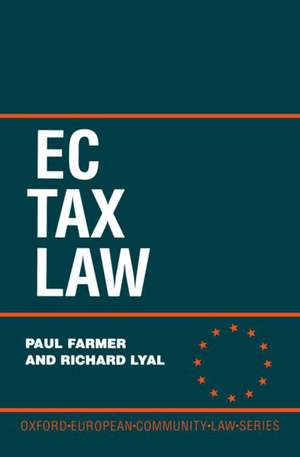

EC Tax Law: Oxford European Union Law Library

Autor Paul Farmer, Richard Lyalen Limba Engleză Hardback – 16 feb 1995

Din seria Oxford European Union Law Library

- 12%

Preț: 500.65 lei

Preț: 500.65 lei - 17%

Preț: 735.65 lei

Preț: 735.65 lei - 10%

Preț: 373.53 lei

Preț: 373.53 lei - 30%

Preț: 1177.56 lei

Preț: 1177.56 lei - 30%

Preț: 847.17 lei

Preț: 847.17 lei - 33%

Preț: 884.54 lei

Preț: 884.54 lei - 30%

Preț: 1050.29 lei

Preț: 1050.29 lei - 34%

Preț: 1047.59 lei

Preț: 1047.59 lei - 30%

Preț: 751.87 lei

Preț: 751.87 lei - 34%

Preț: 495.68 lei

Preț: 495.68 lei - 26%

Preț: 583.89 lei

Preț: 583.89 lei - 18%

Preț: 336.79 lei

Preț: 336.79 lei - 31%

Preț: 473.83 lei

Preț: 473.83 lei - 23%

Preț: 1905.67 lei

Preț: 1905.67 lei - 17%

Preț: 437.56 lei

Preț: 437.56 lei - 34%

Preț: 672.61 lei

Preț: 672.61 lei - 34%

Preț: 1599.58 lei

Preț: 1599.58 lei - 11%

Preț: 1199.89 lei

Preț: 1199.89 lei - 16%

Preț: 541.41 lei

Preț: 541.41 lei - 16%

Preț: 589.55 lei

Preț: 589.55 lei - 13%

Preț: 437.00 lei

Preț: 437.00 lei - 30%

Preț: 820.89 lei

Preț: 820.89 lei - 25%

Preț: 690.30 lei

Preț: 690.30 lei - 26%

Preț: 1212.63 lei

Preț: 1212.63 lei - 23%

Preț: 1057.09 lei

Preț: 1057.09 lei

Preț: 675.51 lei

Preț vechi: 1019.94 lei

-34% Nou

Puncte Express: 1013

Preț estimativ în valută:

129.26€ • 134.95$ • 106.98£

129.26€ • 134.95$ • 106.98£

Carte tipărită la comandă

Livrare economică 25-31 martie

Preluare comenzi: 021 569.72.76

Specificații

ISBN-13: 9780198257646

ISBN-10: 0198257643

Pagini: 392

Ilustrații: 1

Dimensiuni: 160 x 241 x 26 mm

Greutate: 0.75 kg

Editura: Clarendon Press

Colecția Clarendon Press

Seria Oxford European Union Law Library

Locul publicării:Oxford, United Kingdom

ISBN-10: 0198257643

Pagini: 392

Ilustrații: 1

Dimensiuni: 160 x 241 x 26 mm

Greutate: 0.75 kg

Editura: Clarendon Press

Colecția Clarendon Press

Seria Oxford European Union Law Library

Locul publicării:Oxford, United Kingdom

Recenzii

...its approach is both analytical and practical. For those involved in maritime and commercial law, it provides a comprehensive and authoritative discussion on complex areas of taxation relevant to transnational contracts within the Community. It was a pleasure to read such a clear exposition of what is normally regarded as a somewhat intimidating subject. The authors are to be congratulated for providing a stimulating work which is well-presented and clearly indexed. They provide a useful list of 'Further Reading' in the fields touched on by their book. EC Tax Law will be well received by those specialised in the field of taxation and those whose work concerns transnatioanl contracts who require some knowledge of the Community dimension which is of ever-increasing significance.