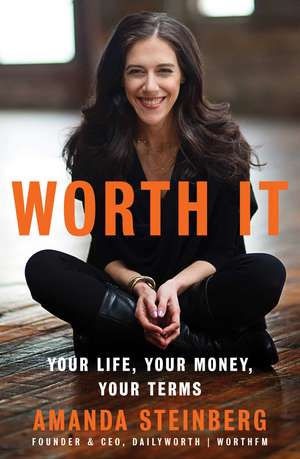

Worth It: Your Life, Your Money, Your Terms

Autor Amanda Steinbergen Limba Engleză Hardback – 9 mar 2017

From the founder and superstar CEO of DailyWorth.com the go-to financial site for women with more than one million subscribers comes a fresh book that redefines the relationship between women, self-worth, and money. Worth It shows women how to view money as a source of personal power and freedom and live life on their terms.

Millions of women want to create financial stability and abundance in their lives, but they don’t know how. They are stuck in overwhelming confusion and guilt, driven by internalized “money stories” that have nothing to do with what is really possible. As the founder of DailyWorth.com, a financial media and education platform, Amanda Steinberg encounters these smart, ambitious women every day. With this book, she helps them face their money stories head on and wake up to the prosperity that awaits them.

Worth It outlines the essential financial information women need and everything the institutions and advisors don’t spell out. Steinberg gets to the bottom of why women are stressed and anxious when it comes to their finances and teaches them to stay away from strict budgeting and other harsh austerity practices. Instead, she makes money relatable, while sharing strategies she uses herself to build confidence and ease in her own financial life. Through her first-hand experiences and the stories from other women who’ve woken up, Steinberg’s powerful and encouraging advice can help women of any age and income view money as a source of freedom and independence and create bright financial futures.

Millions of women want to create financial stability and abundance in their lives, but they don’t know how. They are stuck in overwhelming confusion and guilt, driven by internalized “money stories” that have nothing to do with what is really possible. As the founder of DailyWorth.com, a financial media and education platform, Amanda Steinberg encounters these smart, ambitious women every day. With this book, she helps them face their money stories head on and wake up to the prosperity that awaits them.

Worth It outlines the essential financial information women need and everything the institutions and advisors don’t spell out. Steinberg gets to the bottom of why women are stressed and anxious when it comes to their finances and teaches them to stay away from strict budgeting and other harsh austerity practices. Instead, she makes money relatable, while sharing strategies she uses herself to build confidence and ease in her own financial life. Through her first-hand experiences and the stories from other women who’ve woken up, Steinberg’s powerful and encouraging advice can help women of any age and income view money as a source of freedom and independence and create bright financial futures.

| Toate formatele și edițiile | Preț | Express |

|---|---|---|

| Paperback (1) | 94.61 lei 3-5 săpt. | |

| – | 94.61 lei 3-5 săpt. | |

| Hardback (1) | 96.01 lei 22-34 zile | |

| Gallery Books – 9 mar 2017 | 96.01 lei 22-34 zile |

Preț: 96.01 lei

Preț vechi: 186.45 lei

-49% Nou

Puncte Express: 144

Preț estimativ în valută:

18.37€ • 19.14$ • 15.21£

18.37€ • 19.14$ • 15.21£

Carte disponibilă

Livrare economică 14-26 martie

Preluare comenzi: 021 569.72.76

Specificații

ISBN-13: 9781501140990

ISBN-10: 150114099X

Pagini: 288

Ilustrații: 4 charts

Dimensiuni: 140 x 213 x 25 mm

Greutate: 0.37 kg

Editura: Gallery Books

Colecția Gallery Books

ISBN-10: 150114099X

Pagini: 288

Ilustrații: 4 charts

Dimensiuni: 140 x 213 x 25 mm

Greutate: 0.37 kg

Editura: Gallery Books

Colecția Gallery Books

Notă biografică

Amanda Steinberg launched DailyWorth in 2009 to bring a fresh voice and an outsider’s perspective to personal finance. Forbes named her one of the twenty-one New American Money Masters. DailyWorth.com has made Forbes’s 100 Best Websites for Women three years running. Amanda has also appeared on GMA, Today, CNN, and MSNBC, among other major media venues. Her new digital investing platform, WorthFM, received front-page coverage in The New York Times Business section. She is the author of Worth It.

Extras

Worth It

The (money) story of my life: what I learned, when I rose, why I fell, and how I started all over again from scratch.

There’s something extracruel about adolescence. It’s arguably the most insane time of a girl’s life. To begin with, you had to survive raging hormones, your mind-body transformation, and the relentless coup d’états within tweenage girls’ social ranks. In the midst of this turmoil, it turns out that you also began forming your core identity—by telling yourself a story. It turns out that a primary way we make sense and meaning of our lives over time is by internally penning a “personal narrative,” according to a growing body of psychological research. It’s your life story according to you, though deciding on major themes or choosing which memories to keep or toss is not a conscious process. It’s our budding psyches’ way of describing who we are to ourselves and in the world, why and how we got that way, and what our futures can, or will, look like. As life goes on, you become the story you tell about yourself. And not surprisingly, a big piece of that story is about money.

