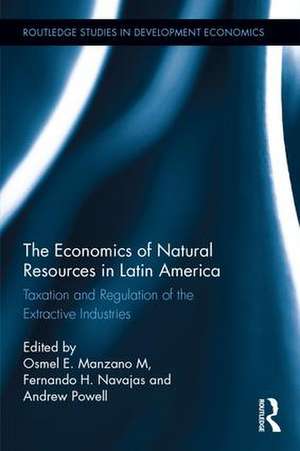

The Economics of Natural Resources in Latin America: Taxation and Regulation of the Extractive Industries: Routledge Studies in Development Economics

Editat de Osmel E. Manzano M., Fernando Navajas, Andrew Powellen Limba Engleză Hardback – 20 noi 2017

This volume focuses on economic efficiency: where Latin America stands in terms of the current tax system for the extractive sector; how policies have changed in this regard; and how policies may be improved. The Economics of Natural Resources in Latin America is timely, since this new era of lower and volatile prices and possible reconfiguration of investment flows poses a challenge to natural resource tax systems in the world. The argument of the book will be made by a collection of papers around the issue of tax efficiency in the region and concludes with chapters on institutions and the role of transparency.

This book shows that there are varieties of experiences in resource taxation and management of revenues in Latin America that could be used to shape policy interventions in other regions. This variety is not only related to their diverse impact on welfare, but also on the policy challenges faced by the countries in the region. This volume is well suited for those who study and find interest in development economics, political economy and public finance, as well as policy

| Toate formatele și edițiile | Preț | Express |

|---|---|---|

| Paperback (1) | 386.51 lei 43-57 zile | |

| Taylor & Francis – 12 dec 2019 | 386.51 lei 43-57 zile | |

| Hardback (1) | 1003.43 lei 43-57 zile | |

| Taylor & Francis – 20 noi 2017 | 1003.43 lei 43-57 zile |

Din seria Routledge Studies in Development Economics

-

Preț: 309.74 lei

Preț: 309.74 lei -

Preț: 327.17 lei

Preț: 327.17 lei -

Preț: 326.49 lei

Preț: 326.49 lei -

Preț: 311.41 lei

Preț: 311.41 lei -

Preț: 394.37 lei

Preț: 394.37 lei - 8%

Preț: 396.84 lei

Preț: 396.84 lei -

Preț: 260.82 lei

Preț: 260.82 lei - 18%

Preț: 1165.24 lei

Preț: 1165.24 lei - 15%

Preț: 470.31 lei

Preț: 470.31 lei - 18%

Preț: 1057.05 lei

Preț: 1057.05 lei - 18%

Preț: 1225.29 lei

Preț: 1225.29 lei - 18%

Preț: 1113.63 lei

Preț: 1113.63 lei - 18%

Preț: 1300.62 lei

Preț: 1300.62 lei - 26%

Preț: 878.42 lei

Preț: 878.42 lei - 18%

Preț: 1166.05 lei

Preț: 1166.05 lei - 18%

Preț: 1059.45 lei

Preț: 1059.45 lei -

Preț: 381.11 lei

Preț: 381.11 lei - 25%

Preț: 823.63 lei

Preț: 823.63 lei - 21%

Preț: 361.84 lei

Preț: 361.84 lei - 16%

Preț: 274.01 lei

Preț: 274.01 lei - 18%

Preț: 1060.87 lei

Preț: 1060.87 lei - 18%

Preț: 1168.85 lei

Preț: 1168.85 lei - 18%

Preț: 1171.89 lei

Preț: 1171.89 lei - 18%

Preț: 1068.18 lei

Preț: 1068.18 lei - 18%

Preț: 1060.19 lei

Preț: 1060.19 lei - 18%

Preț: 1341.98 lei

Preț: 1341.98 lei - 18%

Preț: 1169.16 lei

Preț: 1169.16 lei - 18%

Preț: 1057.05 lei

Preț: 1057.05 lei - 15%

Preț: 714.66 lei

Preț: 714.66 lei - 18%

Preț: 1287.06 lei

Preț: 1287.06 lei - 18%

Preț: 1124.73 lei

Preț: 1124.73 lei - 18%

Preț: 1157.34 lei

Preț: 1157.34 lei - 27%

Preț: 832.80 lei

Preț: 832.80 lei - 26%

Preț: 850.91 lei

Preț: 850.91 lei - 18%

Preț: 1066.79 lei

Preț: 1066.79 lei - 25%

Preț: 658.19 lei

Preț: 658.19 lei - 25%

Preț: 992.63 lei

Preț: 992.63 lei - 18%

Preț: 1069.23 lei

Preț: 1069.23 lei - 15%

Preț: 703.08 lei

Preț: 703.08 lei -

Preț: 395.63 lei

Preț: 395.63 lei - 18%

Preț: 706.91 lei

Preț: 706.91 lei -

Preț: 422.96 lei

Preț: 422.96 lei - 18%

Preț: 1055.38 lei

Preț: 1055.38 lei - 27%

Preț: 993.85 lei

Preț: 993.85 lei - 18%

Preț: 707.10 lei

Preț: 707.10 lei -

Preț: 409.19 lei

Preț: 409.19 lei

Preț: 1003.43 lei

Preț vechi: 1223.70 lei

-18% Nou

Puncte Express: 1505

Preț estimativ în valută:

