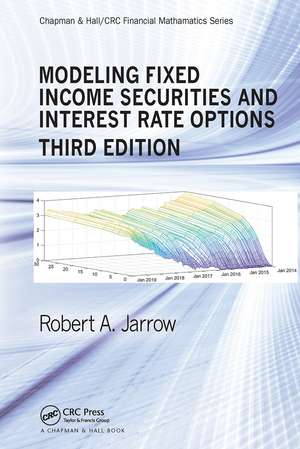

Modeling Fixed Income Securities and Interest Rate Options: Chapman and Hall/CRC Financial Mathematics Series

Autor Robert Jarrowen Limba Engleză Paperback – 21 ian 2023

Modeling Fixed Income Securities and Interest Rate Options, Third Edition presents the basics of fixed-income securities in a way that, unlike competitive texts, requires a minimum of prerequisites. While other books focus heavily on institutional details of the bond market, all of which could easily be learned "on the job," the third edition of this classic textbook is more focused with presenting a coherent theoretical framework for understanding all basic models.

The author’s unified approach—the Heath Jarrow Morton model—under which all other models are presented as special cases, enhances understanding of the material. The author’s pricing model is widely used in today’s securities industry. This new edition offers many updates to align with advances in the research and requires a minimum of prerequisites while presenting the basics of fixed-income securities.

Highlights of the Third Edition

- Chapters 1-16 completely updated to align with advances in research

- Thoroughly eliminates out-of-date material while advancing the presentation

- Includes an ample amount of exercises and examples throughout the text which illustrate key concepts

.