Money started out as a game to me—a video game, to be specific. Nintendo’s Kid Icarus was my nemesis throughout my tweenhood, and to beat it required tactical maneuvers to increase one’s chief assets, pixelated gold “coins.” You played a character called Pit, a winged boy equipped with a bow and arrows. Your job was to free the goddess by collecting the three “sacred” treasures guarded by monsters. To defeat them, you, Pit, had to zap them with your powerful arrows. And to build up your store of powerful arrows, you needed to amass and manage an ample supply of gold coins. You also needed “hearts” to give you the strength to do what needed to be done. It sounds like the ultimate geek fairy tale now, but let me tell you: getting to the happy ending was not easy. At all. And it consumed me for the better part of my adolescence.

Month after month, the monsters outmaneuvered me, depleted my arsenal, and ripped at my wings. I, Pit, would invariably die. My winnings, my progress, my life: Boom! Gone, just like that. You’d think that I’d give up after taking sound beatings for a couple of weeks. It never occurred to me. On the contrary, I became a more confident and skillful Pit because I knew what all players know: the game is never really over. You can always hit the reset button. In fact, when you start over again, you improve your score each time—and not simply because you’ve learned from earlier mistakes and know best how to increase and manage your critical assets. The major reason you jump levels is almost always because you risked an untried strategy—and it worked. When it does, you suddenly see with new clarity and depth how the game is played. You can’t wait to hit that reset button.

So, as I learned to shoot with increasing precision, I started to power-spike through the first spate of levels, facing bigger, meaner monsters. And finally, after two solid years of playing, I beat Kid Icarus. I won. I’d mastered this game. I knew how to regenerate from loss and start over. I knew how to learn from my mistakes and to strategically deploy my knowledge. To build up my assets. To gain dexterity and build confidence. Take calculated risks. Be ready to cope with the unexpected, no matter what. See how it all worked from a completely different—and optimal—vantage point.

It’s both weird and inspiring to me, looking back on it now. I mean, on the one hand, here I was, a punk kid soaking up the glory of my newfound ass-kicking skills. But on the other, I came to value deeply those same ass-kicking skills as an adult. Ultimately, they became the fundamental principles undergirding my philosophy of managing money—and the same skills I would use years later, when I reinvented myself and began building solid financial worth for myself and my kids.

But I didn’t see my gamer skill set as valuable, even lifesaving, in the real world for a long, long time—and after a great deal of pain and soul-searching. That quest was no Kid Icarus. It started in my own life. It started with my mom.

When my parents divorced in the early 1980s, there was no such thing as “conscious uncoupling.” Divorce was all but unheard-of in conservative suburban Philadelphia. There was no cultural acceptance of it, no narrative of psychological recovery from it. Divorced was not in my mom’s cultural lexicon until my father moved out. My mother was raised to be the worthy woman of the 1950s: the diligent housewife and center of the organized, loving home. She was a good girl from a good family. For her, a successful life story was straightforward: you married well; raised attractive, competent children; and supported your husband’s needs and career. In return, you were rewarded with a secure, comfortable life and a sense of personal fulfillment. Even privileged women who had been sent to college, like my mother, typically acknowledged that their chief goal was to graduate with an “MRS. degree.” When my father divorced her, Mom lost more than her husband. She lost her identity. She went from “priceless” to abandoned.

With three daughters and no job prospects, Mom was stunned. My two older sisters—one eleven years older, the other eight years—and I watched as the “good girl” melted down. The foundation Mom had built over years ruptured in a matter of months. I’d often find her crying on the edge of her bed in her dimly lit bedroom. One day, she snapped and gripped my scrawny biceps, telling me: “Always be able to support yourself financially.”

Meanwhile, my dad, a successful surgeon, remarried and lived with my new stepmother and her children in a stunning house with a small fleet of cars. When I visited my dad on weekends and vacations, I could only see what I didn’t have: a fancy home, a glittering pool, a family that I wished was mine. I marinated in jealousy, grief, and resentment. Cue the first themes in my personal narrative: Husbands and fathers won’t save you; they might not even stick around. Be independent, earn a lot of money, and buy your own cars and house. The way to heal is living well.

Meanwhile, Mom began to emerge. It took her years to lose that glazed-over postdivorce look, but when she did, she did it with stunning determination. Her undergraduate degree in the sixties had been in math and physics. She’d even done computer programming. “Computers filled entire rooms, and we used punch cards,” she told me. Now she went back to graduate school, earning an MBA from Drexel in information systems (high-tech eighties speak). After graduating, she got a job putting together personal computers via mail order. She filled our garage with thick beige monitors and CPUs with floppy disk drives, computer parts awaiting assembly. Then she took on a bigger job, working at the Philadelphia Stock Exchange on its first computer help desk. She started a career at forty-two years old. Boom. Mom hit the reset button. Game on.

To avoid a two-hour commute, she moved us to downtown Philadelphia. We settled into a town house on a cobblestone street dating back to Philadelphia’s colonial era. Our neighborhood, known as South Street, was also the punk mecca of bohemian Philadelphia in 1989. It was gritty. Our new neighbors were the back doors of restaurants. Steam from hot kitchens and waiters on smoke breaks. After ten years of reclusive life in the suburbs, this shift into urban adventure was exhilarating. My mother and her career took off. She’d pump up the volume—the Talking Heads song “Burning Down the House” was a favorite—and we’d dance on the dining room table. She was laughing.

