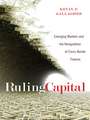

Tax Havens – How Globalization Really Works: Cornell Studies in Money

Autor Ronen Palan, Richard Murphy, Christian Chavagneuxen Limba Engleză Paperback – 14 ian 2010

| Toate formatele și edițiile | Preț | Express |

|---|---|---|

| Paperback (1) | 230.67 lei 3-5 săpt. | +16.95 lei 5-11 zile |

| MB – Cornell University Press – 14 ian 2010 | 230.67 lei 3-5 săpt. | +16.95 lei 5-11 zile |

| Hardback (1) | 719.53 lei 6-8 săpt. | |

| MB – Cornell University Press – 14 ian 2010 | 719.53 lei 6-8 săpt. |

Din seria Cornell Studies in Money

-

Preț: 150.13 lei

Preț: 150.13 lei -

Preț: 178.58 lei

Preț: 178.58 lei -

Preț: 183.67 lei

Preț: 183.67 lei -

Preț: 350.90 lei

Preț: 350.90 lei -

Preț: 143.90 lei

Preț: 143.90 lei -

Preț: 152.81 lei

Preț: 152.81 lei -

Preț: 155.48 lei

Preț: 155.48 lei -

Preț: 391.20 lei

Preț: 391.20 lei -

Preț: 363.56 lei

Preț: 363.56 lei -

Preț: 270.71 lei

Preț: 270.71 lei -

Preț: 431.89 lei

Preț: 431.89 lei -

Preț: 412.65 lei

Preț: 412.65 lei -

Preț: 416.37 lei

Preț: 416.37 lei -

Preț: 419.04 lei

Preț: 419.04 lei -

Preț: 501.30 lei

Preț: 501.30 lei -

Preț: 417.89 lei

Preț: 417.89 lei -

Preț: 334.81 lei

Preț: 334.81 lei -

Preț: 289.40 lei

Preț: 289.40 lei -

Preț: 273.30 lei

Preț: 273.30 lei -

Preț: 340.25 lei

Preț: 340.25 lei -

Preț: 204.76 lei

Preț: 204.76 lei -

Preț: 255.64 lei

Preț: 255.64 lei -

Preț: 266.89 lei

Preț: 266.89 lei -

Preț: 450.51 lei

Preț: 450.51 lei -

Preț: 513.36 lei

Preț: 513.36 lei -

Preț: 484.51 lei

Preț: 484.51 lei -

Preț: 402.16 lei

Preț: 402.16 lei -

Preț: 393.63 lei

Preț: 393.63 lei

Preț: 230.67 lei

Nou

Puncte Express: 346

Preț estimativ în valută:

44.14€ • 45.92$ • 36.44£

44.14€ • 45.92$ • 36.44£

Carte disponibilă

Livrare economică 24 martie-07 aprilie

Livrare express 08-14 martie pentru 26.94 lei

Preluare comenzi: 021 569.72.76

Specificații

ISBN-13: 9780801476129

ISBN-10: 0801476127

Pagini: 280

Ilustrații: 20

Dimensiuni: 164 x 225 x 18 mm

Greutate: 0.39 kg

Editura: MB – Cornell University Press

Seria Cornell Studies in Money

ISBN-10: 0801476127

Pagini: 280

Ilustrații: 20

Dimensiuni: 164 x 225 x 18 mm

Greutate: 0.39 kg

Editura: MB – Cornell University Press

Seria Cornell Studies in Money

Cuprins

IntroductionPart I: Tax Havens and Their Uses

1. What is a Tax Haven?

2. Tax Havens: Vital Statistics

3. The Instruments of Tax HavensPart II: The Evolution of Tax Havens

4. Origins of the Tax Havens

5. The British Empire Strikes BackPart III: Tax Havens in World Politics

6. Tax Havens and the Developed World

7. Issues in DevelopmentPart IV: The Battle for Hearts And Minds

8. Signs of Discontent

9. Institutional Attacks on Tax Havens

10. Tax Havens in the Twenty-First CenturyConclusionGlossary

References

Index

1. What is a Tax Haven?

2. Tax Havens: Vital Statistics

3. The Instruments of Tax HavensPart II: The Evolution of Tax Havens

4. Origins of the Tax Havens

5. The British Empire Strikes BackPart III: Tax Havens in World Politics

6. Tax Havens and the Developed World

7. Issues in DevelopmentPart IV: The Battle for Hearts And Minds

8. Signs of Discontent

9. Institutional Attacks on Tax Havens

10. Tax Havens in the Twenty-First CenturyConclusionGlossary

References

Index

Descriere

This book provide an up-to-date evaluation of the role and function of tax havens in the global financial system--their history, inner workings, impact, extent, and enforcement. They make clear that tax havens have a major impact on the global economy.