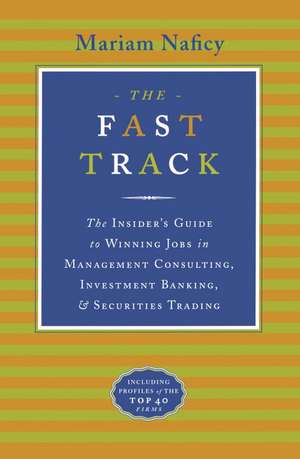

The Fast Track

Autor Mariam Naficy Editat de Naficyen Limba Engleză Paperback – 30 sep 1997

Are you thinking about working for the likes of McKinsey, Merrill Lynch, or Salomon Brothers? Thousands of undergraduates, MBA students, and others are rushing for prestigious entry-level positions in the highly competitive and lucrative fields of management consulting, investment banking, and securities trading. How are you going to compete? In The Fast Track, experienced recruiter and fast-track insider Mariam Naficy helps you make the right decisions every step of the way as she guides you through the rigorous, highly specialized recruiting process. The Fast Track includes:

Comprehensive job descriptions of consultants, analysts, and traders, explained in layperson terms.

Over twenty in-depth interviews with people in the business at every level from first-year analysts to CEOs and recruiting managers.

Tips on preparing an irresistible rÚsumÚ, giving a great interview, and choosing the right firm. Listen in as recruiters at a top firm review candidates they interviewed.

Profiles of the top forty firms across the country with information you can't find anywhere else, including career paths, office culture, and interviews with employees.

Preț: 118.82 lei

Nou

Puncte Express: 178

Preț estimativ în valută:

22.74€ • 23.80$ • 18.81£

22.74€ • 23.80$ • 18.81£

Carte disponibilă

Livrare economică 15-29 martie

Preluare comenzi: 021 569.72.76

Specificații

ISBN-13: 9780767900409

ISBN-10: 0767900405

Pagini: 368

Dimensiuni: 155 x 236 x 18 mm

Greutate: 0.5 kg

Editura: BROADWAY BOOKS

ISBN-10: 0767900405

Pagini: 368

Dimensiuni: 155 x 236 x 18 mm

Greutate: 0.5 kg

Editura: BROADWAY BOOKS

Notă biografică

Mariam Naficy, a graduate of Williams College, worked as an analyst at Goldman, Sachs & Co. and as a consultant at Gemini Management Consulting, where she recruited new employees. She is currently pursuing her MBA at the Stanford Business School.

Extras

Investment banking and management consulting grow more popular each year with job-hunters. In fact, these professions are the careers preferred by MBAs, with 50 percent of business school graduates taking jobs as bankers or consultants each year. Many large banks and consultancies receive over 5,000 applications each year for analyst and associate positions. To win a job in the face of this fierce competition, you must understand how the investment banks and consulting firms make their hiring decisions. As you read this chapter, step outside your shoes and step into the recruiter's. The more you understand the recruiter's perspective, the more you will be able to position yourself appropriately.

Throughout this chapter, I will be distinguishing between the recruiting process for targeted and nontargeted candidates. Targeted candidates are students at the top schools where firms recruit on campus, while nontargeted candidates are those who are students at other schools or those who have graduated a few years ago.

Where Are the Jobs?

Investment banks have large headquarters offices, where most employees and jobs are located. Consulting firms, on the other hand, are more decentralized. Employees are distributed around the country in order to ensure that they are near clients, and many jobs will be available outside headquarters.

Like providers of other business services such as advertising and accounting, banks and consultancies are headquartered in major metropolitan areas. The biggest banks are based in New York City and the biggest consulting firms in New York and Boston. But don't despair if you live elsewhere. A number of investment banks and consulting firms are based in Chicago, San Francisco, Los Angeles, and other major business centers. One area rising in prominence is the San Francisco Bay Area, where the growth of high-tech companies is fueling a demand for local investment bankers. In addition, investment banks and consulting firms hire people from around the country to fill their headquarters office; if you're willing to relocate, you will improve your chances of finding a job. Finally, remember that jobs are available at a wide range of firms, from large firms that everyone has heard of to smaller boutiques and regional companies. Consult Chapter 4 for information on how to find the smaller firms.

Who Runs Recruiting?