If it was liberating for her, it was also liberating for me. Mom gave me a lot of freedom, much more than most kids my own age. No curfew, no limits on TV or sugared cereals. When my twelve-year-old self came home with new ear piercings and dyed hair, Mom didn’t worry. But I did. I began to realize how different Mom and I were from everyone else. My other friends weren’t allowed to do things like this. Their families had one boy, one girl, married parents, a welcoming home. The mother would be warm and intellectual, loving and strict. The father, when he was at home, was genial but firm. They loved each other. My friends had chores, books their parents had assigned them to read, family dinners where they discussed those books. Their parents hosted interesting dinner parties with interesting people; their families took culturally enriching vacations. I wanted this family. I wanted this life. This was the idealized family life: the peaceful, well-ordered home run by a worthy woman and benevolent patriarch, populated by smart, engaged kids. They lived by the rules.

Subconsciously, I was hoping that Mom would draw the line and enforce “normal” family rules. She didn’t have any use for “normal” back then, though. “Normal” had left her stranded in the suburbs, an outsider among married couples. She was regenerating herself as a mother and woman, the quantum-leap version of hitting the reset button. Her identity was no longer wrapped up in a man’s valuation of her as “priceless” or anything else. She was developing and evaluating her own worth. And starting over made her promote her newfound philosophy. “Roots and wings—roots to know you have a family who loves you and a secure home, and wings to chart your own path, the confidence to face whatever obstacles may get in your way,” she’d tell me. “Yes, you’ll fly right into storms and get thrown around a bit. But you’ll be fine. I believe in you.”

I was thrown around all right. I wandered and prowled at will. When our thirteen-year-old neighbor offered to pay me twenty-five dollars for a hand job, I accepted. More than once. Hey, having grown up in an all-female household, I was curious about boy parts. I also wanted to buy one of the expensive crystal necklaces that everyone had at school. It seemed like a fair trade at the time. I’d hop on the SEPTA (public) bus and ride deep into West Philly, where I learned to talk my way in and out of awkward teenage experiments. I acted and reacted on my feet: Pit on the street.

Enter a new theme in my personal narrative: I need family, traditions, a sense of normalcy. I wanted that well-ordered peaceful home with the thriving children and admiring husband, where my contributions would support our family and create a prosperous environment. Even as I knew, perhaps, it wasn’t really my life. Even then, I knew I’d never grow up to become the archetypal “good wife.” I would have to create a different kind of home, be a different kind of mother, wife, woman, so that I would feel comfortable, fulfilled—not an impostor in my own life. I knew that I would soar and crash again and again—but I would always pull myself back up, hit reset, and regenerate.

My mother’s warning to my five-year-old self was my North Star—and it would become the core of my identity. I didn’t expect to be taken care of. I didn’t yearn for a man—or a boss—to provide for me. That felt like prison. So in my senior year of college in Manhattan, I was making forty dollars an hour programming databases for college administrators. That was crazy money for a college kid. I was one of the first to buy a cell phone and take a spontaneous vacation to St. Barths. The year I graduated, 1999, the Internet exploded, and I convinced the CEO of a Boston-based website programming company to let me open a New York City office under his established brand. He thought I was far too young, but I ignored him and did it anyway. I was going to make real money now.

But hold up a minute. As unconventional and tenacious as I was, I ached for love, children, and my own fairy-tale version of sustainable Zen living. So, in my early twenties, I strategically frequented bars, parties, and even Shabbat dinners (oy—I’m not even religious) until I met my match. The One was a psychotherapist, PhD, yogi, and a drummer: the perfect yin to my yang of money and tech. We united, threw a killer postmodern wedding bash, birthed a baby boy, and moved to Philly. Life finally felt normal. Now I had a marriage and a family. We also needed the right house to complete our episode of The Wonder Years: The Dot-Com Years. The house we bought was the starter version of an English manor. I was finally living well.

The problem was, I secretly had no idea how to manage any of it: Our income, lifestyle, and savings that created financial security. Investments that created worth and wealth. Granted, we were young, but I talked a big game—I played a big game. By age twenty-five, I hit six figures. But I didn’t know a thing about money except how to work to earn it. I didn’t know that I was actually digging myself into a big financial hole. By age thirty, I would end up almost $100,000 in debt.

For the time being, though, our home looked well ordered. You couldn’t tell we had problems. But the costs were adding up fast. First, my computer programming business, Soapbxx (the domain name “Soapbox.com” was already registered), got a $60,000 bill for back taxes. That was triple the amount I had paid the previous year. The business was growing rapidly, and profits were increasing—but I hadn’t adjusted my taxes. When you’re self-employed, you have to file taxes quarterly. I’d been paying taxes for my previous year’s earnings but been too delirious with work and young children to recognize that a jump in revenues would mean a jump in taxes, too. My business had cashflow issues. Our clients often paid late, and we owed vendors thousands of dollars. The company checking account had $2,000 in it. Not nearly enough to pay for anything.

Our stone manse wasn’t helping, either. The cost of repairing and maintaining a big, 100-year-old house was steep. The heating bills alone were $1,000 a month. The crumbling windows cost $10,000 to replace. The mortgage payments on a $700,000 home were humungous. Raising a child was much more exhausting and expensive than I’d anticipated. There wasn’t enough money to pay any of these bills. There was never enough.

Then I became pregnant with our second child, a baby girl. A boy and a girl! But . . . I wasn’t prepared for the even more intense exhaustion and stress of having a newborn and a toddler. And the social pressure to be the perfect mother—to breast-feed, practice attachment parenting, avoid TV before age two—clashed with work pressure. During work, I’d get called by day care to pick up a sick child. On weekends, a client would call in a broken Web page. We had to spend, spend, spend to hire more help at work, more help at home, and try not to lose our minds in the process. Crushing, gutting, frantic. It dawned on me that I was Pit from Kid Icarus again, with no coins and no hearts left. Except I was all grown-up and couldn’t hit a button to start over.

