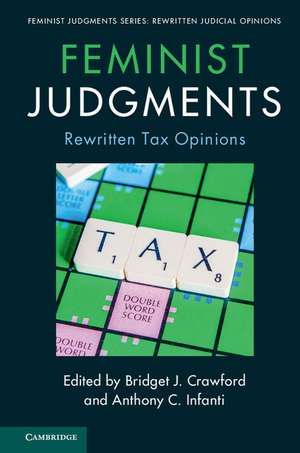

Feminist Judgments: Rewritten Tax Opinions: Feminist Judgment Series: Rewritten Judicial Opinions

Editat de Bridget J. Crawford, Anthony C. Infantien Limba Engleză Paperback – 27 dec 2017

| Toate formatele și edițiile | Preț | Express |

|---|---|---|

| Paperback (1) | 271.77 lei 3-5 săpt. | |

| Cambridge University Press – 27 dec 2017 | 271.77 lei 3-5 săpt. | |

| Hardback (1) | 782.17 lei 6-8 săpt. | |

| Cambridge University Press – 27 dec 2017 | 782.17 lei 6-8 săpt. |

Preț: 271.77 lei

Nou

Puncte Express: 408

Preț estimativ în valută:

52.01€ • 54.10$ • 42.94£

52.01€ • 54.10$ • 42.94£

Carte disponibilă

Livrare economică 24 martie-07 aprilie

Preluare comenzi: 021 569.72.76

Specificații

ISBN-13: 9781316649596

ISBN-10: 1316649598

Pagini: 354

Dimensiuni: 153 x 228 x 20 mm

Greutate: 0.49 kg

Editura: Cambridge University Press

Colecția Cambridge University Press

Seria Feminist Judgment Series: Rewritten Judicial Opinions

Locul publicării:New York, United States

ISBN-10: 1316649598

Pagini: 354

Dimensiuni: 153 x 228 x 20 mm

Greutate: 0.49 kg

Editura: Cambridge University Press

Colecția Cambridge University Press

Seria Feminist Judgment Series: Rewritten Judicial Opinions

Locul publicării:New York, United States

Cuprins

Part I. Introduction and Overview: 1. Introduction to the Feminist Judgments: Rewritten Tax Opinions Project Bridget J. Crawford and Anthony C. Infanti; 2. Feminist judging for substantive gender equality in tax law: changing international and comparative constitutional contexts Kathleen A. Lahey; Part II. The Feminist Judgments: 3. United States v. Rickert, 188 US 432 (1903) Chloe Thompson and Grant Christensen; 4. Lucas v. Earl, 281 U.S. 111 (1930) Francine J. Lipman and Ann Murphy; 5. Welch v. Helvering, 290 US 111 (1933) Nicole Appleberry and Mary Louise Fellows; 6. United States v. Davis, 370 US 65 (1962) Linda M. Beale and Patricia A. Cain; 7. Bob Jones University v. United States, 461 US 574 (1983) Elaine Waterhouse Wilson and David A. Brennen; 8. Manufacturers Hanover Trust Co. v. United States, 75 F.2d 459 (2d Cir. 1985) Mildred Wigfall Robinson and Mary L. Heen; 9. Estate of Clack, 106 T.C. 131 (1996) Goldburn P. Maynard, Jr and Wendy C. Gerzog; 10. Cheshire v. Commissioner, 115 T.C. 183 (2000), aff'd, 282 F.3d 326 (5th Cir. 2002) Michelle L. Drumbl and Danshera Cords; 11. Magdalin v. Commissioner, 96 T.C.M. (CCH) 491 (2008), aff'd, 2010–1 US Tax Cas. (CCH) 50,150 (1st Cir. 2009) Katherine Pratt and Jennifer Bird-Pollan; 12. O'Donnabhain v. Commissioner, 134 T.C. 34 (2010), acq., 2011-47 I.R.B. 789 (Nov. 21, 2011) Nancy J. Knauer and David B. Cruz; 13. United States v. Windsor, 133 S. Ct. 2675 (2013) Allison Anna Tait and Ruthann Robson.

Recenzii

'… the book is a beautiful gift, not only to tax scholars and professionals, but also to women's rights advocates and political actors who aim at fostering substantive gender equality, including as regards taxation.' Alice Pirlot, Literature review

Descriere

Feminist scholars rewrite major tax decisions in order to illustrate the key role of viewpoint in statutory interpretation.