192.01€ • 200.98$ • 159.81£

192.01€ • 200.98$ • 159.81£

Carte tipărită la comandă

Livrare economică 31 martie-14 aprilie

Preluare comenzi: 021 569.72.76

Specificații

ISBN-13: 9781138085367

ISBN-10: 1138085367

Pagini: 258

Ilustrații: 68 Line drawings, black and white; 43 Tables, black and white; 68 Illustrations, black and white

Dimensiuni: 156 x 234 x 23 mm

Greutate: 0.54 kg

Ediția:1

Editura: Taylor & Francis

Colecția Routledge

Seria Routledge Studies in Development Economics

Locul publicării:Oxford, United Kingdom

ISBN-10: 1138085367

Pagini: 258

Ilustrații: 68 Line drawings, black and white; 43 Tables, black and white; 68 Illustrations, black and white

Dimensiuni: 156 x 234 x 23 mm

Greutate: 0.54 kg

Ediția:1

Editura: Taylor & Francis

Colecția Routledge

Seria Routledge Studies in Development Economics

Locul publicării:Oxford, United Kingdom

Public țintă

Postgraduate and UndergraduateCuprins

Chapter 1: The Taxation of Non-Renewable Resources in Latin America: Introduction and Overview

- Commodity prices, the super-cycle and implications for fiscal revenues

- Recent literature on non-renewables

- Institutions and instruments: gaps in relation to best practices

- What next for resource tax systems in Latin America?

- Conclusions

- Methodological approach

- Results

- Concluding remarks

- The role of copper in Chilean Development

- Mining sector today

- Deacon’s Model

- Data and parameters

- Relevant Tax Regimes in the Case of Chile

- Simulations of the scenarios

- Concluding remarks

- Institutional Setting

- The Model

- Data

- Results

- Introducing depreciation in Deacon’s Model

- Concluding remarks

- The Theory on Oil Production and Taxes.

- The Venezuelan Case

- Estimating the Effects upon Oil Exploitation of the Tax Rules

- A brief review of the performance sector

- Concluding Remarks

- Some facts about the oil and gas sectors in Argentina after the 2001-2002 crisis.

- Making sense of regulations: a dynamic political-economy agency model of state intervention in the gas market

- Self-enforcing equilibrium characterization with no exports, positive imports and positive subsidies.

- Rationalizing facts on Argentina’s oil and gas in the 2000’s with the model results. Some policy implications.

- Concluding remarks

- Analytical Framework

- Empirical Evidence

- Concluding Remarks

- The Evolution of the EITI

- Prior Research

- Data and Measurement Issues

- Empirical Model and Estimation Methodology

- Findings

- Case Studies: Nigeria and Peru

- Concluding Remarks

Descriere

This book aims to understand the trade-off between the degree of taxation overall, the profitability of the relevant industry and the amount of investment and subsequent production in the region, as well as the relevance of institutions in the performance of the sector. It focuses on economic efficiency: where Latin America stands in terms of the current tax system for the extractive sector; how policies have changed in this regard; and how policies may be improved. The argument of the book will be made by a collection of papers around the issue of tax efficiency in the region and concludes with chapters on institutions and the role of transparency.

Notă biografică

Osmel Manzano is Regional Economic Advisor for the Country Department for Belize, Central America, Mexico, Panama and Dominican Republic at the Inter-American Development Bank, USA. He is responsible for the economic work and macroeconomic monitoring of the IADB in Central America, Mexico and the Dominican Republic.

Fernando Navajas is Professor of economics at the Universities of Buenos Aires and La Plata and Chief Economist at FIEL, Argentina. He is currently President of the Argentine Association of Political Economy and Director of the Applied Economics Institute of the National Academy of Economic Science of Argentina.

Andrew Powell is Principal Advisor in the Research Department (RES) of the Inter-American Development Bank, USA. He has published numerous academic papers in leading economic journals in areas including commodity markets, risk management, the role of multilaterals, regulation, banking and international finance.

Fernando Navajas is Professor of economics at the Universities of Buenos Aires and La Plata and Chief Economist at FIEL, Argentina. He is currently President of the Argentine Association of Political Economy and Director of the Applied Economics Institute of the National Academy of Economic Science of Argentina.

Andrew Powell is Principal Advisor in the Research Department (RES) of the Inter-American Development Bank, USA. He has published numerous academic papers in leading economic journals in areas including commodity markets, risk management, the role of multilaterals, regulation, banking and international finance.