Some knowledge of basic money management would have helped. How should I properly calculate the true cost of owning a home? How do I create savings when I have so much debt? It’s not that I didn’t want to save money. But the three-ring circus of earning money, baby-rearing, and keeping up with monstrous heating bills never seemed to leave me much to work with. I’ll just keep working harder, I told myself, pouring another glass of wine.

We budgeted. I set up a Mint account. It took hours to reprogram it to autocategorize each expense into a clearly delineated category. “Kids.” “Gifts.” But wait, what about gifts for kids? Where does that expense go? And we’re out of money, but if we show up to Yael’s birthday party without a gift, will we be bad community members and shunned from future birthdays? Only when I was done did I realize that there was no way that budgeting was going to get me out of that mess. I needed a framework: a new paradigm. As luck would have it, right as my personal financial crisis was hitting home, I got an e-mail about a workshop on women and money. “Is it possible to maintain integrity, build wealth, and make a difference?” the e-mail asked. Please let the answer be yes, I thought. The workshop was to be led by old friends of mine: a hip-hop artist and entrepreneur named Rha Goddess, and a spiritually elevated human rights advocate, Lea Endres. We’d be “shattering the glass ceiling & other myths about why women won’t claim money, power, and respect.” I needed this.

So, on a hot September day, at six months pregnant, I took the train from Philadelphia to New York City, desperate for new insights on money. In the workshop, I realized how my own “money story”—my personal narrative and identity around money—was driving me. My money story had told me that financial freedom was the key to the good life, and that meant working hard and making a lot of money. But once I had the money, I had no idea what to do with it. I had no savings, no appreciating investments, nothing that made my actual financial worth more than that of my teenage self. My “assets” (i.e. real estate, business) were actually driving me into debt. My money story had told me that I was going to build a secure, prosperous home with my husband. But I had no emergency fund and no safety net to catch me if I ever fell off the high wire during my precarious balancing act. And I did fall.

What had gone wrong? I had been following the personal narrative I’d written in adolescence, but I hadn’t edited it for adulthood. I hadn’t listened when my inner wisdom was cuing me to shift focus, to reengineer the arc of my story to form a bridge to authentic freedom—not a slide to self-destruction.

My money story was actually a riff on Cinderella: weird, wild, isolated girl is magically saved by her own ambition, Prince Supportive, their children, and expensive stuff.

That fairy tale crashed and burned—with massive financial consequences. Even though I learned not to be dependent like my mother, I still ended up in horrible financial trouble like she did.

Leaving the workshop, I had another epiphany. Money doesn’t have to be the source of so much anxiety or stress. It can also be a source of freedom, power, and choices in our lives. This can be true regardless of our financial circumstances—whether we have $100,000 in debt or $1,000,000 in the bank. It is not just about how much you have or don’t have. It all depends on how you handle it. Curveballs in life (children, divorce, death, layoffs, moving) are constant, but the way you position yourself to catch those curveballs can be strategic and consistent. You’ll be fine. If you have a healthy money story and if you’re not afraid to engage.

Sometime after I gave birth to my daughter, Maya, I realized my marriage was in trouble. I had married the sweetest man, but slowly I’d been discovering that I didn’t fit into the role of “wife.” Or at least the wife we had both wanted. He’d married a woman he loved, only to find that my drive and ambition made me a pretty terrible companion. When I should have been snuggling up to watch a movie or helping to plant the vegetable garden, I was instead hiding in the bathroom to answer e-mails. Our financial stress pushed me into work. So I created further projects to contract. I was doing anything I could to try to pay our mounting pile of bills—a Sisyphean task.

Even after the workshop, I was still sure something was seriously wrong with me. I had tried different therapies to deflate my oversized ambition. My drive and aspirations were problems—clearly they were hurting my marriage. I wanted to love being an attentive mom, loving wife, and gracious hostess. I wanted to create that priceless home, in all senses. But I didn’t. I hated what it took to be all those things at once. There were so many rules and social norms to adhere to, so many ideas of right and wrong. I didn’t want to follow any of them. I’d been raised by a liberated single mother, given a long leash, and I went where I wanted to go. And with terrible clarity, it hit me: I didn’t want to be here. I sobbed and sobbed with grief—and relief. I knew that I had to deconstruct and rebuild my life anew.

So I took a couple hundred deep breaths and moved out. I left our pristine home for a dingy two-bedroom apartment a few blocks away for my kids and me. It had a parquet floor, peeling linoleum paneling, and thin walls, but I could afford it. I bought a used 2004 Toyota hatchback. I started cutting and dyeing my own hair. I went DIY across the board. I felt embarrassed by such radical downsizing. But I could breathe again.

For the first time in my adult life, I had cash. I was finally going in the right direction, freeing myself from bills, meeting my expenses. I could see a day when I’d be building savings and investments. And I made DailyWorth my therapeutic creative outlet. I wanted women to get this new message about money: that it could be plentiful, nourishing, and within their (my) grasp.

Today, I rent a small house with a fireplace and arched windows. I have made peace with not being “normal.” I put my savings account ahead of social expectations, and my investment account ahead of more clothes. As Lea and Rha taught me, what you want doesn’t start by creating a budget. It starts with your money story.

I’ve just told you mine. Now let’s get to yours.

CHAPTER 1

Hit the Reset Button.

