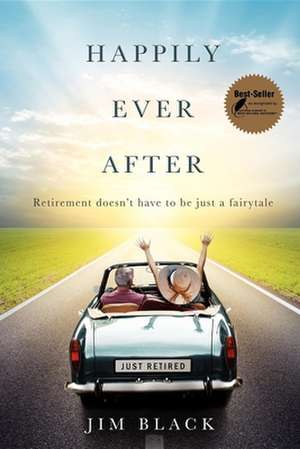

Happily Ever After: Retirment Doesn't Have to Be Just a Fairytale

Autor Jim Blacken Limba Engleză Paperback – 30 apr 2012

Happily Ever After doesn’t have to be just a fairytale anymore

This book was written with the current retiree in mind. It is one of the first books to recognize that once you get that last paycheck from your employer (the last paycheck for the rest of your life), you need to start seeing your money differently.

One of the biggest fears of most retirees or those preparing for retirement is that they may run out of money before they die. That fear can be greatly reduced by following the simple, easy to implement strategies and plan that Jim Black shares in this book.

As a retiree, you have spent 40 years or more saving and accumulating assets for retirement. Yet a single down year in the stock market can change your retirement forever. Most retirees think that they need to choose between growth and income, or risk and return, but Jim Black will show you that those options are not mutually exclusive.

Using real life examples and humor, Black has created a process that helps retirees overcome their basic fears. He has done this in a manner that anyone, regardless of their financially sophistication, should be able to implement for themselves.

By reading this book and implementing the strategies, you will greatly increase your chances of retiring on your terms, and living Happily Ever After.

This book was written with the current retiree in mind. It is one of the first books to recognize that once you get that last paycheck from your employer (the last paycheck for the rest of your life), you need to start seeing your money differently.

One of the biggest fears of most retirees or those preparing for retirement is that they may run out of money before they die. That fear can be greatly reduced by following the simple, easy to implement strategies and plan that Jim Black shares in this book.

As a retiree, you have spent 40 years or more saving and accumulating assets for retirement. Yet a single down year in the stock market can change your retirement forever. Most retirees think that they need to choose between growth and income, or risk and return, but Jim Black will show you that those options are not mutually exclusive.

Using real life examples and humor, Black has created a process that helps retirees overcome their basic fears. He has done this in a manner that anyone, regardless of their financially sophistication, should be able to implement for themselves.

By reading this book and implementing the strategies, you will greatly increase your chances of retiring on your terms, and living Happily Ever After.

| Toate formatele și edițiile | Preț | Express |

|---|---|---|

| Paperback (2) | 80.38 lei 3-5 săpt. | |

| Advantage Media Group – 30 apr 2012 | 80.38 lei 3-5 săpt. | |

| CreateSpace Independent Publishing Platform – | 85.46 lei 3-5 săpt. |

Preț: 80.38 lei

Nou

Puncte Express: 121

Preț estimativ în valută:

15.38€ • 16.06$ • 12.73£

15.38€ • 16.06$ • 12.73£

Carte disponibilă

Livrare economică 14-28 martie

Preluare comenzi: 021 569.72.76

Specificații

ISBN-13: 9781599323053

ISBN-10: 1599323052

Pagini: 132

Dimensiuni: 152 x 229 x 8 mm

Greutate: 0.2 kg

Editura: Advantage Media Group

ISBN-10: 1599323052

Pagini: 132

Dimensiuni: 152 x 229 x 8 mm

Greutate: 0.2 kg

Editura: Advantage Media Group

Notă biografică

Jim Black has been providing advice to clients for over 24 years. In that time he has worked for some of the largest financial institutions in the world, and advised clients in nearly all phases of the financial spectrum. He has a B.S degree in International Finance from Brigham Young University, and an MBA from Willamette University. He has also earned the (CFP) Certified Financial Planning designation, which is imperative to understanding and incorporating his planning strategies to the needs of his clients.

After serving as an officer in Military Intelligence for several years, Black helped start a trust department for a bank in Oregon. Several years ago, he again began providing his expertise, advice and direction to individual clients through his practice in Redmond, Washington.

After serving as an officer in Military Intelligence for several years, Black helped start a trust department for a bank in Oregon. Several years ago, he again began providing his expertise, advice and direction to individual clients through his practice in Redmond, Washington.

Cuprins

Introduction: Off on the Right Foot

Many Happy Returns

¿What, Me Worry?¿

Retiring on Your Terms

What¿s in Your Buckets?

Conclusion: It¿s About Living Well

About the Author