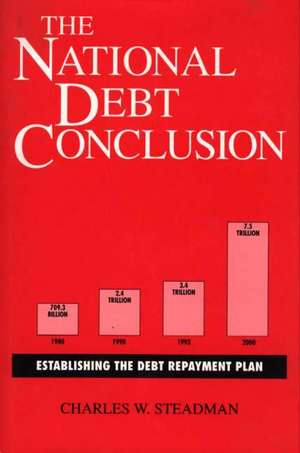

The National Debt Conclusion: Establishing the Debt Repayment Plan

Autor Charles W. Steadmanen Limba Engleză Hardback – 29 oct 1993 – vârsta până la 17 ani

Preț: 344.58 lei

Preț vechi: 555.64 lei

-38% Nou

Puncte Express: 517

Preț estimativ în valută:

65.94€ • 69.02$ • 54.88£

65.94€ • 69.02$ • 54.88£

Carte tipărită la comandă

Livrare economică 31 martie-14 aprilie

Preluare comenzi: 021 569.72.76

Specificații

ISBN-13: 9780275943608

ISBN-10: 0275943607

Pagini: 176

Dimensiuni: 140 x 210 x 19 mm

Greutate: 0.39 kg

Ediția:New.

Editura: Bloomsbury Publishing

Colecția Praeger

Locul publicării:New York, United States

ISBN-10: 0275943607

Pagini: 176

Dimensiuni: 140 x 210 x 19 mm

Greutate: 0.39 kg

Ediția:New.

Editura: Bloomsbury Publishing

Colecția Praeger

Locul publicării:New York, United States

Notă biografică

CHARLES W. STEADMAN is an attorney and financier specializing in corporate finance, private banking, and capital investment./e He is chairman of Steadman Security Corporation, a private bank in Washington, D.C., and chairman of the National Debt Repayment Foundation, also in Washington.

Cuprins

National Debt: The Greater Force and Dictator of PolicyWhy Has the National Debt Grown?Sacrifice of OpportunityManaging the National DebtNational Debt and the Average AmericanDemise of the Social OrderProfligate Spending and Revolving Error: Carter to Reagan to BushPast Experience in Debt Repayment: Ethical Commitment of the FoundersDebt Repayment after the Civil War, World War I, and World War IIA Plan for Debt RetirementEpilogue: Present Choices and Future ExpectationsIndex