The (money) story of my life: what I learned, when I rose, why I fell, and how I started all over again from scratch.

There’s something extracruel about adolescence. It’s arguably the most insane time of a girl’s life. To begin with, you had to survive raging hormones, your mind-body transformation, and the relentless coup d’états within tweenage girls’ social ranks. In the midst of this turmoil, it turns out that you also began forming your core identity—by telling yourself a story. It turns out that a primary way we make sense and meaning of our lives over time is by internally penning a “personal narrative,” according to a growing body of psychological research. It’s your life story according to you, though deciding on major themes or choosing which memories to keep or toss is not a conscious process. It’s our budding psyches’ way of describing who we are to ourselves and in the world, why and how we got that way, and what our futures can, or will, look like. As life goes on, you become the story you tell about yourself. And not surprisingly, a big piece of that story is about money.

Money started out as a game to me—a video game, to be specific. Nintendo’s Kid Icarus was my nemesis throughout my tweenhood, and to beat it required tactical maneuvers to increase one’s chief assets, pixelated gold “coins.” You played a character called Pit, a winged boy equipped with a bow and arrows. Your job was to free the goddess by collecting the three “sacred” treasures guarded by monsters. To defeat them, you, Pit, had to zap them with your powerful arrows. And to build up your store of powerful arrows, you needed to amass and manage an ample supply of gold coins. You also needed “hearts” to give you the strength to do what needed to be done. It sounds like the ultimate geek fairy tale now, but let me tell you: getting to the happy ending was not easy. At all. And it consumed me for the better part of my adolescence.

Month after month, the monsters outmaneuvered me, depleted my arsenal, and ripped at my wings. I, Pit, would invariably die. My winnings, my progress, my life: Boom! Gone, just like that. You’d think that I’d give up after taking sound beatings for a couple of weeks. It never occurred to me. On the contrary, I became a more confident and skillful Pit because I knew what all players know: the game is never really over. You can always hit the reset button. In fact, when you start over again, you improve your score each time—and not simply because you’ve learned from earlier mistakes and know best how to increase and manage your critical assets. The major reason you jump levels is almost always because you risked an untried strategy—and it worked. When it does, you suddenly see with new clarity and depth how the game is played. You can’t wait to hit that reset button.

So, as I learned to shoot with increasing precision, I started to power-spike through the first spate of levels, facing bigger, meaner monsters. And finally, after two solid years of playing, I beat Kid Icarus. I won. I’d mastered this game. I knew how to regenerate from loss and start over. I knew how to learn from my mistakes and to strategically deploy my knowledge. To build up my assets. To gain dexterity and build confidence. Take calculated risks. Be ready to cope with the unexpected, no matter what. See how it all worked from a completely different—and optimal—vantage point.

It’s both weird and inspiring to me, looking back on it now. I mean, on the one hand, here I was, a punk kid soaking up the glory of my newfound ass-kicking skills. But on the other, I came to value deeply those same ass-kicking skills as an adult. Ultimately, they became the fundamental principles undergirding my philosophy of managing money—and the same skills I would use years later, when I reinvented myself and began building solid financial worth for myself and my kids.

But I didn’t see my gamer skill set as valuable, even lifesaving, in the real world for a long, long time—and after a great deal of pain and soul-searching. That quest was no Kid Icarus. It started in my own life. It started with my mom.

Support Yourself

When my parents divorced in the early 1980s, there was no such thing as “conscious uncoupling.” Divorce was all but unheard-of in conservative suburban Philadelphia. There was no cultural acceptance of it, no narrative of psychological recovery from it. Divorced was not in my mom’s cultural lexicon until my father moved out. My mother was raised to be the worthy woman of the 1950s: the diligent housewife and center of the organized, loving home. She was a good girl from a good family. For her, a successful life story was straightforward: you married well; raised attractive, competent children; and supported your husband’s needs and career. In return, you were rewarded with a secure, comfortable life and a sense of personal fulfillment. Even privileged women who had been sent to college, like my mother, typically acknowledged that their chief goal was to graduate with an “MRS. degree.” When my father divorced her, Mom lost more than her husband. She lost her identity. She went from “priceless” to abandoned.

With three daughters and no job prospects, Mom was stunned. My two older sisters—one eleven years older, the other eight years—and I watched as the “good girl” melted down. The foundation Mom had built over years ruptured in a matter of months. I’d often find her crying on the edge of her bed in her dimly lit bedroom. One day, she snapped and gripped my scrawny biceps, telling me: “Always be able to support yourself financially.”

Meanwhile, my dad, a successful surgeon, remarried and lived with my new stepmother and her children in a stunning house with a small fleet of cars. When I visited my dad on weekends and vacations, I could only see what I didn’t have: a fancy home, a glittering pool, a family that I wished was mine. I marinated in jealousy, grief, and resentment. Cue the first themes in my personal narrative: Husbands and fathers won’t save you; they might not even stick around. Be independent, earn a lot of money, and buy your own cars and house. The way to heal is living well.

Really Different

Meanwhile, Mom began to emerge. It took her years to lose that glazed-over postdivorce look, but when she did, she did it with stunning determination. Her undergraduate degree in the sixties had been in math and physics. She’d even done computer programming. “Computers filled entire rooms, and we used punch cards,” she told me. Now she went back to graduate school, earning an MBA from Drexel in information systems (high-tech eighties speak). After graduating, she got a job putting together personal computers via mail order. She filled our garage with thick beige monitors and CPUs with floppy disk drives, computer parts awaiting assembly. Then she took on a bigger job, working at the Philadelphia Stock Exchange on its first computer help desk. She started a career at forty-two years old. Boom. Mom hit the reset button. Game on.