One important difference among companies is whether they make hiring decisions on a centralized or decentralized basis. Most investment banks use a centralized recruiting process while most management consulting firms use a decentralized process.

Centralized Model: The headquarters office manages recruiting for all offices. The headquarters office reviews all resumÚs, performs interviews, and makes hiring decisions. For the first-round interview, nontargeted candidates need to find their own way to the headquarters office, whereas students at target schools are interviewed by company representatives on campus. For the final round, all interviewees are flown in to the headquarters office at the firm's expense.

Decentralized Model: Although there are uniform recruiting standards throughout the firm, each branch office is responsible for managing its own recruiting process and interviewing students from local schools. The branch office screens resumÚs, performs interviews, and makes hiring decisions. Candidates are first screened by their local branch office and then forwarded onto the office that the candidate prefers. Chances of students at nontarget schools of breaking into the recruiting process are greater, since it is easier to schedule an impromptu interview at a local office than it is to try to fit into the schedule at a headquarters office 5,000 miles away.

Division vs. firm: At large firms with diverse businesses, each separate division runs its own recruiting. This is common at investment banks. Investment banking, sales and trading, and other departments each run their own recruiting process. A divided recruiting process is also found at some large consulting firms with separate information technology and strategy consulting divisions, such as Andersen Consulting. If a firm has a division-by-division recruiting policy, you should research each division's different culture, recruiting procedures, and hiring preferences.

The Standard Recruiting Process from Your Perspective

Now let's review the standard recruiting process used by large management consulting firms and investment banks. Later in the chapter I explain how this process differs for nontargeted candidates.

You're lucky. The major banks and consulting firms have very similar recruiting procedures, so once you understand one, you understand them all. Candidates have five main points of contact with the recruiter that provide opportunities for you and the recruiter to assess each other. the campus interview session, the resumÚ screening, the first-round interview, the final interview, and the selling process. Your leverage increases--and the recruiter's leverage decreases--the further you progress. Here's the whole process from a successful candidate's point of view:

The Campus Information Session: You're a student at a targeted school, and in the fall you attend all the dog-and-pony shows held on campus. During the information session, sometimes called a "Meet the Company" or a "social event," you listen to the firm explain itself and its recruiting procedures. You attempt to discern the differences between firms. Sometimes it's difficult. They all seem to say, "People are our most important asset." You want to make yourself remembered by recruiters, but you watch some classmates try too hard to ingratiate themselves by asking lots of questions during the session and you decide that's not the right approach. Instead, you mingle after the presentation, spending some quality one-on-one time with a recruiter you picked out.

The ResumÚ Screening: As a student at a targeted school, you submit your resumÚ to your campus career center by the deadline they specify, and they send the resumÚ to the companies on your behalf. If you were a nontargeted candidate, you would have to send your resumÚ directly to the company. You try to use your resumÚ to communicate why you are different from all the other applicants and therefore worth talking to. Then you wait to see if you're chosen. The resumÚ screening is the most competitive step in the recruiting process.

The First-Round Interview: Face-to-face with one or two interviewers, you sweat it out for forty-five minutes during the first interview. Since you're a student at a targeted school, the interview is conducted on campus. Nontargeted candidates are interviewed in the company's main office. Now that you have a foot in the door, your job is a little easier. You throw your energy into "selling" yourself and addressing the firm's concerns. If you make the cut, you will be invited to a second-round or final interview.

The Final Interview: The final hurdle in the obstacle course is a difficult one: a grueling day of interviews at the firm's main office a week or two after the first interview. The firm puts on a cheery spin on the day that you're dreading, calling it "Super Saturday." But you're also starting to feel a little like a celebrity. You are flown to the firm's headquarters and put up in a nice hotel. You are interviewed by a variety of people, from peers who are just a year ahead of you to high-level managers. Each interview lasts about one hour and tests you on a different area: one covers quantitative skills, another "fit" with the firm. Ten interviews and a social event later, you are on your way home and waiting for The Call. Most firms make decisions immediately afterward, so jobs are offered in the following few days. Some people will be placed on a "waiting list" and won't hear back until offerees have decided whether to join the firm.

The Selling Process: Exhausted, you're happy that the tables have turned and you now have the leverage. You've gotten the job offer, and all of a sudden you're receiving phone calls, lots of them, from the firm. They are trying hard to "sell" themselves to you. You're invited to the office, put up at a swank hotel, taken out to dinner and dancing. One analyst has been assigned to cover you during the sell process. This process will last as long as you are undecided.

