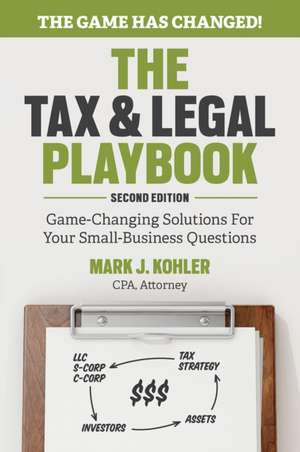

The Tax and Legal Playbook: Game-Changing Solutions to Your Small Business Questions

Autor Mark Kohleren Limba Engleză Paperback – 7 aug 2019

The Tax Cut and Jobs Act of 2017 marks the biggest tax reform in more than 30 years. The changes to the tax code are complex (especially for the small-business owner), but you don't have to go it alone. CPA and Attorney Mark J. Kohler delivers a comprehensive analysis of the new tax and legal structure you desperately need to help make the new tax law work for you.

In this revised edition of The Tax and Legal Playbook, Kohler reveals clear-cut truths about tax and legal planning and delivers a practical, play-by-play guide that helps you build wealth, save on taxes, and protect your assets. Using real-world case studies, tax-savvy tips, game plans, and discussion points, Kohler coaches you through the complexities of the tax game of the small-business owner. You'll also learn how to:

- Examine your business needs and pick the right business entity for you

- Build your personal and corporate credit in eight steps

- Implement affordable asset protection strategies

- Take advantage of underutilized business tax deductions

- Pick the right health-care, retirement, and estate plans

- Bring on partners and investors the right way

- Plan for your future with self-directed retirement funds

Preț: 132.78 lei

Nou

25.41€ • 26.60$ • 21.02£

Carte tipărită la comandă

Livrare economică 05-19 aprilie

Specificații

ISBN-10: 1599186438

Pagini: 368

Dimensiuni: 152 x 224 x 25 mm

Greutate: 0.52 kg

Ediția:00002

Editura: Entrepreneur Press

Notă biografică

Cuprins

Acknowledgments

Introduction

Part I: Pre-Season Planning

Appendix A: Homestead Exemption by State

Appendix B: Tenants by the Entirety by State

Appendix C: Charging Order Protection Entities (COPE) and Series LLC by State

Index