To avoid a two-hour commute, she moved us to downtown Philadelphia. We settled into a town house on a cobblestone street dating back to Philadelphia’s colonial era. Our neighborhood, known as South Street, was also the punk mecca of bohemian Philadelphia in 1989. It was gritty. Our new neighbors were the back doors of restaurants. Steam from hot kitchens and waiters on smoke breaks. After ten years of reclusive life in the suburbs, this shift into urban adventure was exhilarating. My mother and her career took off. She’d pump up the volume—the Talking Heads song “Burning Down the House” was a favorite—and we’d dance on the dining room table. She was laughing.

If it was liberating for her, it was also liberating for me. Mom gave me a lot of freedom, much more than most kids my own age. No curfew, no limits on TV or sugared cereals. When my twelve-year-old self came home with new ear piercings and dyed hair, Mom didn’t worry. But I did. I began to realize how different Mom and I were from everyone else. My other friends weren’t allowed to do things like this. Their families had one boy, one girl, married parents, a welcoming home. The mother would be warm and intellectual, loving and strict. The father, when he was at home, was genial but firm. They loved each other. My friends had chores, books their parents had assigned them to read, family dinners where they discussed those books. Their parents hosted interesting dinner parties with interesting people; their families took culturally enriching vacations. I wanted this family. I wanted this life. This was the idealized family life: the peaceful, well-ordered home run by a worthy woman and benevolent patriarch, populated by smart, engaged kids. They lived by the rules.

Whatever Obstacles

Subconsciously, I was hoping that Mom would draw the line and enforce “normal” family rules. She didn’t have any use for “normal” back then, though. “Normal” had left her stranded in the suburbs, an outsider among married couples. She was regenerating herself as a mother and woman, the quantum-leap version of hitting the reset button. Her identity was no longer wrapped up in a man’s valuation of her as “priceless” or anything else. She was developing and evaluating her own worth. And starting over made her promote her newfound philosophy. “Roots and wings—roots to know you have a family who loves you and a secure home, and wings to chart your own path, the confidence to face whatever obstacles may get in your way,” she’d tell me. “Yes, you’ll fly right into storms and get thrown around a bit. But you’ll be fine. I believe in you.”

I was thrown around all right. I wandered and prowled at will. When our thirteen-year-old neighbor offered to pay me twenty-five dollars for a hand job, I accepted. More than once. Hey, having grown up in an all-female household, I was curious about boy parts. I also wanted to buy one of the expensive crystal necklaces that everyone had at school. It seemed like a fair trade at the time. I’d hop on the SEPTA (public) bus and ride deep into West Philly, where I learned to talk my way in and out of awkward teenage experiments. I acted and reacted on my feet: Pit on the street.

Enter a new theme in my personal narrative: I need family, traditions, a sense of normalcy. I wanted that well-ordered peaceful home with the thriving children and admiring husband, where my contributions would support our family and create a prosperous environment. Even as I knew, perhaps, it wasn’t really my life. Even then, I knew I’d never grow up to become the archetypal “good wife.” I would have to create a different kind of home, be a different kind of mother, wife, woman, so that I would feel comfortable, fulfilled—not an impostor in my own life. I knew that I would soar and crash again and again—but I would always pull myself back up, hit reset, and regenerate.

Real Money

My mother’s warning to my five-year-old self was my North Star—and it would become the core of my identity. I didn’t expect to be taken care of. I didn’t yearn for a man—or a boss—to provide for me. That felt like prison. So in my senior year of college in Manhattan, I was making forty dollars an hour programming databases for college administrators. That was crazy money for a college kid. I was one of the first to buy a cell phone and take a spontaneous vacation to St. Barths. The year I graduated, 1999, the Internet exploded, and I convinced the CEO of a Boston-based website programming company to let me open a New York City office under his established brand. He thought I was far too young, but I ignored him and did it anyway. I was going to make real money now.

But hold up a minute. As unconventional and tenacious as I was, I ached for love, children, and my own fairy-tale version of sustainable Zen living. So, in my early twenties, I strategically frequented bars, parties, and even Shabbat dinners (oy—I’m not even religious) until I met my match. The One was a psychotherapist, PhD, yogi, and a drummer: the perfect yin to my yang of money and tech. We united, threw a killer postmodern wedding bash, birthed a baby boy, and moved to Philly. Life finally felt normal. Now I had a marriage and a family. We also needed the right house to complete our episode of The Wonder Years: The Dot-Com Years. The house we bought was the starter version of an English manor. I was finally living well.

The problem was, I secretly had no idea how to manage any of it: Our income, lifestyle, and savings that created financial security. Investments that created worth and wealth. Granted, we were young, but I talked a big game—I played a big game. By age twenty-five, I hit six figures. But I didn’t know a thing about money except how to work to earn it. I didn’t know that I was actually digging myself into a big financial hole. By age thirty, I would end up almost $100,000 in debt.