There are variations on this story. Many investment banks and consulting firms hold three rounds of interviews: two on campus and a final round in the office. In schools outside major cities, a popular model is to invite successful first-round candidates to a second interview that same day or night. Smaller firms or regional offices may use different, and perhaps less formalized, recruiting procedures. It is wise to confirm your understanding of each company's process.

How to Use the Company Profiles

The companies profiled here have reviewed fact-checked their profiles, but the viewpoints and insider interviews were independently gathered and developed by the author. I've randomly selected "insiders" to provide their personal opinion of each company. I have included these interviews to provide you with an honest point of view that you don't typically get in the recruiting process, but they should not be taken as absolute truth. Interviews are by nature very subjective, and odder insiders might disagree vehemently with the opinions expressed in them.

How can you use the profiles to help you? Be diligent in getting your resumÚ to the right person. Recruiting for the prestigious positions you are applying to is generally run as a separate process from recruiting for other departments within an investment bank or consulting firm. The company profiles list the name and title of the person you'll need to send your resumÚ to, as of 1997. However, recruiters change frequently, sometimes every few months. It is absolutely imperative to call the company or visit its Web site to verify the name listed before sending out your package.

When calling investment banks and large consulting firms, even if you give the receptionist the title of the person you are looking for, your call might be forwarded to the Human Resources Department. Do not send your resumÚ there, since they typically do not run the recruiting process for the prestigious analyst and associate positions.

Other information about the company profiles:

"Recruiting" indicates whether the company's recruiting process is centralized (all resumÚs screened at headquarters) or decentralized (each office screens resumÚs and runs its own recruiting process). Investment banks tend to have centralized recruiting processes, so you should send your resumé to the recruiting contact at the headquarters office.

For consulting firms, the recruiter at the headquarters office is listed, but often you can apply to other offices directly. In this case, call the headquarters office to get a phone number and name for the regional office, or the company's Internet site.

"Summer Jobs" indicates whether the firm has summer positions for either undergraduates or graduate school students.

"Undergrad Title" and "Grad Title" indicate which titles the firm is using for the "analyst" and "associate" positions. Check this before writing your cover letter so that you can properly refer to the position you are applying to.

Use the profile for three things: good reasons for why you want to work for the company, good questions to ask at the end of the interview, and an understanding of the firm's culture so that you can present yourself in a way that's compatible.

Profiles of the Leading Consulting Firms

Goldman, Sachs & Co.

Name: Goldman, Sachs & Co.

Headquarters: 85 Broad Street, New York, NY 10004, (212) 902-1000

World Wide Web: www.gs.com

Recruiting: Centralized: Apply to New York office

Summer Position: Graduate only

Graduate Recruiting Contact (Headquarters): Alissa Burstein, Associate

Grad Title: Associate (All Divisions)

Undergrad Recruiting Contact (Headquarters): Andrea Baum, Vice President; Alissa Burstein, Associate

Undergrad Title: Financial Analyst (Investment Banking); Analyst (Equities, Fixed Income, C&C, Asset Management, Research)

Related Reading: Anita Raghavan, "Goldman Sachs Abandons Public Sale Amid Younger Partners' Opposition," Wall Street Journal, January 22, 1996. Joseph McCarthy, "The Natural: Interview with Goldman Sachs Senior Partner Jon Corzine," Chief Executive,Business Week, March 20, 1995. Brett Fromson, "Farm Boy to Financier," The Washington Post, November 6, 1994. Michael Carroll, et al. "Inside Goldman's College of Cardinals," Institutional Investor, October, 1994. Larry Light, "The Street's Big Holdout May Have to Go Public," Business Week, November 25, 1991.

Other Offices: (Domestic) Boston, Chicago, Dallas, Houston, Los Angeles, Memphis, Miami, Philadelphia, San Francisco, Washington D.C.; (International) Beijing, Frankfurt, Grand Cayman, Hong Kong, London, Madrid, Mexico City, Milan, Montreal, Osaka, Paris, Sao Paulo, Seoul Shanghai, Singapore, Sydney, Taipei, Tokyo, Toronto, Vancouver, Zurich

Part 1: Analysis

The preeminent investment bank of the 1990s is blessed with a name that sounds like money. Goldman Sachs, a full-line investment bank headquartered in New York, is widely regarded as the most prestigious firm on Wall Street. One of three bulge-bracketed firms along with Morgan Stanley and Merrill Lynch, Goldman operates in and dominates a variety of product areas. The firm has its pick of clients, advising kingdoms and Fortune 500 companies and sometimes turning away business. Money is what Goldman is known for producing; its pretax profit reached an eye-popping $2.7 billion in 1993. To put that in perspective, Goldman made more profit than the gross domestic product of Nicaragua and many other countries.