| Toate formatele și edițiile | Preț | Express |

|---|---|---|

| Paperback (1) | 342.37 lei 3-5 săpt. | +25.62 lei 4-10 zile |

| CRC Press – 21 ian 2023 | 342.37 lei 3-5 săpt. | +25.62 lei 4-10 zile |

| Hardback (1) | 678.96 lei 6-8 săpt. | |

| CRC Press – 30 sep 2019 | 678.96 lei 6-8 săpt. |

Din seria Chapman and Hall/CRC Financial Mathematics Series

-

Preț: 356.64 lei

Preț: 356.64 lei - 9%

Preț: 641.09 lei

Preț: 641.09 lei - 8%

Preț: 531.57 lei

Preț: 531.57 lei -

Preț: 364.17 lei

Preț: 364.17 lei - 9%

Preț: 768.95 lei

Preț: 768.95 lei - 9%

Preț: 1213.57 lei

Preț: 1213.57 lei - 9%

Preț: 609.70 lei

Preț: 609.70 lei - 9%

Preț: 704.12 lei

Preț: 704.12 lei - 8%

Preț: 410.56 lei

Preț: 410.56 lei - 8%

Preț: 496.03 lei

Preț: 496.03 lei - 8%

Preț: 489.60 lei

Preț: 489.60 lei - 9%

Preț: 716.12 lei

Preț: 716.12 lei - 9%

Preț: 833.53 lei

Preț: 833.53 lei - 8%

Preț: 459.85 lei

Preț: 459.85 lei - 9%

Preț: 730.39 lei

Preț: 730.39 lei - 8%

Preț: 548.55 lei

Preț: 548.55 lei - 8%

Preț: 544.51 lei

Preț: 544.51 lei - 9%

Preț: 595.35 lei

Preț: 595.35 lei -

Preț: 356.87 lei

Preț: 356.87 lei - 8%

Preț: 375.01 lei

Preț: 375.01 lei - 9%

Preț: 1212.11 lei

Preț: 1212.11 lei - 9%

Preț: 574.57 lei

Preț: 574.57 lei -

Preț: 403.11 lei

Preț: 403.11 lei - 13%

Preț: 310.44 lei

Preț: 310.44 lei - 30%

Preț: 1014.74 lei

Preț: 1014.74 lei - 12%

Preț: 312.43 lei

Preț: 312.43 lei - 30%

Preț: 1014.74 lei

Preț: 1014.74 lei -

Preț: 456.76 lei

Preț: 456.76 lei -

Preț: 436.14 lei

Preț: 436.14 lei - 15%

Preț: 598.50 lei

Preț: 598.50 lei - 18%

Preț: 783.69 lei

Preț: 783.69 lei - 15%

Preț: 570.70 lei

Preț: 570.70 lei - 24%

Preț: 900.85 lei

Preț: 900.85 lei - 18%

Preț: 793.01 lei

Preț: 793.01 lei - 18%

Preț: 1280.44 lei

Preț: 1280.44 lei - 9%

Preț: 608.29 lei

Preț: 608.29 lei - 22%

Preț: 371.11 lei

Preț: 371.11 lei - 20%

Preț: 508.41 lei

Preț: 508.41 lei - 26%

Preț: 763.78 lei

Preț: 763.78 lei - 20%

Preț: 1288.30 lei

Preț: 1288.30 lei

Preț: 342.37 lei

Nou

Puncte Express: 514

Preț estimativ în valută:

65.52€ • 71.15$ • 55.04£

65.52€ • 71.15$ • 55.04£

Carte disponibilă

Livrare economică 01-15 aprilie

Livrare express 15-21 martie pentru 35.61 lei

Preluare comenzi: 021 569.72.76

Specificații

ISBN-13: 9781032475264

ISBN-10: 1032475269

Pagini: 384

Ilustrații: 66

Dimensiuni: 156 x 234 x 25 mm

Greutate: 0.53 kg

Ediția:3

Editura: CRC Press

Colecția CRC Press

Seria Chapman and Hall/CRC Financial Mathematics Series

ISBN-10: 1032475269

Pagini: 384

Ilustrații: 66

Dimensiuni: 156 x 234 x 25 mm

Greutate: 0.53 kg

Ediția:3

Editura: CRC Press

Colecția CRC Press

Seria Chapman and Hall/CRC Financial Mathematics Series

Cuprins

I INTRODUCTION

Introduction

Traded Securities

The Classical Approach

II Theory

The Term Structure of Interest Rates

The Evolution of the Term Structure of Interest Rates

The Expectations Hypothesis

Trading Strategies, Arbitrage Opportunities, and Complete Markets

Bond Trading Strategies—An Example

Bond Trading Strategies—The Theory

Contingent Claims Valuation—Theory

III Applications

Coupon Bonds

Options on Bonds

Forwards and Futures

Swaps, Caps, Floors and Swaptions

Interest Rate Exotics

IV Implementation/Estimation

Continuous-Time Limits

Parameter Estimation

Extensions

Index

Introduction

Traded Securities

The Classical Approach

II Theory

The Term Structure of Interest Rates

The Evolution of the Term Structure of Interest Rates

The Expectations Hypothesis

Trading Strategies, Arbitrage Opportunities, and Complete Markets

Bond Trading Strategies—An Example

Bond Trading Strategies—The Theory

Contingent Claims Valuation—Theory

III Applications

Coupon Bonds

Options on Bonds

Forwards and Futures

Swaps, Caps, Floors and Swaptions

Interest Rate Exotics

IV Implementation/Estimation

Continuous-Time Limits

Parameter Estimation

Extensions

Index

Notă biografică

Robert A. Jarrow is a Ronald P. & Susan E. Lynch Professor of Investment Management and a Professor of Finance at the Johnson Graduate School of Management in Cornell University. He holds a Ph.D. in finance from the Massachusetts Institute of Technology and wrote for many journals and books, which include Finance Theory and The Economic Foundations of Risk Management.

Descriere

Modeling Fixed Income Securities and Interest Rate Options offers several new updates. The new edition of the classic textbook presents the basics of fixed-income securities. It requires a minimum of prerequisites. The author presents a coherent theoretical framework for understanding all basic models.