Never Enough

For the time being, though, our home looked well ordered. You couldn’t tell we had problems. But the costs were adding up fast. First, my computer programming business, Soapbxx (the domain name “Soapbox.com” was already registered), got a $60,000 bill for back taxes. That was triple the amount I had paid the previous year. The business was growing rapidly, and profits were increasing—but I hadn’t adjusted my taxes. When you’re self-employed, you have to file taxes quarterly. I’d been paying taxes for my previous year’s earnings but been too delirious with work and young children to recognize that a jump in revenues would mean a jump in taxes, too. My business had cashflow issues. Our clients often paid late, and we owed vendors thousands of dollars. The company checking account had $2,000 in it. Not nearly enough to pay for anything.

Our stone manse wasn’t helping, either. The cost of repairing and maintaining a big, 100-year-old house was steep. The heating bills alone were $1,000 a month. The crumbling windows cost $10,000 to replace. The mortgage payments on a $700,000 home were humungous. Raising a child was much more exhausting and expensive than I’d anticipated. There wasn’t enough money to pay any of these bills. There was never enough.

Then I became pregnant with our second child, a baby girl. A boy and a girl! But . . . I wasn’t prepared for the even more intense exhaustion and stress of having a newborn and a toddler. And the social pressure to be the perfect mother—to breast-feed, practice attachment parenting, avoid TV before age two—clashed with work pressure. During work, I’d get called by day care to pick up a sick child. On weekends, a client would call in a broken Web page. We had to spend, spend, spend to hire more help at work, more help at home, and try not to lose our minds in the process. Crushing, gutting, frantic. It dawned on me that I was Pit from Kid Icarus again, with no coins and no hearts left. Except I was all grown-up and couldn’t hit a button to start over.

A Riff on Cinderella

Some knowledge of basic money management would have helped. How should I properly calculate the true cost of owning a home? How do I create savings when I have so much debt? It’s not that I didn’t want to save money. But the three-ring circus of earning money, baby-rearing, and keeping up with monstrous heating bills never seemed to leave me much to work with. I’ll just keep working harder, I told myself, pouring another glass of wine.

We budgeted. I set up a Mint account. It took hours to reprogram it to autocategorize each expense into a clearly delineated category. “Kids.” “Gifts.” But wait, what about gifts for kids? Where does that expense go? And we’re out of money, but if we show up to Yael’s birthday party without a gift, will we be bad community members and shunned from future birthdays? Only when I was done did I realize that there was no way that budgeting was going to get me out of that mess. I needed a framework: a new paradigm. As luck would have it, right as my personal financial crisis was hitting home, I got an e-mail about a workshop on women and money. “Is it possible to maintain integrity, build wealth, and make a difference?” the e-mail asked. Please let the answer be yes, I thought. The workshop was to be led by old friends of mine: a hip-hop artist and entrepreneur named Rha Goddess, and a spiritually elevated human rights advocate, Lea Endres. We’d be “shattering the glass ceiling & other myths about why women won’t claim money, power, and respect.” I needed this.

So, on a hot September day, at six months pregnant, I took the train from Philadelphia to New York City, desperate for new insights on money. In the workshop, I realized how my own “money story”—my personal narrative and identity around money—was driving me. My money story had told me that financial freedom was the key to the good life, and that meant working hard and making a lot of money. But once I had the money, I had no idea what to do with it. I had no savings, no appreciating investments, nothing that made my actual financial worth more than that of my teenage self. My “assets” (i.e. real estate, business) were actually driving me into debt. My money story had told me that I was going to build a secure, prosperous home with my husband. But I had no emergency fund and no safety net to catch me if I ever fell off the high wire during my precarious balancing act. And I did fall.

What had gone wrong? I had been following the personal narrative I’d written in adolescence, but I hadn’t edited it for adulthood. I hadn’t listened when my inner wisdom was cuing me to shift focus, to reengineer the arc of my story to form a bridge to authentic freedom—not a slide to self-destruction.

My money story was actually a riff on Cinderella: weird, wild, isolated girl is magically saved by her own ambition, Prince Supportive, their children, and expensive stuff.

That fairy tale crashed and burned—with massive financial consequences. Even though I learned not to be dependent like my mother, I still ended up in horrible financial trouble like she did.

Leaving the workshop, I had another epiphany. Money doesn’t have to be the source of so much anxiety or stress. It can also be a source of freedom, power, and choices in our lives. This can be true regardless of our financial circumstances—whether we have $100,000 in debt or $1,000,000 in the bank. It is not just about how much you have or don’t have. It all depends on how you handle it. Curveballs in life (children, divorce, death, layoffs, moving) are constant, but the way you position yourself to catch those curveballs can be strategic and consistent. You’ll be fine. If you have a healthy money story and if you’re not afraid to engage.

Terrible Clarity

Sometime after I gave birth to my daughter, Maya, I realized my marriage was in trouble. I had married the sweetest man, but slowly I’d been discovering that I didn’t fit into the role of “wife.” Or at least the wife we had both wanted. He’d married a woman he loved, only to find that my drive and ambition made me a pretty terrible companion. When I should have been snuggling up to watch a movie or helping to plant the vegetable garden, I was instead hiding in the bathroom to answer e-mails. Our financial stress pushed me into work. So I created further projects to contract. I was doing anything I could to try to pay our mounting pile of bills—a Sisyphean task.

Even after the workshop, I was still sure something was seriously wrong with me. I had tried different therapies to deflate my oversized ambition. My drive and aspirations were problems—clearly they were hurting my marriage. I wanted to love being an attentive mom, loving wife, and gracious hostess. I wanted to create that priceless home, in all senses. But I didn’t. I hated what it took to be all those things at once. There were so many rules and social norms to adhere to, so many ideas of right and wrong. I didn’t want to follow any of them. I’d been raised by a liberated single mother, given a long leash, and I went where I wanted to go. And with terrible clarity, it hit me: I didn’t want to be here. I sobbed and sobbed with grief—and relief. I knew that I had to deconstruct and rebuild my life anew.