Goldman was founded as a commercial paper firm just after the Civil War by German Jewish immigrant Marcus Goldman. The Depression was hard on Goldman Sachs, but the firm was managed ably by Sidney Weinberg, who started as janitor and worked his way up to the chairman's seat. Guided by Weinberg and later leaders including Weinberg's son John, John Whitehead, and current Treasury Secretary Robert Rubin, the firm built a reputation around integrity and putting clients' interests first--the fourteenth and first tenets, respectively, of the Business Principles that the firm lives by. Goldman refused to work on the acquisition side of hostile takeovers during the l980s.

Goldman is the last private partnership on Wall Street, and this makes the firm what it is. Why? The Goldman partnership is the most exclusive club on the Street--the prize that everyone within the firm, down to the most junior banker dreams of. It represents gu

Throughout this chapter, I will be distinguishing between the recruiting process for targeted and nontargeted candidates. Targeted candidates are students at the top schools where firms recruit on campus, while nontargeted candidates are those who are students at other schools or those who have graduated a few years ago.

Where Are the Jobs?

Investment banks have large headquarters offices, where most employees and jobs are located. Consulting firms, on the other hand, are more decentralized. Employees are distributed around the country in order to ensure that they are near clients, and many jobs will be available outside headquarters.

Like providers of other business services such as advertising and accounting, banks and consultancies are headquartered in major metropolitan areas. The biggest banks are based in New York City and the biggest consulting firms in New York and Boston. But don't despair if you live elsewhere. A number of investment banks and consulting firms are based in Chicago, San Francisco, Los Angeles, and other major business centers. One area rising in prominence is the San Francisco Bay Area, where the growth of high-tech companies is fueling a demand for local investment bankers. In addition, investment banks and consulting firms hire people from around the country to fill their headquarters office; if you're willing to relocate, you will improve your chances of finding a job. Finally, remember that jobs are available at a wide range of firms, from large firms that everyone has heard of to smaller boutiques and regional companies. Consult Chapter 4 for information on how to find the smaller firms.

Who Runs Recruiting?

One important difference among companies is whether they make hiring decisions on a centralized or decentralized basis. Most investment banks use a centralized recruiting process while most management consulting firms use a decentralized process.

Centralized Model: The headquarters office manages recruiting for all offices. The headquarters office reviews all resumÚs, performs interviews, and makes hiring decisions. For the first-round interview, nontargeted candidates need to find their own way to the headquarters office, whereas students at target schools are interviewed by company representatives on campus. For the final round, all interviewees are flown in to the headquarters office at the firm's expense.

Decentralized Model: Although there are uniform recruiting standards throughout the firm, each branch office is responsible for managing its own recruiting process and interviewing students from local schools. The branch office screens resumÚs, performs interviews, and makes hiring decisions. Candidates are first screened by their local branch office and then forwarded onto the office that the candidate prefers. Chances of students at nontarget schools of breaking into the recruiting process are greater, since it is easier to schedule an impromptu interview at a local office than it is to try to fit into the schedule at a headquarters office 5,000 miles away.

Division vs. firm: At large firms with diverse businesses, each separate division runs its own recruiting. This is common at investment banks. Investment banking, sales and trading, and other departments each run their own recruiting process. A divided recruiting process is also found at some large consulting firms with separate information technology and strategy consulting divisions, such as Andersen Consulting. If a firm has a division-by-division recruiting policy, you should research each division's different culture, recruiting procedures, and hiring preferences.

The Standard Recruiting Process from Your Perspective

Now let's review the standard recruiting process used by large management consulting firms and investment banks. Later in the chapter I explain how this process differs for nontargeted candidates.

