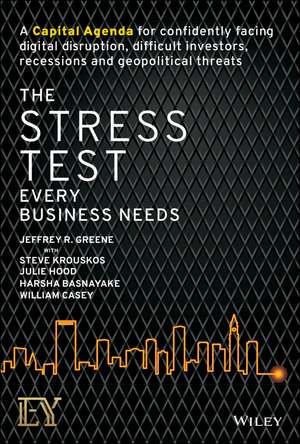

The Stress Test Every Business Needs: A Capital Ag enda for Confidently Facing Digital Disruption, Di fficult Investors, Recessions and Geopolitical Thr

Autor JR Greeneen Limba Engleză Hardback – 18 oct 2018

Preț: 207.34 lei

Nou

39.71€ • 40.91$ • 33.26£

Carte disponibilă

Livrare economică 03-17 februarie

Livrare express 17-23 ianuarie pentru 29.93 lei

Specificații

ISBN-10: 1119417945

Pagini: 272

Dimensiuni: 159 x 232 x 25 mm

Greutate: 0.45 kg

Editura: Wiley

Locul publicării:Hoboken, United States

Descriere

Citește un capitol aici. #uncapitolpezi

Do better business, get better results

The Stress Test Every Business Needs shows you how to optimize your business strategy to improve your results. Drawing from recent high-profile cases that illustrate the impact of common mistakes, this book brings the Stress Test methodology out of banking and applies it to businesses in any sector. If shareholder value is created through raising, investing, optimizing, and preserving capital, how can business leaders ensure stability and growth in an era of instability and stagnation? Stress Testing makes every business stronger; by taking a holistic view across your company's businesses, functions, and geographies, you become better equipped to make the tough decisions that draw the line between sinking, surviving, and thriving.

Brexit is showing the world what happens when we insufficiently prepare for low probability/high impact events; Allergan proved that outperforming peers doesn't necessarily ward off activist shareholders; companies around the world prove every day that operating in multiple businesses doesn't always produce a synergistic effect. Missteps like these are preventable, predictable, and avoidable, and this book provides the framework to help you keep your company above the fray.

- Learn from recent management successes and failures

- Make your business stronger amidst heightened uncertainty and investor scrutiny

- Make smart trade-offs among competing investment opportunities

- Optimize resource allocation to maximize resilience

Companies that formulate strategy and set operational priorities with a balanced investment agenda are best positioned to control their own destiny. Planning is only beneficial when it's effective, productive, and feasible, and structured toward meeting your company's specific goal. The Stress Test Every Business Needs provides a roadmap to better business through smart investment decisions.