So I took a couple hundred deep breaths and moved out. I left our pristine home for a dingy two-bedroom apartment a few blocks away for my kids and me. It had a parquet floor, peeling linoleum paneling, and thin walls, but I could afford it. I bought a used 2004 Toyota hatchback. I started cutting and dyeing my own hair. I went DIY across the board. I felt embarrassed by such radical downsizing. But I could breathe again.

For the first time in my adult life, I had cash. I was finally going in the right direction, freeing myself from bills, meeting my expenses. I could see a day when I’d be building savings and investments. And I made DailyWorth my therapeutic creative outlet. I wanted women to get this new message about money: that it could be plentiful, nourishing, and within their (my) grasp.

Life on Your Terms

Today, I rent a small house with a fireplace and arched windows. I have made peace with not being “normal.” I put my savings account ahead of social expectations, and my investment account ahead of more clothes. As Lea and Rha taught me, what you want doesn’t start by creating a budget. It starts with your money story.

I’ve just told you mine. Now let’s get to yours.

Recenzii

Amanda Steinberg gives us unvarnished assessments of sexism, our complex relationships with money, and her own path to taking control of her money and her life. Now with Amanda’s help, you will find the courage, and the tools, to make your money work for you.

After a while, personal finance books all look the same. Worth It is not even in the same milieu. It changed how I think about my money, my future, and my life.

The reasons people mishandle money are far more deeply rooted than an absence of information, and many self-help books make things worse with intimidating how-to lists that don't address the real source of the problem. Salvation has finally arrived thanks to Amanda Steinberg, the founder of DailyWorth, who bridges the gap between technical know-how and emotional resistance with her brilliant new book, Worth It. Combining savvy nuts-and-bolts instruction with psychological insight smart enough to help even the most recalcitrant, Worth It is written in a warm, user-friendly tone that feels like your best girlfriend reassuring you instead of a scary math teacher yelling at you to do your homework, Money is power, and nobody can achieve real freedom without financial autonomy. Worth It shows the way for anyone to achieve the ultimate goal: Free At Last.

Amanda Steinberg has done more toward educating women financially than anyone I know. She eloquently captures the pain and obstacles women face with money. Her stories are riveting. Her writing is inspiring. Her advice is brilliantly clear. I can’t imagine anyone reading this without being deeply touched and highly motivated.

Amanda Steinberg is a champion for women and their relationship to money. She believes that in order to raise our net-worth we must raise our self-worth. In her book Worth It, she guides us to step outside our comfort zone in order to step into financial freedom. This is a must read if you want to live with confidence, abundance and freedom

For all the finance books I've read, I've never felt so gotten as to my inner world around money and relationships. It's like dawn coming into deep unconscious, ancient patterns in my mind. And I know I'm not alone in this tangled darkness. This is going to be a landmark book - one that catalyzes liberation for women in their fullest expression of power and worth. This is how we rise.

Holy WOW! Worth It is a book I want every one of my female friends and clients to read. Finally someone who talks to us in our own language and delivers crisp advice you’ll be excited to act on immediately. Ladies, we have come into a critical juncture where we can no longer ignore the importance of money both in our lives and as a tool to lead. Read this now. It’s time.

After a while, personal finance books all look the same. Worth It is not even in the same milieu. It changed how I think about my money, my future, and my life.

The reasons people mishandle money are far more deeply rooted than an absence of information, and many self-help books make things worse with intimidating how-to lists that don't address the real source of the problem. Salvation has finally arrived thanks to Amanda Steinberg, the founder of DailyWorth, who bridges the gap between technical know-how and emotional resistance with her brilliant new book, Worth It. Combining savvy nuts-and-bolts instruction with psychological insight smart enough to help even the most recalcitrant, Worth It is written in a warm, user-friendly tone that feels like your best girlfriend reassuring you instead of a scary math teacher yelling at you to do your homework, Money is power, and nobody can achieve real freedom without financial autonomy. Worth It shows the way for anyone to achieve the ultimate goal: Free At Last.

Amanda Steinberg has done more toward educating women financially than anyone I know. She eloquently captures the pain and obstacles women face with money. Her stories are riveting. Her writing is inspiring. Her advice is brilliantly clear. I can’t imagine anyone reading this without being deeply touched and highly motivated.

Amanda Steinberg is a champion for women and their relationship to money. She believes that in order to raise our net-worth we must raise our self-worth. In her book Worth It, she guides us to step outside our comfort zone in order to step into financial freedom. This is a must read if you want to live with confidence, abundance and freedom

For all the finance books I've read, I've never felt so gotten as to my inner world around money and relationships. It's like dawn coming into deep unconscious, ancient patterns in my mind. And I know I'm not alone in this tangled darkness. This is going to be a landmark book - one that catalyzes liberation for women in their fullest expression of power and worth. This is how we rise.

Holy WOW! Worth It is a book I want every one of my female friends and clients to read. Finally someone who talks to us in our own language and delivers crisp advice you’ll be excited to act on immediately. Ladies, we have come into a critical juncture where we can no longer ignore the importance of money both in our lives and as a tool to lead. Read this now. It’s time.

Descriere

Worth It shows women how to view money as a source of personal power and freedom and live life on their terms.