You're lucky. The major banks and consulting firms have very similar recruiting procedures, so once you understand one, you understand them all. Candidates have five main points of contact with the recruiter that provide opportunities for you and the recruiter to assess each other. the campus interview session, the resumÚ screening, the first-round interview, the final interview, and the selling process. Your leverage increases--and the recruiter's leverage decreases--the further you progress. Here's the whole process from a successful candidate's point of view:

The Campus Information Session: You're a student at a targeted school, and in the fall you attend all the dog-and-pony shows held on campus. During the information session, sometimes called a "Meet the Company" or a "social event," you listen to the firm explain itself and its recruiting procedures. You attempt to discern the differences between firms. Sometimes it's difficult. They all seem to say, "People are our most important asset." You want to make yourself remembered by recruiters, but you watch some classmates try too hard to ingratiate themselves by asking lots of questions during the session and you decide that's not the right approach. Instead, you mingle after the presentation, spending some quality one-on-one time with a recruiter you picked out.

The ResumÚ Screening: As a student at a targeted school, you submit your resumÚ to your campus career center by the deadline they specify, and they send the resumÚ to the companies on your behalf. If you were a nontargeted candidate, you would have to send your resumÚ directly to the company. You try to use your resumÚ to communicate why you are different from all the other applicants and therefore worth talking to. Then you wait to see if you're chosen. The resumÚ screening is the most competitive step in the recruiting process.

The First-Round Interview: Face-to-face with one or two interviewers, you sweat it out for forty-five minutes during the first interview. Since you're a student at a targeted school, the interview is conducted on campus. Nontargeted candidates are interviewed in the company's main office. Now that you have a foot in the door, your job is a little easier. You throw your energy into "selling" yourself and addressing the firm's concerns. If you make the cut, you will be invited to a second-round or final interview.

The Final Interview: The final hurdle in the obstacle course is a difficult one: a grueling day of interviews at the firm's main office a week or two after the first interview. The firm puts on a cheery spin on the day that you're dreading, calling it "Super Saturday." But you're also starting to feel a little like a celebrity. You are flown to the firm's headquarters and put up in a nice hotel. You are interviewed by a variety of people, from peers who are just a year ahead of you to high-level managers. Each interview lasts about one hour and tests you on a different area: one covers quantitative skills, another "fit" with the firm. Ten interviews and a social event later, you are on your way home and waiting for The Call. Most firms make decisions immediately afterward, so jobs are offered in the following few days. Some people will be placed on a "waiting list" and won't hear back until offerees have decided whether to join the firm.

The Selling Process: Exhausted, you're happy that the tables have turned and you now have the leverage. You've gotten the job offer, and all of a sudden you're receiving phone calls, lots of them, from the firm. They are trying hard to "sell" themselves to you. You're invited to the office, put up at a swank hotel, taken out to dinner and dancing. One analyst has been assigned to cover you during the sell process. This process will last as long as you are undecided.

There are variations on this story. Many investment banks and consulting firms hold three rounds of interviews: two on campus and a final round in the office. In schools outside major cities, a popular model is to invite successful first-round candidates to a second interview that same day or night. Smaller firms or regional offices may use different, and perhaps less formalized, recruiting procedures. It is wise to confirm your understanding of each company's process.

How to Use the Company Profiles

The companies profiled here have reviewed fact-checked their profiles, but the viewpoints and insider interviews were independently gathered and developed by the author. I've randomly selected "insiders" to provide their personal opinion of each company. I have included these interviews to provide you with an honest point of view that you don't typically get in the recruiting process, but they should not be taken as absolute truth. Interviews are by nature very subjective, and odder insiders might disagree vehemently with the opinions expressed in them.

How can you use the profiles to help you? Be diligent in getting your resumÚ to the right person. Recruiting for the prestigious positions you are applying to is generally run as a separate process from recruiting for other departments within an investment bank or consulting firm. The company profiles list the name and title of the person you'll need to send your resumÚ to, as of 1997. However, recruiters change frequently, sometimes every few months. It is absolutely imperative to call the company or visit its Web site to verify the name listed before sending out your package.

When calling investment banks and large consulting firms, even if you give the receptionist the title of the person you are looking for, your call might be forwarded to the Human Resources Department. Do not send your resumÚ there, since they typically do not run the recruiting process for the prestigious analyst and associate positions.

