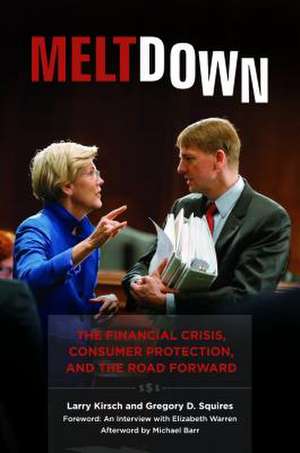

Meltdown: The Financial Crisis, Consumer Protection, and the Road Forward

Cuvânt după de Michael Barr Autor Larry Kirsch, Gregory D. Squires Cuvânt înainte de Elizabeth Warrenen Limba Engleză Hardback – 8 mar 2017 – vârsta până la 17 ani

Preț: 355.52 lei

Preț vechi: 388.07 lei

-8% Nou

Puncte Express: 533

Preț estimativ în valută:

68.04€ • 70.19$ • 57.58£

68.04€ • 70.19$ • 57.58£

Carte tipărită la comandă

Livrare economică 05-19 martie

Preluare comenzi: 021 569.72.76

Specificații

ISBN-13: 9781440842429

ISBN-10: 1440842426

Pagini: 176

Dimensiuni: 156 x 235 mm

Greutate: 0.5 kg

Editura: Bloomsbury Publishing

Colecția Praeger

Locul publicării:New York, United States

ISBN-10: 1440842426

Pagini: 176

Dimensiuni: 156 x 235 mm

Greutate: 0.5 kg

Editura: Bloomsbury Publishing

Colecția Praeger

Locul publicării:New York, United States

Caracteristici

Gives readers unique access to insightful perspectives via on-the-record interviews with a cross-section of stakeholders, ranging from Richard Cordray (director of the CFPB) to public policy leaders, congressional staffers, advocates, scholars, and members of the press

Notă biografică

Larry Kirsch is managing partner of IMR Health Economics, Portland, OR.Gregory D. Squires is professor of sociology and public policy and public administration at George Washington University.

Cuprins

Foreword by Elizabeth WarrenAcknowledgments1. Introduction to a Meltdown2. Up from the Basement: The CFPB Begins to Take Shape3. The Shattered Mortgage Market4. Auto Lending: The Deals and the Dealers5. The CFPB in Action: Did the Consumer Bureau Get What It Needed to Do What Was Necessary?Afterword by Michael BarrNotesIndex

Recenzii

With Meltdown: The Financial Crisis, Consumer Protection, and the Road Forward, Larry Kirsch and Greg Squires provide a valuable service. . . . This book is the first of this type and hopefully sets a trend for evaluating the new federal oversight established after the Great Recession. . . . In sum, Kirsch and Squires have written an insightful book that documents an important phase of an agency's history; that is, how the agency came into being, and its institutional strengths and weaknesses. It provides valuable lessons for the CFPB's growth as well as providing suggestions about how to create future initiatives like this from scratch.