Other information about the company profiles:

"Recruiting" indicates whether the company's recruiting process is centralized (all resumÚs screened at headquarters) or decentralized (each office screens resumÚs and runs its own recruiting process). Investment banks tend to have centralized recruiting processes, so you should send your resumé to the recruiting contact at the headquarters office.

For consulting firms, the recruiter at the headquarters office is listed, but often you can apply to other offices directly. In this case, call the headquarters office to get a phone number and name for the regional office, or the company's Internet site.

"Summer Jobs" indicates whether the firm has summer positions for either undergraduates or graduate school students.

"Undergrad Title" and "Grad Title" indicate which titles the firm is using for the "analyst" and "associate" positions. Check this before writing your cover letter so that you can properly refer to the position you are applying to.

Use the profile for three things: good reasons for why you want to work for the company, good questions to ask at the end of the interview, and an understanding of the firm's culture so that you can present yourself in a way that's compatible.

Profiles of the Leading Consulting Firms

Goldman, Sachs & Co.

Name: Goldman, Sachs & Co.

Headquarters: 85 Broad Street, New York, NY 10004, (212) 902-1000

World Wide Web: www.gs.com

Recruiting: Centralized: Apply to New York office

Summer Position: Graduate only

Graduate Recruiting Contact (Headquarters): Alissa Burstein, Associate

Grad Title: Associate (All Divisions)

Undergrad Recruiting Contact (Headquarters): Andrea Baum, Vice President; Alissa Burstein, Associate

Undergrad Title: Financial Analyst (Investment Banking); Analyst (Equities, Fixed Income, C&C, Asset Management, Research)

Related Reading: Anita Raghavan, "Goldman Sachs Abandons Public Sale Amid Younger Partners' Opposition," Wall Street Journal, January 22, 1996. Joseph McCarthy, "The Natural: Interview with Goldman Sachs Senior Partner Jon Corzine," Chief Executive,Business Week, March 20, 1995. Brett Fromson, "Farm Boy to Financier," The Washington Post, November 6, 1994. Michael Carroll, et al. "Inside Goldman's College of Cardinals," Institutional Investor, October, 1994. Larry Light, "The Street's Big Holdout May Have to Go Public," Business Week, November 25, 1991.

Other Offices: (Domestic) Boston, Chicago, Dallas, Houston, Los Angeles, Memphis, Miami, Philadelphia, San Francisco, Washington D.C.; (International) Beijing, Frankfurt, Grand Cayman, Hong Kong, London, Madrid, Mexico City, Milan, Montreal, Osaka, Paris, Sao Paulo, Seoul Shanghai, Singapore, Sydney, Taipei, Tokyo, Toronto, Vancouver, Zurich

Part 1: Analysis

The preeminent investment bank of the 1990s is blessed with a name that sounds like money. Goldman Sachs, a full-line investment bank headquartered in New York, is widely regarded as the most prestigious firm on Wall Street. One of three bulge-bracketed firms along with Morgan Stanley and Merrill Lynch, Goldman operates in and dominates a variety of product areas. The firm has its pick of clients, advising kingdoms and Fortune 500 companies and sometimes turning away business. Money is what Goldman is known for producing; its pretax profit reached an eye-popping $2.7 billion in 1993. To put that in perspective, Goldman made more profit than the gross domestic product of Nicaragua and many other countries.

Goldman was founded as a commercial paper firm just after the Civil War by German Jewish immigrant Marcus Goldman. The Depression was hard on Goldman Sachs, but the firm was managed ably by Sidney Weinberg, who started as janitor and worked his way up to the chairman's seat. Guided by Weinberg and later leaders including Weinberg's son John, John Whitehead, and current Treasury Secretary Robert Rubin, the firm built a reputation around integrity and putting clients' interests first--the fourteenth and first tenets, respectively, of the Business Principles that the firm lives by. Goldman refused to work on the acquisition side of hostile takeovers during the l980s.

Goldman is the last private partnership on Wall Street, and this makes the firm what it is. Why? The Goldman partnership is the most exclusive club on the Street--the prize that everyone within the firm, down to the most junior banker dreams of. It represents gu

Descriere

Investment banking and management consulting are the most sought-after careers for the two million students pursuing business degrees each year. In this guide, an experienced recruiter lays bare the secrets of breaking into the exciting, fiercely competitive, and lucrative worlds of high finance and consulting, and provides hard-hitting, in-depth profiles of 40 of the top firms in the U.S. 40 graphs & tables.